Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Cypress, Texas, specifically a market update for the neighborhood of 77433. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

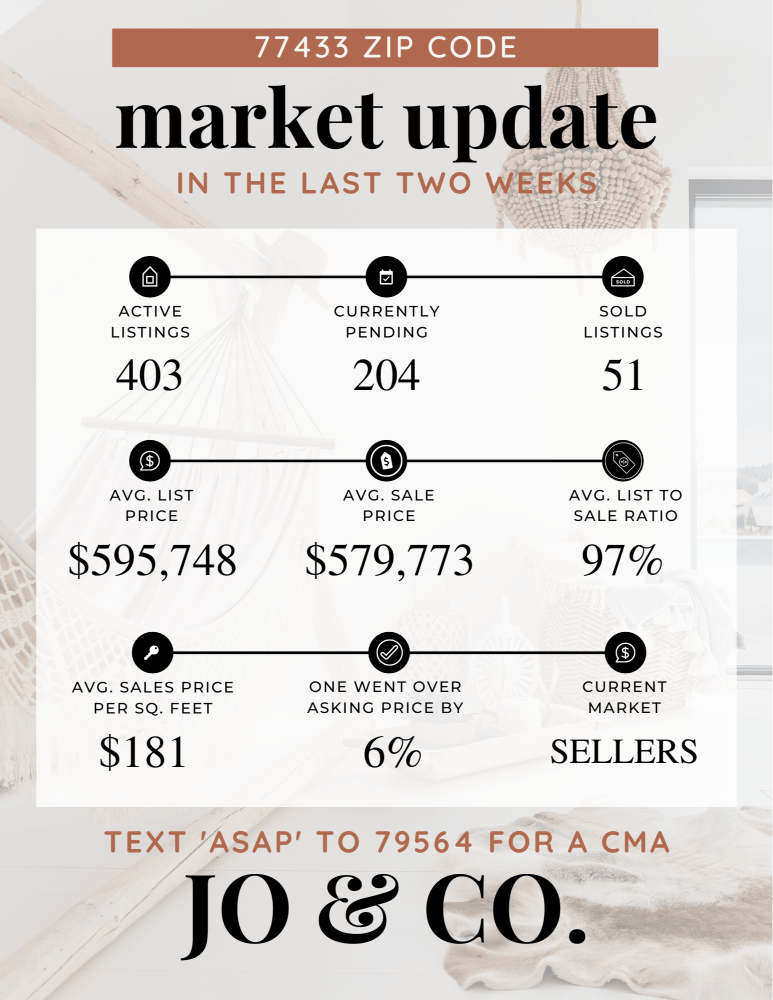

What is happening in the real estate market in 77433?

We currently have 204 homes pending, with 51 homes sold in the last two weeks, averaging a sale price of $181 a square foot. Fifty-One homes sold over the asking price, with one home selling 6% above the listing price.

Compared to the two weeks prior: Homes sold are up from 41 homes sold to 51 homes sold and the average sales price is also up to $579,773 ($554,005 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

If we look at how fast the move-in ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in 77433.

My Two Cents: What I learned this week

As we close the chapter on a year that's been full of ups and downs in the residential real estate world, let's take a moment to reflect before we jump into our predictions for 2024. Here's the scoop from the folks at Zillow: buying a home might still be a bit of a stretch on the wallet in 2024, though possibly not as tight as it was this year. Don't expect a huge plunge in mortgage rates, but there's a bit of buzz about the Federal Reserve hinting at rate cuts next year, which could mean a bit of a break for prospective buyers.

Now, let's talk about those homes that need a little TLC – they're likely to get more love as people compete for more affordable options. Plus, a bunch of homeowners might just get tired of waiting for rates to drop and decide to make their move due to life's ever-changing tides.

Zillow's Senior Economist Orphe Divounguy has some interesting tidbits to share, so let's dig in.

**What's Happening with Home Listings?**

2023's been a tight year for home listings, keeping the competition pretty intense. A lot of folks hung onto their homes, thanks to those super-low interest rates on their mortgages. The start of the year saw just about 884k homes up for grabs, which is actually pretty low compared to previous years.

But here's the deal – a lot of homeowners are eyeing moves that suit their changing lifestyles, whether that's upsizing, downsizing, or just shifting locations. Zillow thinks these folks are going to stop playing the waiting game for lower rates and just go for it.

What this means for the market is potentially more homes up for sale, which is good news for buyers. It could help spread out the demand and maybe even soften those steep prices a bit.

**The Takeaway for Buyers and Sellers:**

If you're looking to buy, brace yourself for some competition come springtime. But sellers, you're not off the hook either. 2023 wasn't always smooth sailing, especially for pricier homes. To stand out, homes might need to be priced more competitively, maybe spruced up a bit to catch those buyers' eyes.

**And About Those Interest Rates…**

Orphe Divounguy from Zillow points out that it's not just the high mortgage rates that are a headache – it's the unpredictability that's really throwing people off. The last couple of years have been a wild ride with rates, but there's a glimmer of hope that things might settle down a bit in 2024. Inflation's on a downward trend towards the Fed's 2% target, which could mean a more stable housing market.

Divounguy suggests that we might not see as many dramatic changes in mortgage rates, but don't hold your breath for a big drop, even with potential Fed cuts.

**The Takeaway Here:**

For those of you looking to buy, even a small dip in rates could be your cue to lock in a mortgage. Stay in the loop with mortgage rate news and keep an eye on inflation and labor market reports – they can be big influencers on mortgage rates.

