Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of 77386. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in 77386?

We currently have 64 homes pending, with 20 homes sold in the last two weeks, averaging a sale price of $181 a square foot. Twenty homes sold over the asking price, with one home selling 2% above the listing price.

Compared to the two weeks prior: Homes sold are slightly down from 22 sold, and the average sales price is down as well. This is most likely a coincidence, so we will be sure to keep an eye on it over the next couple of weeks. Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

If we look at how fast the move-in-ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting the neighborhoods. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in 77386.

Insight From Jo

Hi friend! It might feel quiet out there—I'm seeing more homes hitting the market than I ever have—but fewer buyers are stepping up. That gives us a rare opening for both sides of the fence.

Here’s why it matters right now:

- Deals are slipping away—In July, about 15.3% of home-purchase agreements were canceled nationwide, the highest July cancellation rate on record. In Texas, cancellations were particularly high, with places like San Antonio seeing nearly 23% of contracts fall through. That means many listings are being reconsidered or pulled, creating fresh opportunities for prepared buyers.

- Sellers outpace buyers—Nationally, there are nearly 500,000 more sellers than buyers—34% more, to be exact—the largest gap since 2013. That shift has fully turned the market in favor of buyers.

Why Sellers Should Act Now

You’ve probably heard that “you can’t time the market”, but right now you actually can—because you have plenty of competition but not enough buyers. That means pricing smart, staging well, and staying flexible could help you stand out and close a deal quickly.

- Buyers are cautious (and canceling), but that means if your listing is attractive and well-priced, you’ll capture attention—and action.

- Homes are taking longer to sell, and in many markets, prices are softening or dipping.

- A reliable agent who can guide pricing using up-to-date comparables can give you an edge in this crowded field.

The bottom line? Waiting might only mean more competition and fewer offers down the line.

Why Buyers Should Feel Excited (Not Intimidated)

Let’s be honest: high prices and rising costs have spooked many would-be buyers. But guess what? That hesitation gives savvy buyers real leverage.

- With sellers outnumbering buyers by a substantial margin, you're in the driver’s seat—even if it doesn’t feel that way.

- Homes are staying on the market longer, and many sellers are willing to negotiate on price, closing costs, or repairs.

- If you’re ready, you can negotiate with confidence, making offers that reflect true value—not just market hype.

My Two Cents

- Sellers: Let’s position your home to shine—great photos, fair pricing, and maybe a touch of flexibility to signal you're serious about making things happen. Buyers today are choosing smart over fast.

- Buyers: This is your moment. You have options, you’re not rushed into bidding wars, and you can negotiate terms that truly work for you. Don’t let hesitation cost you a home you love.

I’m here to help—whether that means crafting an inviting listing or putting together a strategic offer that stands out. Reach out when you're ready to take advantage of the moment—because opportunities like this don’t come around every day.

What is happening in the real estate market nationally?

