Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Cypress, Texas, specifically a market update for the neighborhood of 77433. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in 77433?

We currently have 215 homes pending, with 41 homes sold in the last two weeks, averaging a sale price of $185 a square foot. Forty-one homes sold over the asking price, with one home selling 2% above the listing price.

Compared to the two weeks prior: Homes sold are slightly down from 50 sold, but the average sales price per square foot is up to $185 ($184 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

If we look at how fast the move-in-ready (modern) homes are going (must not be overpriced), the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in 77433.

My Two Cents: What I learned this week

The current real estate market in the United States is facing several challenges and uncertainties. I am going to share with y’all some of my assessments.

1. Public Opinion: The majority of Americans polled believe it's a bad time to buy a home, and they don't anticipate mortgage rates decreasing soon. This sentiment could indicate caution among potential buyers, which might affect the market.

2. Call to the Federal Reserve: The Mortgage Bankers Association, National Association of REALTORS, and National Association of Home Builders have requested the Federal Reserve's intervention to stabilize the housing finance market by not raising rates further and withholding the sale of mortgage-backed securities. This reflects concerns about market stability.

3. Cash Deals: The high percentage of cash deals for single-family homes over $1 million suggests that wealthier individuals are still investing in real estate, potentially driving prices in that segment.

4. Migration to Low-Tax States: The movement of wealthier individuals to low-tax states can lead to increased demand in those areas, potentially driving up prices and inflation.

5. Rent vs. Mortgage Costs: The fact that monthly rent is cheaper than a monthly mortgage payment for many indicates that purchasing a home has become more expensive, primarily due to rising borrowing costs.

6. Insurance Premiums: Increased claims related to natural disasters have caused insurance premiums to rise significantly, which could affect homeownership affordability.

The real estate market is influenced by a mix of factors, including public sentiment, government interventions, wealthier individuals' behavior, and economic conditions. It's a complex landscape, and potential buyers and investors should carefully consider these factors before making decisions in the current market. But keep in mind, there are still lots of opportunity to be had. Especially in new construction, where we are seeing the largest incentives we have ever seen before.

What is happening in the real estate market nationally?

