Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Imperial Oaks. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Imperial Oaks?

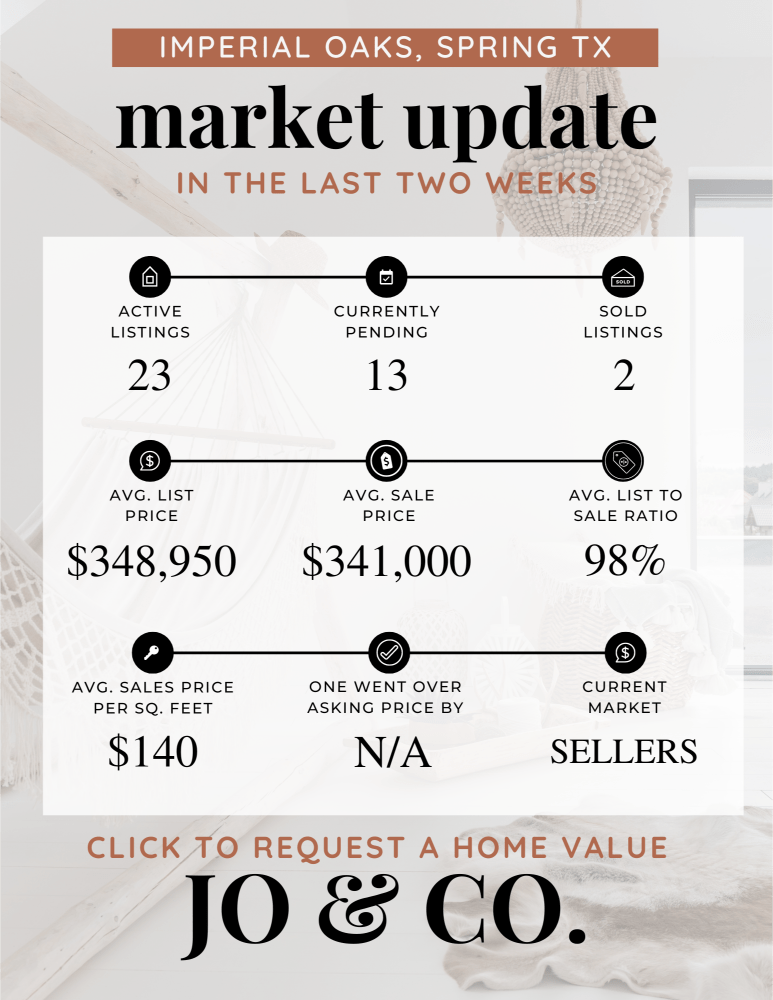

We currently have 13 homes pending, with 2 homes sold in the last two weeks, averaging a sale price of $140 a square foot. Two homes sold over the asking price.

Compared to the two weeks prior: Homes sold are slightly down from 4 sold, and the average sales price is down as well. This is most likely a coincidence, so we will be sure to keep an eye on it over the next couple of weeks. Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

If we look at how fast the move-in-ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting the neighborhoods. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Imperial Oaks.

My Two Cents: What I learned this week

Did you know?

Houston Metro's Population Growth is Outpacing New York, Los Angeles, and Chicago’s

A notable shift in population trends has been observed across the United States, with many Americans opting to move away from large metropolitan areas such as New York, Los Angeles, and Chicago. Amidst this change, the Houston metro area, which encompasses 10 counties and is home to over 7.5 million people, has emerged as a standout, experiencing a significant population spike that has outpaced the growth of other major cities.

Between July 2022 and July 2023, the Houston metro area witnessed a staggering population increase of nearly 140,000 residents. To put this growth into perspective, it translates to a new resident arriving approximately every four minutes. This impressive growth rate has positioned Houston as the second largest gainer in the U.S., closely following Dallas.

In stark contrast to Houston's thriving population, the country's three largest metros—New York, Los Angeles, and Chicago—have experienced population losses during the same period. This shift in demographics highlights a broader trend of Americans seeking new opportunities and lifestyles beyond the traditional urban centers.

One of the key factors contributing to Houston's population boom is its robust job market. The area has not only regained all the jobs lost during the pandemic but has also seen a remarkable 50% increase in pre-pandemic job numbers. This economic resilience and growth have undoubtedly attracted many individuals and families seeking employment opportunities.

Metro areas such as Chicago and San Francisco have yet to recover all the jobs lost due to the pandemic, while New York has only recently managed to regain its lost positions. The disparity in job recovery rates between Houston and these other major cities underscores the unique economic advantages that have fueled Houston's population growth.