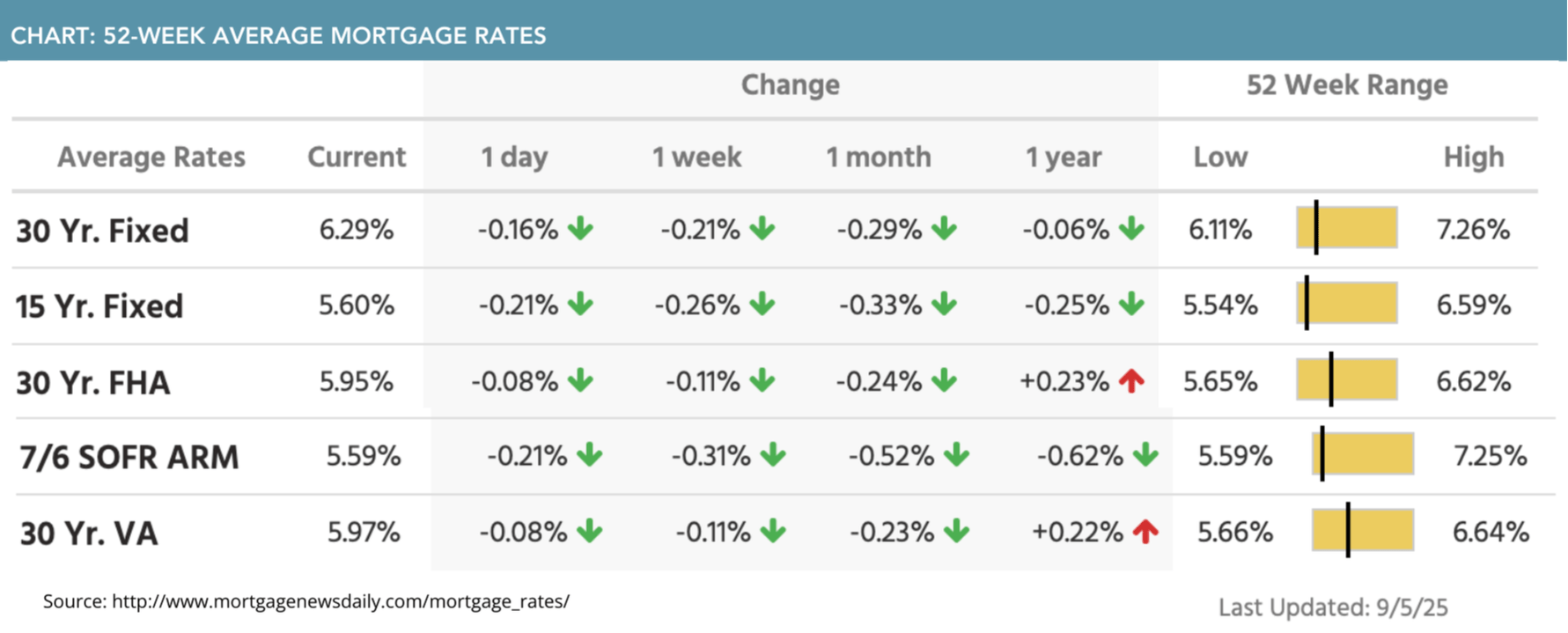

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

-

- Moody’s Analytics’ chief economist says that we are on the brink of a recession. Read Now >>

- How much lower can mortgage rates go? Listen Now >>

- The labor market continued its dramatic slowdown last month. Read Now >>

Market Recap

-

Construction spending slipped 0.1% month-over-month in July.

- Mortgage application submissions slipped 1.2% during the week ending 8/29. While refinance application submissions increased 1%, seasonally adjusted purchase application submissions decreased 3%.

- Job openings on the Job Openings and Labor Turnover Survey (JOLTS) were at 7,181,000 in July, which was lower than the previous month and lower than the forecasted increase.

- The ADP nonfarm employment change posted a gain of 54,000 in August, which was roughly half the increase from the month before and much lower than expected.

- Continuing jobless claims were at a level of 1,940,000 during the week ending 8/23, which was a decrease of 6,000 from the week before. Initial jobless claims were at a level of 237,000 during the following week, which was an increase of 8,000 from the week before.

- The employment situation came in weaker than expected in August. Average hourly earnings inched up 0.3% month-over-month. The average workweek was at 34.2 hours, lower than expected. Government payrolls shed 16,000 jobs. Manufacturing payrolls shed 12,000 jobs — nearly double the expected decline. Nonfarm payrolls added 22,000 jobs, which was much lower than the 75,000 expected and the lowest increase since April 2020. The participation rate was at 62.3%. Private payrolls added 38,000 jobs despite the predicted increase of 75,000. The unemployment rate inched up to 4.3% — the highest level in almost 4 years (however, some experts believe that the slight increase points to a gentler softening of the labor market).

Review of Last Week

MIXED… Stocks ended mixed, with the S&P 500 and the Nasdaq gaining and the Dow lagging slightly, as traders digested mixed economic reports, led by Friday's softer-than expected August jobs data.

That report featured a meager 22,000 new nonfarm payrolls added for the month, with a growing labor force that pushed unemployment up a tick to 4.3%, and higher wages—all evidence of a slowing (but still growing) economy.

Yet weak payrolls greatly increases the likelihood of a Fed rate cut next week, ISM Services showed that huge sector of the economy still expanding, and Q2 productivity grew with only a modest gain in labor costs—all good things!

The week ended with the Dow down 0.3%, to 45,401; the S&P 500 UP 0.3%, to 6,482; and the Nasdaq UP 1.1%, to 21,700.

The disappointing jobs report helped bonds, the 30-Year UMBS 5.5% UP 0.07, to 100.25. In Freddie Mac’s Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate dropped to what Mortgage News Daily called an 11-month low. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… National Association of Home Builders data revealed 2 out of 3 builders offered sales incentives in August—the most so far this year and the highest percentage in 5 years—with 40% doing price cuts.

Market Forecast

MORTGAGE APPLICATIONS, INFLATION, CONSUMER SENTIMENT… We'll keep an eye on the MBA Mortgage Applications Index to see if activity keeps trending upward year-over-year. Inflation is expected to remain moderate in August's Consumer Price Index (CPI), while the August Producer Price Index (PPI) should reveal wholesale prices increasing at a slower pace than they did in July. Economists forecast the preliminary read on University of Michigan Consumer Sentiment for September will rebound from August.

Summary

The Mortgage Bankers Association notes, “Affordability conditions have now improved for two consecutive months,” as the national median monthly payment on purchase loan applications dropped below where it was a year ago.

Attom Data said mortgage activity in April, May, and June showed “a typical spring bounce.” Total activity increased in 201 of 212 metros, with purchase mortgage activity improving in 97% of the metros analyzed.

The Census Bureau reported builders got busier in July. Spending on residential construction came in a tick above the revised June numbers, including a welcome gain in spending on single-family homes.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.