Hi Friends!

I know this is a question many have asked, and I thought I would address it here, on the blog.

To purchase a home, what does my credit score need to be, and how much do I need for a downpayment?

There are a couple different answers to this question, and it depends on the situation.

The first part of the question, what does my credit score need to be, is actually dependent upon the second part of the question, so you need to ask yourself, do I have any money saved up?

If you have money saved up, at least 3.5%, plus another 2-4% for closing costs (title fees, lender fees, escrow account fulfillment (prepaying taxes for the year, and prepaying home owners insurance, etc.), the typical answer is a you need a credit score of 580 to qualify for a FHA loan (a loan backed by the government, with a leniency on credit score, and a regulated interest rate). The one thing to note about FHA loans, is that there is a tiny catch. It isn't a bad one, it is just a present one. When you finance a home with a FHA loan, you are required to pay for a separate insurance policy called, Private Mortgage Insurance, or PMI for short. You can learn more about PMI, and calculate the costs, here.

While it is really easy to apply, and access lenders digitally, and I love my clients to apply this way, I do recommend choosing a local lender for obtaining a preapproval or prequalifcation. Local lenders and mortgage companies have so much to offer, that someone online (Loan Depot, Quicken Loans, etc.) can't possible offer. I personally love supporting small and local businesses, but my favorite reason to use a local lender is that you can meet with them in person, and they are available to be at the closing. Plus all the local lenders and mortgages companies that I recommend, I have worked with before, and that extra fact, has meant a lot to my past clients.

But back to the question at hand.. You wanted to know what your credit score needs to be to purchase a home.. So yes, if you have money saved up, the minimum credit score needs to be 580. If you want to avoid PMI, it can cost anywhere between $100-300, depending on you credit, your down payment, your debt-to-income ratio, the cost of your home, etc., then you would need 20% in savings to obtain a conventional loan.

The minimum credit score for a conventional loan is 620. There are many types of conventional loans, but the thing to know, is that, if you are putting down less than 20% (you can have a downpayment as low as 3% (if you qualify)), you will have PMI, but you can apply to have it removed, once you have paid down 20% of your home loan. With an FHA loan, it is there for the life of the loan, but you can refinance to a conventional loan.

Now if you have very little money saved up, and you have a credit score of 620, you may qualify for a TSAHC grant. TSAHC is applicable on FHA or conventional loans. If you were to do an FHA loan, you would still be subjected to PMI (this would take about 10 years to pay off 20%, yet an appraisal is needed, and I assume with value increases, so you would have 20% of the value paid off sooner, maybe 5-7 years of your loan, if your loan is $200,000 and your interest rate is 5%), but the trade off, is being able to buy a home sooner, since you don't have to wait and save up money. Buying sooner is better, because you are avoiding the almost inevitable interest rate increases, that are foreshadowed, and you are buying a home with 2019 value.

A TSAHC grant contributes up to 5% towards your downpayment, and with some seller concessions, you can typically buy a home with 1-2% in total up front costs. Pretty cool option, if you ask me. Please do note that interest rates for TSAHC loans can tend to be a little higher.

So if you find yourself asking yourself these questions, I would love to assist you. Whether you are ready now, in six months, or a year, I would still love to answer any questions you may still have.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Hugs, Jo.

Thoughtfully written for you by Jordan and the Jo & Co. Team.