Another significant driver of Houston's population increase is international migration. Harris County, which lies within the Houston metro, recorded nearly 42,000 international migrants in the past year—the highest number since at least 2016 and the second highest in the U.S., trailing only Miami-Dade County. This influx of international residents has accounted for nearly 40% of Houston's total population growth last year.

In addition to international migration, Harris County experienced the largest natural population increase in the U.S., with approximately 35,000 more births than deaths during this period. This natural growth, coupled with the influx of international migrants and domestic movers, has contributed to Houston's overall population boom.

As the Houston metro area continues to attract new residents at an unprecedented pace, it serves as a testament to the city's thriving economy, diverse opportunities, and appealing quality of life. While other major metropolitan areas grapple with population losses and slower job recovery rates, Houston stands as a beacon of growth and resilience, drawing in individuals and families from across the country and around the world.

What is happening in the real estate market nationally?

Mortgage rates ended last week trending around similar levels from the previous week. New home sales from March outperformed, as did pending home sales. Mortgage application submissions slipped as did jobless claims. The GDP estimate from Q1 was lower than expected. Inflation and personal income were as expected in March while consumer spending came in hot.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Court grants preliminary approval of NAR settlement. Read Now >>

- How close is the market to ‘the end’ of elevated interest rates? Watch Now >>

- What’s Gen Z’s advantage in housing? Read Now >>

Market Recap

-

New home sales were at a seasonally adjusted rate of 693,000 in March – an 8.8% jump from the month before and 25,000 above the expected rate for March.

-

Mortgage application submissions slipped 2.7% during the week ending 4/19. The Refinance Index slipped 6% while the seasonally adjusted Purchase Index slipped 1%. Refinance application submissions were still up 3% from the same week last year.

-

Continuing jobless claims were at a level of 1,781,000 during the week ending 4/13 – a decline of 15,000 from the previous week. Initial jobless claims were at a level of 207,000 during the week ending 4/20 – a decline of 5,000 from the previous week. Both continuing and initial jobless claims were below their expected levels for their respective weeks.

- The GDP estimate for Q1 of 2024 came in below expectations at just 1.6%. It was expected

to be 2.5%. - Pending home sales, which indicate future closings, rose 3.4% in March, surging beyond the expected 0.3% increase.

-

The Fed’s preferred method of inflation measurement, the core PCE index, came in as expected month-over-month in March at 0.3%. Annual core inflation came in hot as 2.8% vs. the 2.6% expected. Consumer spending came in hot as well at 0.8% vs 0.6% expected. Personal income came in as expected at 0.5%.

Review of Last Week

TECH TO THE RESCUE… Friday, Tech stocks saved the day, pushing the three major indexes to weekly gains, as traders ignored signs of a slowing economy and rising inflation, and focused instead on AI-powered corporate earnings.

The GDP Advanced read came in at a disappointing 1.6% economic growth in Q1, down from Q4's 3.4%. PCE Prices, the Fed's favorite inflation measure, rose in March, remaining at an annual rate significantly above their 2% target.

Yet weekly initial jobless claims fell, indicating continued labor market strength, while the March Personal Income and Spending reports showed consumers both making more money and spending it to help the economy.

The week ended with the Dow UP 0.7%, to 38,240; the S&P 500 UP 2.7%, to 5,100; and the Nasdaq UP 4.2%, to 15,928.

Prices in the bond market were off a tiny bit overall, the 30-Year UMBS 6.0% ending down .08, at $99.02. The national average 30-year fixed mortgage rate continued to edge up in Freddie Mac's Primary Mortgage Market Survey. Remember Survey, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Realtor.com reports the median listing price last week dipped more than 1% versus a year ago, the largest change in 14 weeks, evidence that smaller, more affordable homes are hitting the market.

Market Forecast

HOME PRICES, CONSTRUCTION SPENDING, THE FED, JOBS… The S&P Case-Shiller Home Price Index is expected to book a small gain in February. Economists predict Construction Spending will increase overall in March, and we'll check the residential sector. The Fed's FOMC Rate Decision should report no move, but their policy statement and Chair Powell's presser could be worth examining. Friday's April jobs report is forecast to show modest gains in Nonfarm Payrolls and Hourly Earnings, and no change in the Unemployment Rate.

Summary

Sales in March of newly-built homes posted their biggest monthly increase in 15 months, up almost 9%, pushing sales more than 8% ahead for the year. The median price fell almost 2% versus a year ago.

Up 3.4% in March, the Pending Home Sales index of signed contracts on existing homes is now 7% above a year ago. The National Association of Realtors forecasts a 9% increase in existing home sales this year.

Realtor.com says buyers can expect more available properties and a slight decrease in prices going forward. March saw a 23.5% growth in inventory, and 15% of homes had price reductions, the highest level in five years.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.