Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Auburn Lakes. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

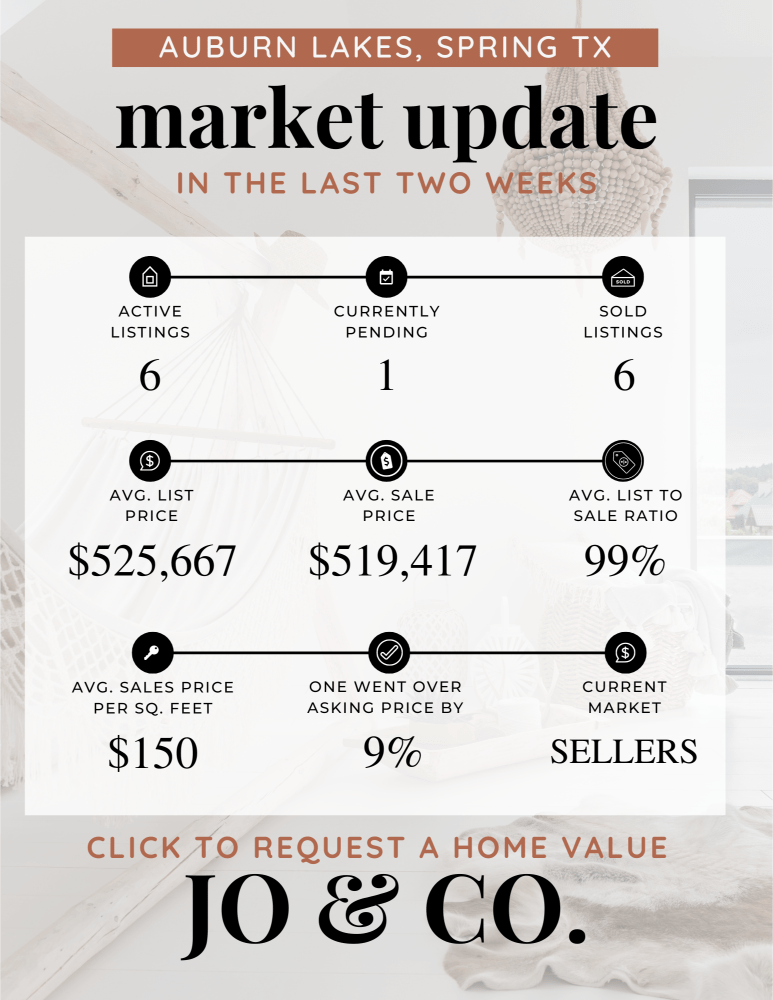

What is happening in the real estate market in Auburn Lakes?

We currently have 1 homes pending, with 6 homes sold in the last two weeks, averaging a sale price of $150 a square foot. Six homes sold over the asking price, with one home selling 9% above the listing price.

Compared to the two weeks prior: Homes sold are up from 2 homes sold to 6 homes sold and the average sales price is also up to $519,417 ($471,872 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

If we look at how fast the move-in ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Auburn Lakes.

