Hi neighbor, Today I will be sharing with you our perspective on the local real estate market here in Tomball, Texas, specifically a market update for the 77375 Zip Code. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in 77375?

We currently have 61 homes pending, with 10 homes sold in the last two weeks, averaging a sale price of $224 a square foot. Ten homes sold over the asking price, with one home selling 4% above the listing price.

Compared to the two weeks prior: Homes sold are slightly down from 11 sold, but the average sales price is up to $675,790 ($638,749 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

If we look at how fast the move-in-ready (modern) homes are going (must not be overpriced), the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in 77375.

Jo's Two Cents

The local Spring market is in full swing. Jo & Co. We currently have 13 clients under contract with 3 more in the wind, and many listings coming soon. Since inventory low, when a move in ready home hits the market in a desirable neighborhood at a reasonable price, we are once again seeing multiple offers, and most homes go under contract right at or above asking price. We aren’t seeing massively aggressive offers, but many strong ones. I don’t know if we will ever see the 2020 and 2021 markets again, but we are seeing glimpses of the same characteristics.

If you have been thinking about upsizing or downsizing, right now might be the perfect time for that. The only thing that can really help our local market right now, besides reduced interest rates, which we should be seeing this year, is more inventory.

If you are curious what your home could be worth, we hope you give us a call. No pressure. Just casual information. Love y’all. Jo.

What is happening in the real estate market nationally?

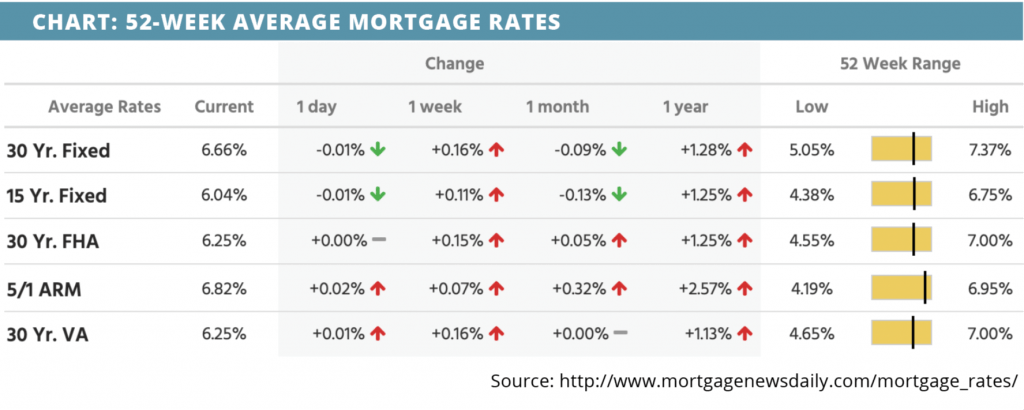

Mortgage rates trended slightly higher last week. Home builder confidence increased, while housing starts and building permits decreased. Mortgage application submissions slipped and jobless claims climbed higher. Existing home sales declined but existing home inventory increased.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- FHFA to formalize fair housing policies. Read Now >>

- A look at the overall housing market. Watch Now >>

- 4 investment property opportunities in the current market. Read Now >>

Market Recap

-

Home builder confidence rose for the fourth consecutive month in April, climbing from 44 to 45 on the National Association of Home Builders (NAHB) housing market sentiment index. This is the highest level in seven months. The present single-family sales component on the index climbed from 49 to 51 while the component for single family sales in the next six months climbed three points to a level of 50, which is the highest level in almost a year.

-

After soaring over 15% in February, building permits slumped a composite 8.8% month-over-month in March. Single family-permits, however, jumped 4.1% month-over-month. Total housing starts slipped 0.8% while single-family starts climbed 2.7%. Though overall starts and permits declined, the positive trend for single-family housing is a sign of housing market stabilization, according to experts.

-

Mortgage application submissions decreased a composite 8.8% during the week ending 4/14. Refinance application submissions fell 6% while purchase application submissions fell 10%.

-

Continuing jobless claims increased more than expected during the week ending 4/8, climbing by 60,000 to reach a level of 1,865,000. Initial jobless claims increased by 5,000 during the following week to reach a level of 245,000.

-

Existing home sales slipped 2.4% month-over-month in March, giving existing home inventory a much-needed chance to increase. The median existing home sales price declined annually.

Review of Last Week

SLIDING SIDEWAYS… Traders played a waiting game ahead of this week's big batch of Q1 corporate earnings reports, so stocks slid mostly sideways, with the three major indexes ending down just a tick.

Disappointing data included the most continuing jobless claims since November 2021, the weakest Philadelphia Fed manufacturing index since May 2020, and the lowest Leading Economic Index since November 2020.

But we did get some better-than-expected corporate earnings, the first positive read in five months for the Empire State manufacturing index, and preliminary April IHS Markit Manufacturing and Services PMIs both showing growth.

The week ended with the Dow down 0.2%, to 33,809; the S&P 500 down 0.1%, to 4,134, and the Nasdaq down 0.4%, to 12,072.

Mimicking stocks, bond prices were off a tick overall, though the UMBS 5.5% ended UP 0.87, at $101.11. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate edged up after five weeks of declines. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… A recent study by Zillow found that some two-thirds of the millennial and Gen Z Americans polled say it’s still realistic to think they can buy a home in the next five years.

Market Forecast

NEW AND PENDING HOME SALES, HOME PRICES, INFLATION… Forecasts call for March New Home Sales to be off slightly, but for the Pending Home Sales index of signed contracts on existing homes to move up. The S&P Case-Shiller Home Price Index should show price increases leveling off in February. Inflation is expected to continue moderating in March according to PCE Prices, the Fed's favorite measure.

Summary

Single-family housing starts rose 2.7% in March, up for the second month in a row for the first time since 2021. With the drop in multi-units, overall starts were off a tick, but homes under construction remain near the highest level on record.

That backlog of projects tells why building permits fell in March. The National Association of Home Builders sentiment index rose for the fourth month, though still less than half the builders see conditions as good.

Sales of existing homes cooled in March after their big February surge. The good news for buyers was that median prices fell 0.9% from March 2022 and are down 12.7% from their mid-2022 peak.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.