Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Cypress, Texas, specifically a market update for the neighborhood of Coles Crossing. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

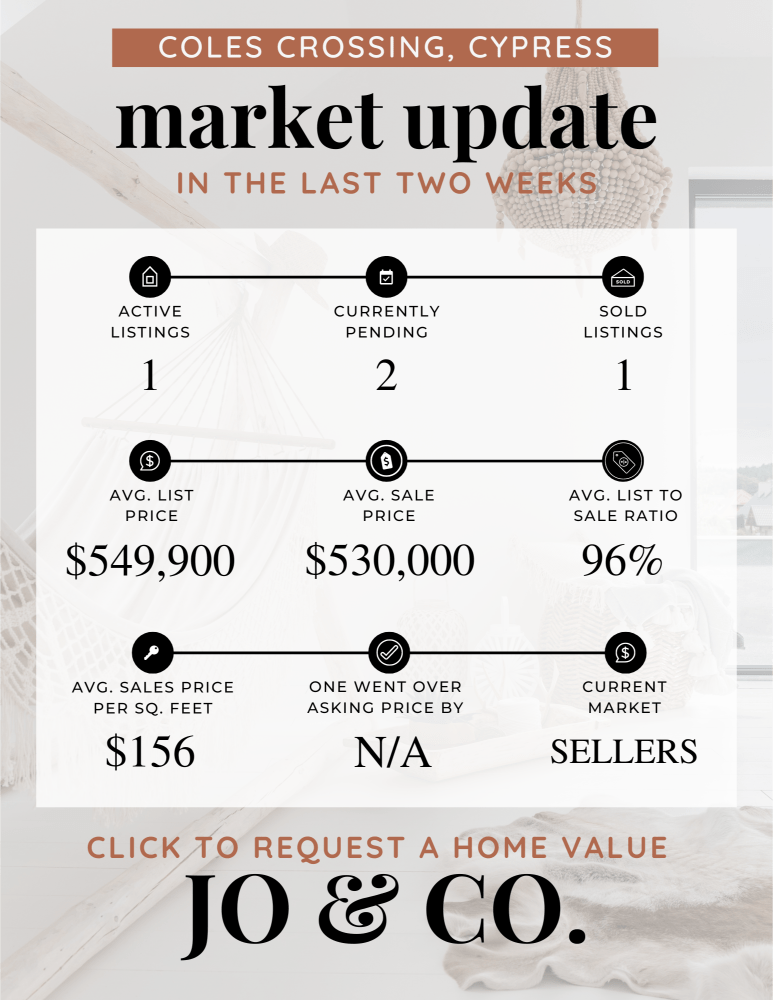

What is happening in the real estate market in Coles Crossing?

We currently have 2 homes pending, with 1 home sold in the last two weeks, averaging a sale price of $156 a square foot. One home sold over the asking price.

Compared to the two weeks prior: Homes sold are slightly down from 2 sold, but the average sales price is up to $530,000 ($383,250 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

If we look at how fast the move-in-ready (modern) homes are going (must not be overpriced), the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Coles Crossing.

My Two Cents: What I learned this week

Things have officially picked up. Don’t mind me over here doing my party dance. I have been seeing the increased online activity for about 6 weeks now, but this week people got in their cars and started house hunting. I have five clients ready to place orders, with half buying virtually.

I am seeing 1/3 financed resale, 1/3 new construction, and 1/3 cash. And all different price points and all different ages. 1/3 are coming from apartments and young and 2/3 are coming from out of state and as homeowners needing to sell.

The rumors were right this year, the spring market would hit late. And I did some research. Some of that is because other states, who are the ones that are buying right now, have spring break later in the year than us Texas folks.

There is good news in this though. I am still seeing new construction builders with interest rates 3.99% – 5% with resale looking at 6.5% before a buy down option. So there is something out there for everyone. I spent yesterday visiting three builders in the Porter area, and three builders in Katy, and they all have lowered their prices, many with high inventory. I am excited, and I cannot wait to hear from you.