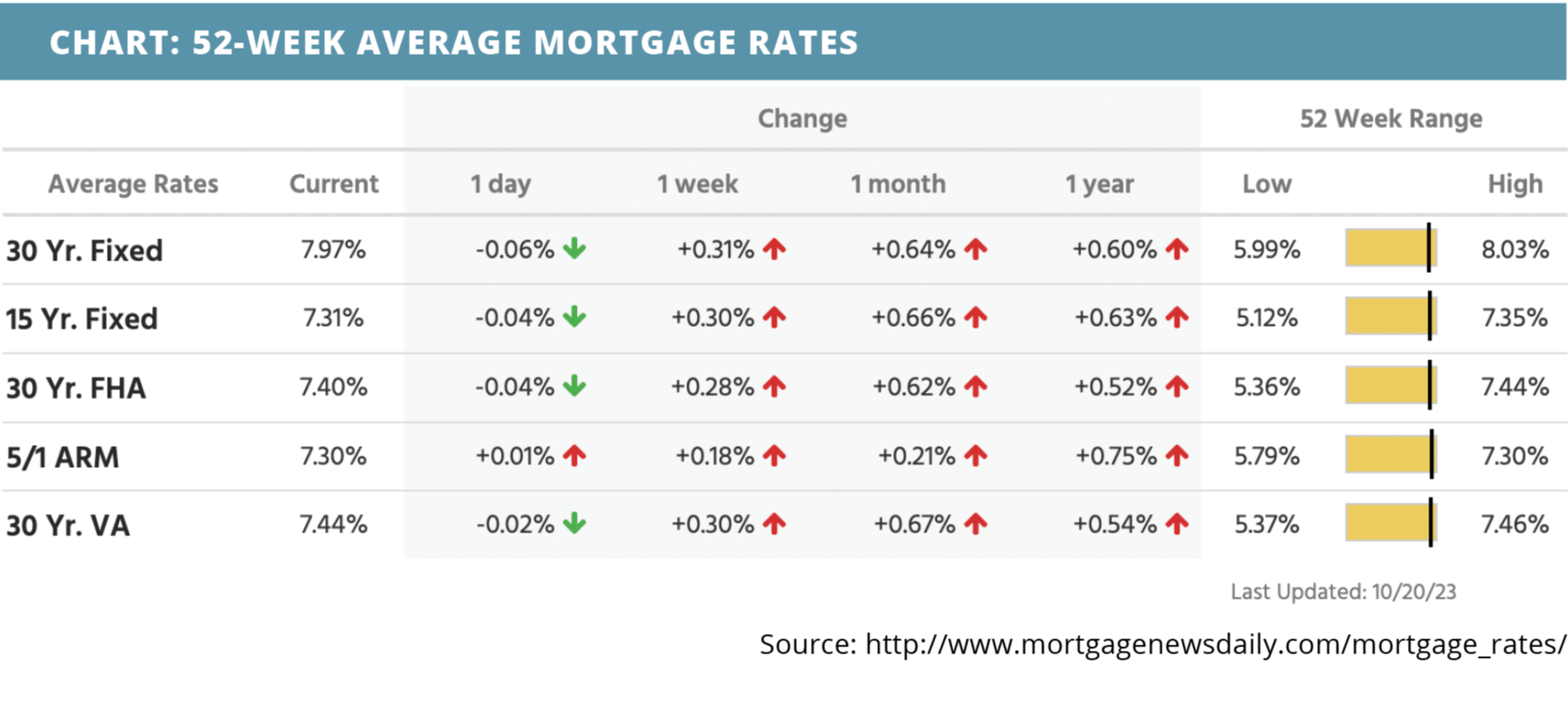

Economic reports came in strong last week, pushing rates higher once again. For one, retail sales from September came in much hotter than expected. Home builder sentiment declined in October. Mortgage application submissions unsurprisingly dropped. Housing starts increased in September while building permits slipped. Continuing jobless claims increased while initial jobless claims slipped. Existing home sales were higher than expected in September.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Rates, recessions, and reflecting on the current market with HousingWire Lead Analyst. Read Now >>

- What is the ‘tale of two housing markets’? Read Now >>

- Tight housing market supply means crash is unlikely. Watch Now >>

Market Recap

-

Retail sales increased 0.7% month-over-month in September, more than double the expected amount.

-

The National Association of Home Builders’ (NAHB) housing market sentiment index was at a level of 40 in October, a four-point decrease from the month before.

-

Mortgage application submissions decreased a composite 6.9%. The Refinance Index decreased 10% while the seasonally adjusted Purchase Index decreased 6% from one week earlier.

-

Building permits were at a seasonally adjusted annual rate of 1,473,000, a 4.4% month-over-month decrease in September. Housing starts, on the other hand, increased 7% in September, rising to a level of 1,358,000.

-

Continuing jobless claims were at 1,734,000 during the week ending 10/7, an increase of 30,000. Initial jobless claims were at 198,000 during the week ending 10/14, a decrease of roughly 13,000.

Review of Last Week

WORRY TIMES THREE… Rising Treasury yields, higher oil prices, and concerns about the war in the Middle East created enough worries to have all three major stock indexes book their worst week in a month.

As the price of the 10-year Treasury fell, its yield rose, so investors feared possible higher borrowing costs. In addition, the Leading Economic Index fell in September, as it has for the last eighteen months in a row.

But investors also saw: September Retail Sales up, on healthy consumer spending; initial jobless claims below 200,000, suggesting continued employment growth; and an improving industrial sector.

The week ended with the Dow down 1.6%, to 33,127; the S&P 500 down 2.4%, to 4,224; and the Nasdaq down 3.2%, to 12,984.

Led by Treasuries, bond prices fell overall, the 30-Year UMBS 6.0% dropping 1.15, to $96.16. The national average 30-year fixed mortgage rate inched up just six basis points (0.06%) in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Sellers should take note that in the third quarter, profit margins on median-priced single-family and condo sales increased to almost 60%, as the median home price nationwide hit a new high of $350,000.

Market Forecast

NEW AND PENDING HOME SALES, GDP, INFLATION… September should see New Home Sales continuing to rise, and, happily, the Pending Home Sales index of signed contracts on existing homes is also expected to gain. The Advanced GDP read for Q3 is predicted to show economic growth at 4%, not exactly cooling under the Fed's rate hikes. But the Fed's favorite inflation measure, Core PCE Prices, is forecast up at a slightly slower pace.

Summary

Builders increased activities in September, sending Housing Starts back up, by 7.0% over August. Starts for single-families are now up 8.6% the past year, as tight existing home inventories are driving buyers to new builds.

Building Permits slipped in September, all due to multifamilies. Single-family permits rose, as they've done every month since February. And the number of homes under construction is near the highest level on record.

Tight inventories sent monthly Existing Home Sales down in September. The supply of homes for sale, at 3.4 months, is well below the 5 months of a normal market, while the median price is up 2.8% from a year ago.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.