We are Waiting for You

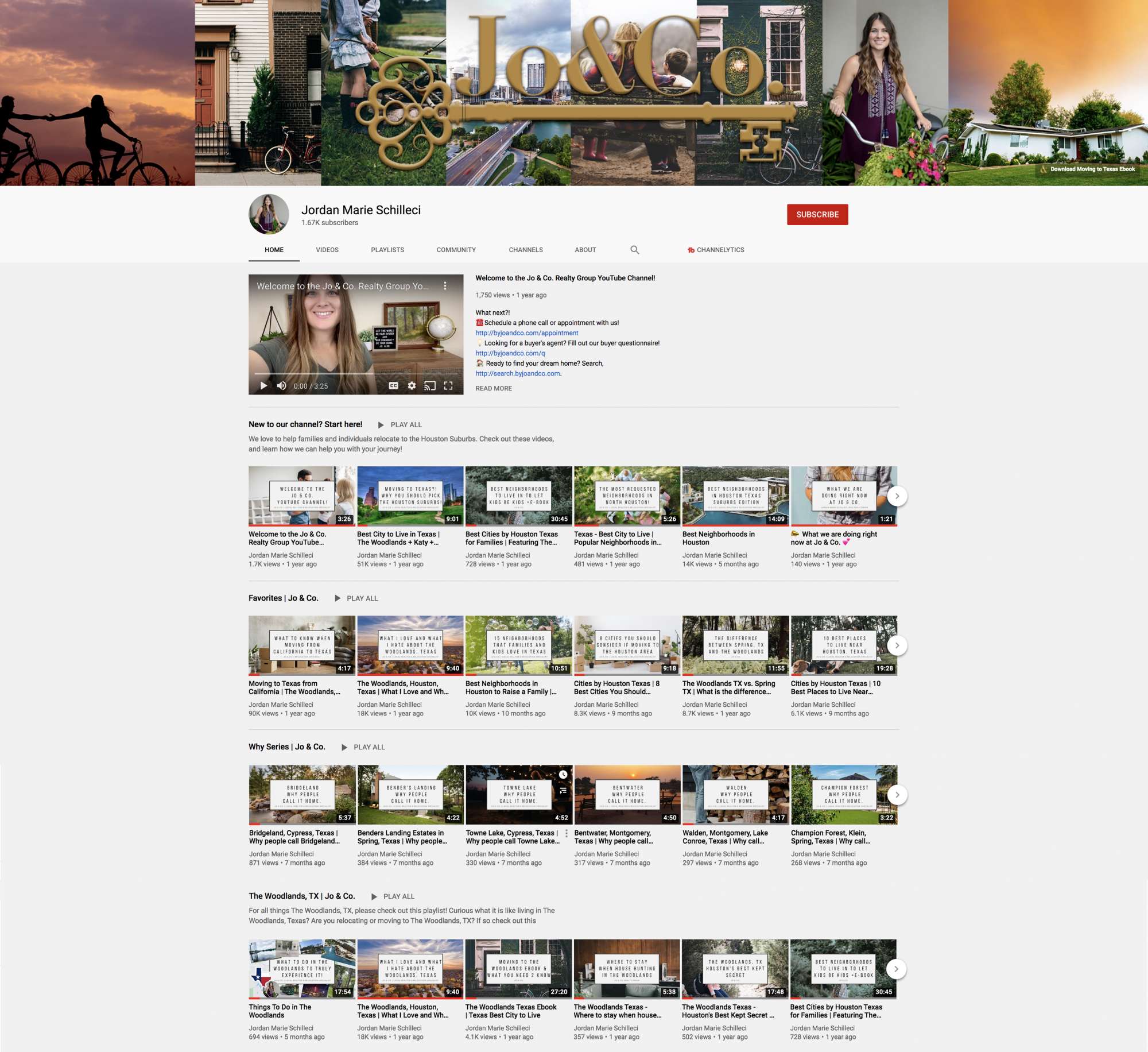

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

Links to check out..

➟ Our YouTube Channel :: http://byjoandco.com/youtube

➟ How do property taxes work in Texas? :: http://byjoandco.com/propertytaxesintexas

➟ Things to do in The Woodlands :: http://byjoandco.com/inthewoodlands

➟ Safest Neighborhoods in Houston :: http://byjoandco.com/safesthouston

➟ Best Neighborhoods in Houston :: http://byjoandco.com/bestneighborhoods

➟ Houston Texas Where to Live :: http://byjoandco.com/houstontexaswheretolive

➟ First Time Texas Home Buyer :: http://byjoandco.com/firsttimetexasbuyer

What next?!

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.

Visit the Jo & Co. YouTube Channel

At Jo & Co. we know that most people struggle with the home buying or selling experience. We are a brokerage, real people, that do more for you, by being with you every step of the way, so that you plant your roots in the right soil. One way that we go above and beyond is with the content we share on YouTube. Click the photo below to explore our channel.