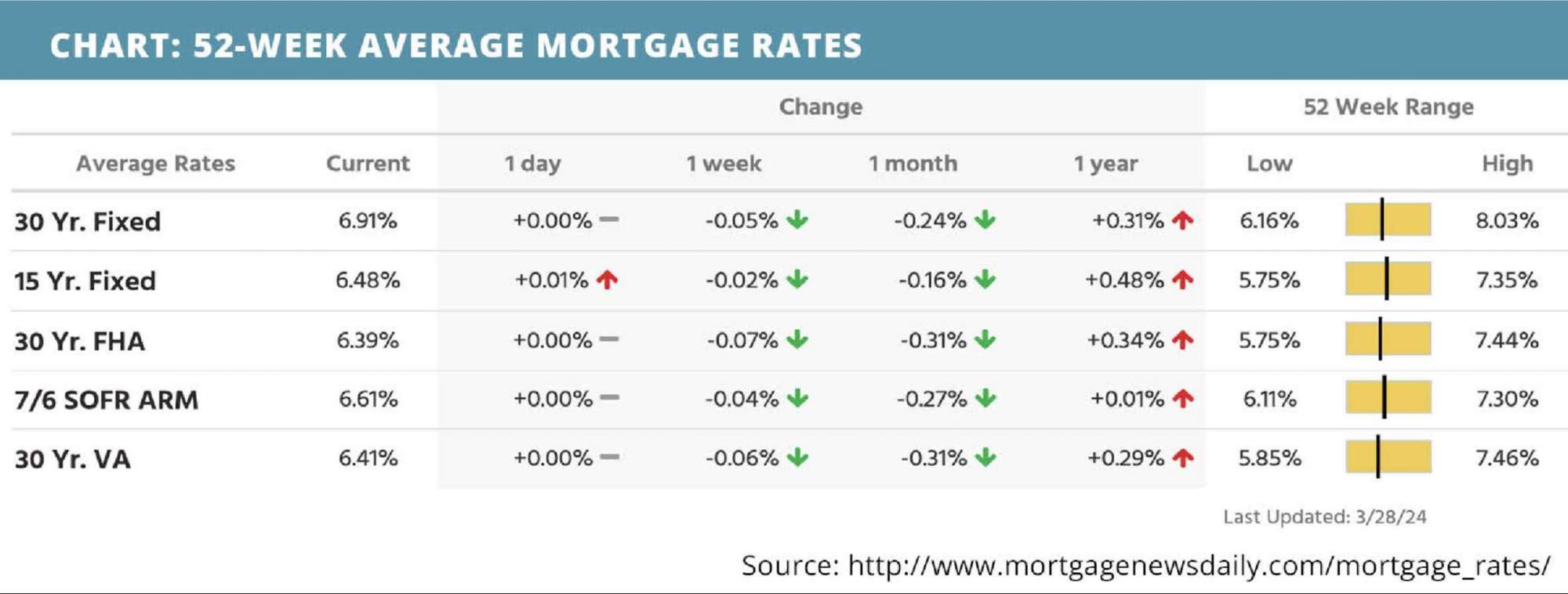

What is happening in the real estate market nationally?

Rates were unchanged last week. New home sales slipped in February, as did home price growth on the FHFA index in January. The 20-City Case Shiller index had a different story for prices. Mortgage application submissions slipped, as did initial jobless claims. Continuing jobless claims rose. The Q4 GDP estimate was higher than expected. Inflation on the PCE index was as expected while personal spending came in hot and personal income was lower than expected in February.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- HousingWire Lead Analyst discusses economics of NAR settlement. Read Now >>

- New home buyers may want to consider phase inspections. Read Now >>

- Rents across U.S. grew for first time in 6 months. Read Now >>

Market Recap

-

New home sales were at a seasonally adjusted rate of 662,000 in February, a 0.3% decline from the month before. Economists were expecting a slight increase. Annually, sales were still up 5.9%. The median new home price declined as well – down 7.6% year-over-year.

-

The FHFA home price index slipped 0.1% month-over-month in January. It was expected to increase 0.2%. Annually, prices are still up 6.3%.

-

The 20-city Case-Shiller home price index inched up 0.1% month-over-month and 6.6% year-over-year in January. This was as expected.

-

Mortgage application submissions decreased a composite 0.7% during the week ending 3/22. The Refinance Index declined 2% while the seasonally adjusted Purchase Index only slipped 0.2%.

-

Continuing jobless claims climbed by 24,000 during the week ending 3/15 to reach a level of 1,819,000. Initial jobless claims fell by 2,000 during the week ending 3/23 down to a level of 210,000.

-

The Q4 GDP estimate fell to 3.4%, which was higher than the expected 3.2%.

-

Pending home sales rose above expectations in February, climbing 1.6% month-over-month.

- The core PCE index from February came in as expected at 0.3% month-over-month and 2.8% year-over-year. Personal income was lower than expected at 0.3% while consumer spending came in higher than expectations at 0.8%.

Review of Last Week

ANOTHER RECORD HIGH… The major stock indexes made muted weekly moves, yet both the Dow and the S&P 500 hit record highs on Thursday, the final trading day of the quarter, as markets were closed for Good Friday.

However, investors didn’t see Friday’s PCE Prices, the Fed’s favorite inflation gauge. Overall PCE inflation edged up to 2.5%, and Core PCE (excluding food and energy) was 2.8%, up from the Fed’s 2% target for rate cuts.

Final Q4 GDP came in at 3.4% economic growth, though that was seen as dated information. Weaker than expected March Consumer Confidence was balanced by low initial jobless claims showing labor market strength.

The week ended with the Dow UP 0.8%, to 39,807; the S&P 500 UP 0.4%, to 5,254; but the Nasdaq down 0.3%, to 16,379.

Bonds overall edged ahead for the week, with the 30-Year UMBS 5.5% UP .11, to $99.21. The national average 30-year fixed mortgage rate moved lower in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Realtor.com reported 664,716 homes on the market in February 2024—more February listings than in any of the prior three years. Finding a home should be easier.

Market Forecast

CONSTRUCTION SPENDING, MANUFACTURING, JOBS… For February, Construction Spending is forecast to gain overall, but we’ll check out the residential part. Manufacturing activity should still be contracting in March according to the ISM Manufacturing Index. Friday’s March jobs report is expected to show a slowdown in new Nonfarm Payrolls and a dip in the Unemployment Rate.

Summary

The Pending Home Sales index of signed contracts on existing homes rose in February. The National Association of Realtors noted “slow and steady progress,” thanks to “increasing demand along with more inventory.”

New Home Sales were largely unchanged in February, after two straight monthly gains. Good news for buyers—the median sale price fell for the sixth straight month and is down nearly 20% from its 2022 peak.

Home prices overall posted mixed signals in January, with the national Case-Shiller index up a tick and the FHFA index of homes financed with conforming mortgages down a tick, both up a bit the past year.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.