My Two Cents: What I learned this week

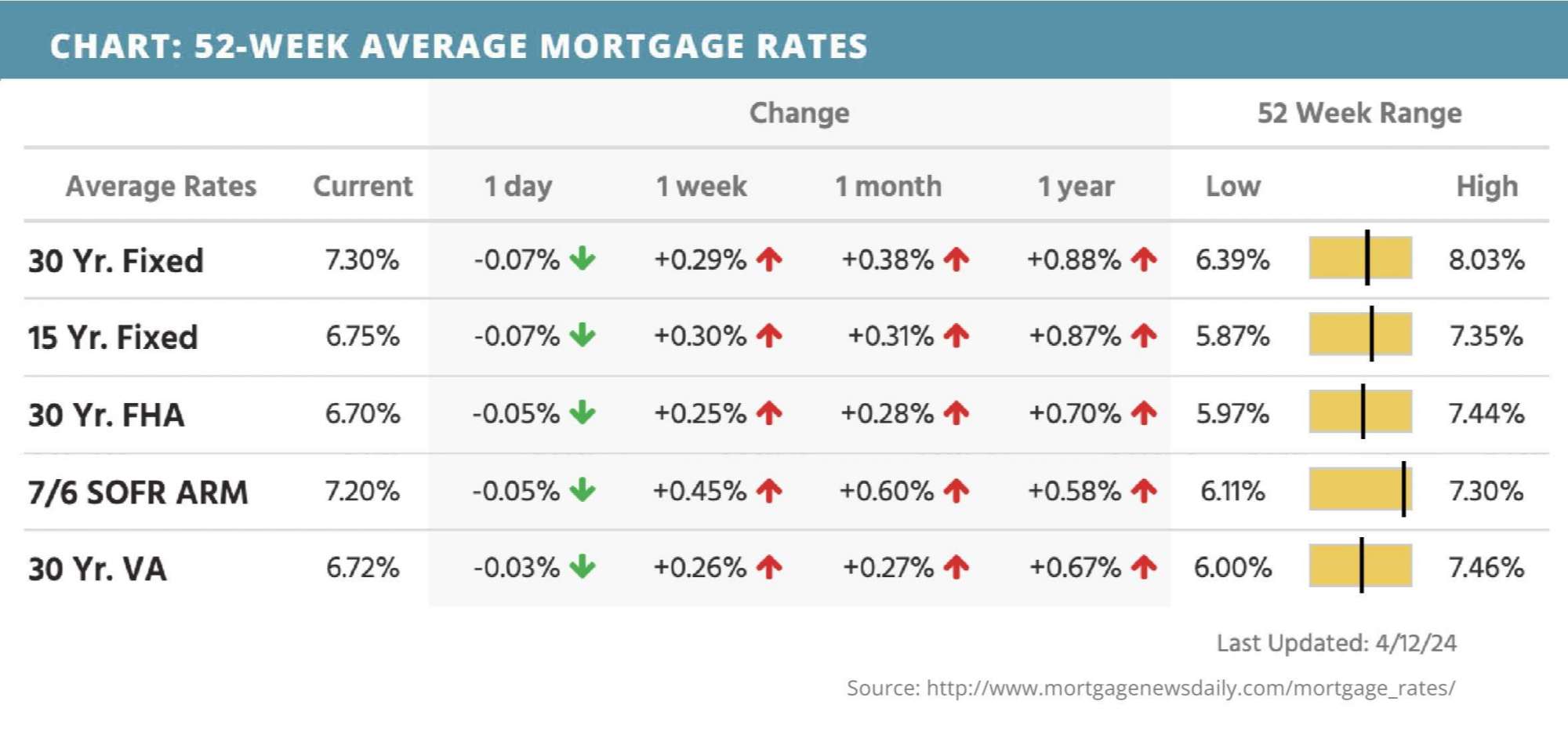

Interests rates have been booping between 6% and 7% the last couple of weeks. But many buyers haven’t been deterred. I have spent the last 3 weeks showing homes every day, and got 4 under contract, with 3 in the wind.

It has been a mixture of new construction and resale, but I still feel confident in sharing with you that new construction is where a deal can still be made. At least for the next 45 days.

Here is a list of my favorite builders right now:

Toll Brothers is now offering 5.875%.

Lennar is offering 4.25%.

Village Builders is offering 4.25%.

Davidson Homes is offering 3.99%.

Highland Homes is offering 4.875% the first year.

Brightland Homes is offering 5.49%.

D.R. Horton is offering 4.5% FHA. (north of I-10).

Century Community offering 4.875% FHA, 4.875% VA, and 5.5% conventional.

Meritage Homes is offering 5.875%.

Starlight Homes is offering 5.99%.

Highland Homes is offering a 1 year rate buy down.

HistoryMaker is offering 3.99%.

M/I Homes is offering 5.25%.

Taylor Morrison 5.49% .