**Improving Affordability: Wages on the Rise**

Here's some good news: real hourly wages are climbing back up after taking a hit during the pandemic. When you factor in inflation, Americans are actually seeing an increase in real wages. Plus, the stock market, after a bit of a slump in 2022, has bounced back – the S&P 500 is up about 16% from last year. This means more financial muscle for housing as we head into the new year.

Divounguy notes that with declining rates recently, there's been a spike in mortgage applications. A stable economy with steady or slightly falling rates is helpful for the housing market. Affordability looks like it's on the upswing.

**The Bottom Line for Buyers:**

When you're coaching your buyer clients, focus on the bigger picture – monthly costs as a percentage of income, not just mortgage rates. This will give them a clearer idea of what they can realistically afford.

What is happening in the real estate market nationally?

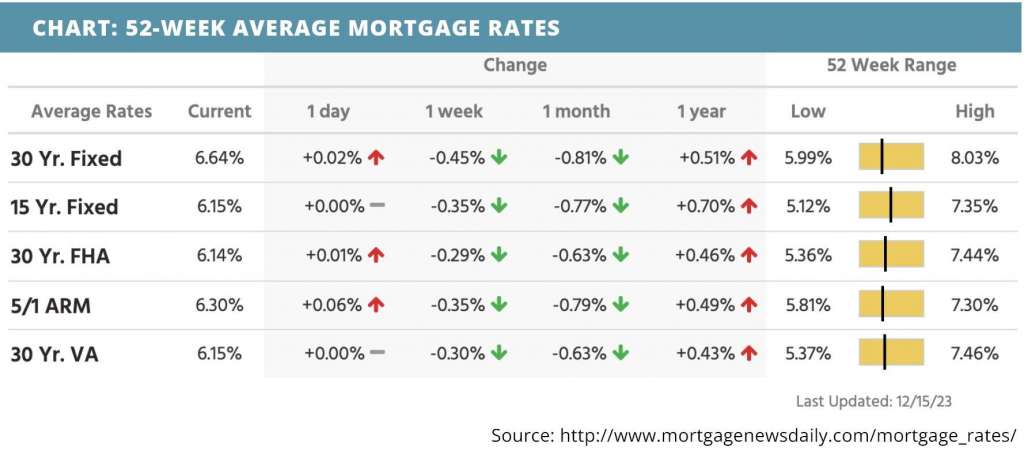

Rates plummeted last week thanks to good news from the Fed. Inflation was as expected in November and retail sales climbed. Mortgage application submissions jumped a couple weeks ago thanks to the recent rate trends. Continuing jobless claims climbed while initial jobless claims sank.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Sub 7% mortgage rates are set to “thaw” the market. Watch Now >>

- The rate cut cycle has begun. Listen Now >>

- The housing market is picking up. Read Now >>

Market Recap

-

Inflation on the consumer price index was as expected in November, at 0.3% month-over-month and 3.1% annually.

-

Mortgage application submissions surged 7.4% during the week ending 12/8, marking the sixth consecutive week of increases. The Refinance Index skyrocketed 19% week-over-week and was 27% higher than the same week one year ago. The seasonally adjusted Purchase Index jumped 4% week-over-week.

-

The Fed voted to leave interest rates unchanged in December and projected that there will be three 25-basis-point rate cuts in 2024.

-

Continuing jobless claims jumped by 20,000 during the week ending 12/1 to reach a level of 1,876,000. Initial jobless claims were at a level of 202,000 during the week ending 12/8, a 19,000 decrease from the week before.

-

Retail sales inched up 0.3% month-over-month in November vs. the 0.1% decrease expected

Review of Last Week

THE FED PLAYS SANTA… The three major stock indexes rose for the seventh week in a row as Wall Street traders reveled in the surprise holiday gifts that came out of the Fed’s Wednesday meeting.

These were a “dot plot” projection of three rate cuts in 2024, a soft landing forecast for the economy (lower growth and inflation without big job losses), and Fed Chair Powell’s acknowledging that rate hikes are likely over.

The latest economic data pointed to that soft landing. The Consumer Price Index ticked down to 3.1% in November, Retail Sales rebounded a bit, and weekly initial jobless claims still sit well below recession levels.

The week ended with the Dow UP 2.9%, to 37,305; the S&P 500 UP 2.5%, to 4,719; and the Nasdaq UP 2.8%, to 14,814.

Prices in the bond markets rose as well, the 30-Year UMBS 5.5% finishing up, at $100.10. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate dropped for the seventh week in a row. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… The steep drop in new listings typical at this time of year hasn’t happened. So, buyers have more choices, and, since inventory is still down, sellers can expect good prices, with less competition.

Market Forecast

HOME BUILDING, NEW AND EXISTING HOME SALES, INFLATION… Builder activity should slow a tick in November, as measured by both Housing Starts and Building Permits. But New Home Sales are expected to continue their upward trend, while Existing Home Sales also register a gain. This week features the Fed's favorite inflation gauge, PCE Prices—and that’s forecast to show price gains moderating.

The stock and bond markets will be closed next Monday, December 25, Christmas Day.

Summary

Realtor.com reports active inventory came in last week 4% above a year ago, pushed north by new listings, up almost 7% from a year ago. The median listing price showed a modest 1.5% annual gain.

The Mortgage Bankers Association revealed demand for purchase mortgages headed up five of the past six weeks, while demand for refinances blasted off—jumping by 19% last week, 27% ahead of a year ago.

Freddie Mac believes that given “the Federal Reserve Board’s current expectations that they will lower the federal funds target rate next year, we likely will see a gradual thawing of the housing market in the new year.”

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.