D.R. Horton is offering a move-in package and up to$10k towards closing costs.

Brightland Homes is offering 5.49% plus $10k toward closing costs and bottom line pricing.

J. Patrick is offering up to $20k in incentives.

Lennar does have a program that is 0% down

The Woodlands Hills is offering up to $10k towards closing costs.

Newmark Homes is offering $21k that can be used as incentives.

Century Community up to 6% towards closing costs, plus move in package (w/d/f/b).

Meritage Homes up to $18k towards closing costs, plus move in package.

Starlight Homes is offering 5.99% rate with 7k with closing costs with preferred lender.

Highland Homes is offering $15k off price, $20k towards closing costs, and 1 year rate buy down.

Colina Homes is offering $12k plus OTP.

Chessman Homes is offering up to 6% toward closing costs.

Taylor Morrison 5.49% interest rate with 3% towards closing costs.

If you are wanting to take advantage of the last 4 weeks of a buyer’s market, please reach out to me.

Hugs, Jo.

What is happening in the real estate market nationally?

Mortgage rates trended higher last week thanks to a hotter-than-expected inflation report. Mortgage application submissions increased as did continuing jobless claims. Initial jobless claims declined.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- CMG acquires Norcom Mortgage’s retail assets, expanding its presence across the northeast. Read Now >>

- CPI data takes one rate cut off the table. Listen Now >>

- How did the CPI affect home builders? Watch Now >>

Market Recap

-

Mortgage application submissions climbed 0.1% during the week ending 4/5. The Refinance Index rose 10% while the Purchase Index slipped 5%.

-

Inflation came in hotter than expected in March on the consumer price index (CPI), rising 0.4% month-over-month vs 0.3% expected. Core CPI, which strips food and energy, was hot too, coming in at 0.4% vs 0.3% expected.

-

Continuing jobless claims were at 1,817,000 during the week ending 3/30, a 40,000 increase from the week before. Initial jobless claims were at 211,000 during the week ending 4/6, an 11,000 decline from the week before.

Review of Last Week

PRICES ROSE, PRICES FELL… Wall Street got the news that consumer price inflation rose again, and that, along with geopolitical concerns, sent stock prices plummeting on the three big indexes.

The March Consumer Price Index (CPI) hit a 3.5% annual rate, as inflation accelerated for the second straight month. With real average hourly earnings up only 0.6% the past year, consumer spending power is evaporating.

So, the Fed can take its time getting to rate cuts, especially with initial jobless still low. And University of Michigan Consumer Sentiment, while remaining down, is above where it was a year ago.

The week ended with the Dow down 2.4%, to 37,983; the S&P 500 down 1.6%, to 5,123; and the Nasdaq down 0.5%, to 16,175.

Bonds hate inflation too, so prices fell overall, the 30-Year UMBS 5.5% dropping 1.86 and landing at $97.22. The national average 30-year fixed mortgage rate edged up slightly in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… The National Association of Realtors says millennials now make up the largest share of the housing market—38% of all buyers—finally surpassing baby boomers, who have slipped to 31% of sales.

Market Forecast

HOME BUILDING, EXISTING HOME SALES, RETAIL SALES… It's expected we'll get a slight slowdown in Housing Starts for March, though Building Permits should remain the same as February's annual rate. March Retail Sales are forecast to come in ahead for the month, but at a slightly lower growth rate, indicating consumers are still spending, just not as enthusiastically.

Summary

Last week, new listings came in more than 30% higher than a year ago, the highest growth rate in three years. Total inventory was also more than 30% up from a year ago, ahead of the prior year’s level for the 22nd straight week.

Plus, the March inventory of homes priced from $200,000 to $350,000 was up more than 30% annually—and builders are targeting affordable homes, their median square footage the lowest since 2010.

Fannie Mae reports consumer views on homebuying and home selling stayed on the uptick in March: “Both our ‘good time to buy’ and ‘good time to sell’ measures continued their slow upward drift this month.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.