Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Cypress, Texas, specifically a market update for the neighborhood of Fairfield. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Fairfield?

We currently have 11 homes pending, with 5 homes sold in the last two weeks, averaging a sale price of $168 a square foot. Five homes sold over the asking price, with one home selling 1.5% above the listing price.

Compared to the two weeks prior: The number of homes sold is still the same, but the average sales price is up to $488,700 ($407,300 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways! The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Fairfield.

My Two Cents: What I learned this week

With another week behind us, I want to chat about the market. The Fed is not missing a beat and the market is dancing right along, leading to some of the nicest mortgage rates we’ve seen in a while. Feels like we’re all waving a goodbye to those rate hike worries for now. Or maybe it is just wishful thinking. But I love that there is hope in the air.

So, the Fed’s kept their foot steady on the pedal, holding rates right at their 22-year high. Looks like the long-term rates’ little jump has started to slow things down all on its own, possibly doing the Fed’s work for them. The bond market, acting like fans at a sold-out show, really cheered on this decision and Jerome Powell’s reassuring words, letting rates take a wee breather.

Then there’s the Treasury, hinting at a more streamlined borrowing plan for the year’s home stretch. Here’s the deal: offering fewer long-term bonds means there’s less pressure to bump up interest rates to attract buyers. It’s a nifty ‘less is more’ approach, and the bond market is eating it up.

It’s not all smooth sailing, though – the ISM Manufacturing Report let out a bit of a groan, marking a year of contraction. Not the best news for the industry, but hey, in the quirky world of bonds, a little economic sour can actually sweeten rates. And don’t forget, we’re all in this global economic jam session together. Europe’s cooler-than-expected inflation tune is helping keep our long-term rates in a mellow rhythm.

Ahead, we’ll keep an eye out to see if this market melody keeps playing. No big economic headlines are expected soon, but with a few Treasury auctions coming up, it’s anyone’s guess if these chill rates will stick around. The mortgage market is like a big band with bond prices leading, and they’ve been hitting some encouraging notes lately – suggesting maybe, just maybe, we’re tuning out of a long-term downtrend. Here’s to hoping for more of these good vibes as we sail into next week. Keep it light, friends!

What is happening in the real estate market nationally?

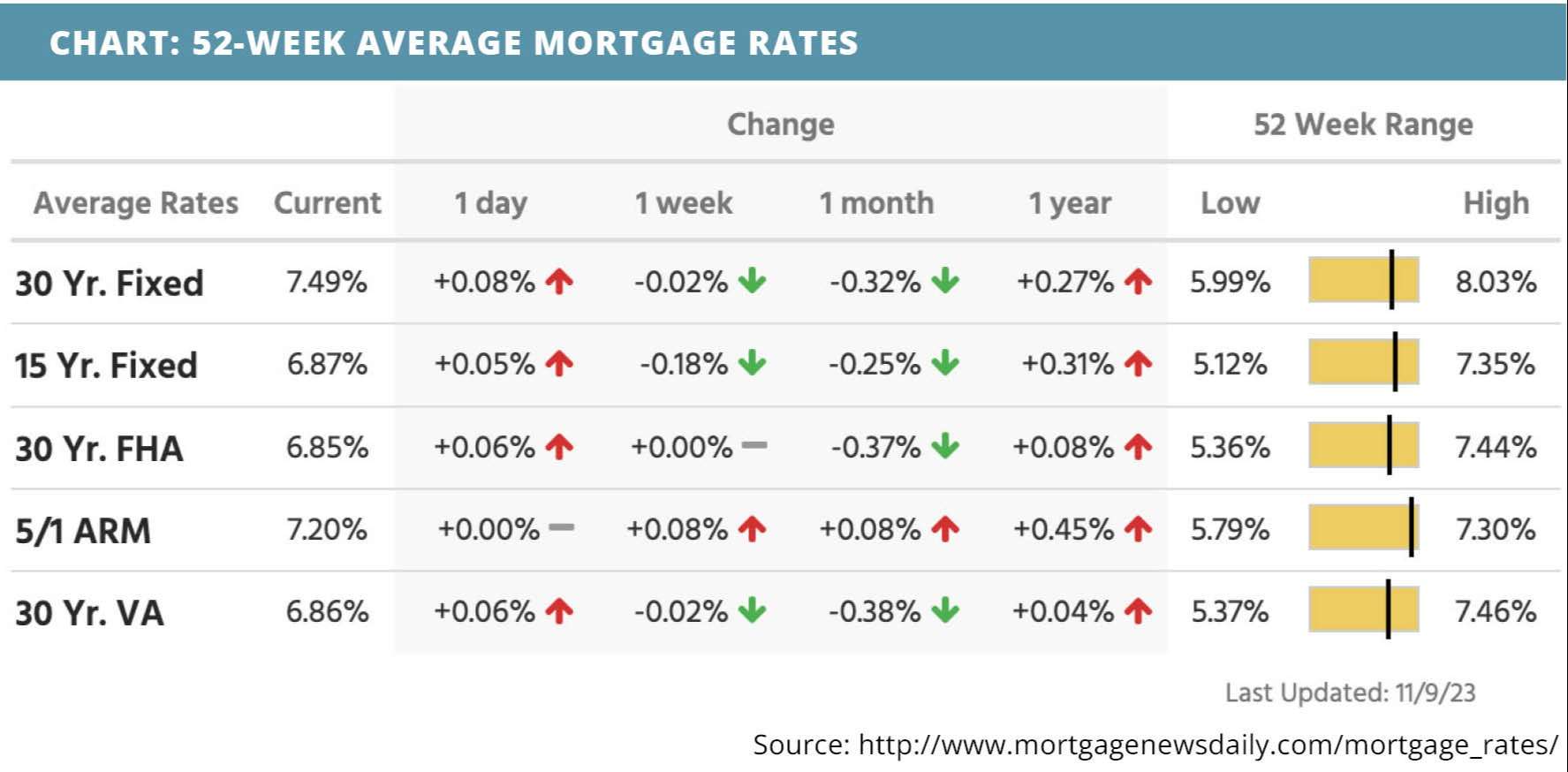

Mortgage rates inched up slightly last week, as did mortgage application submissions two weeks ago. Continuing jobless claims climbed while initial jobless claims fell.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable New

- HousingWire Lead Analyst explains why home prices won’t crash in the next recession. Read Now >>

- Nearly one third of American home buyers are paying in cash. Read Now >>

- Diana Olick talks about the beginning of mortgage rate decreases. Watch Now >>

Market Recap

-

Mortgage application submissions saw a composite increase of 2.5% during the week ending 11/3. The Refinance Index jumped by 2% while the seasonally adjusted Purchase Index increased by 3%.

-

Continuing jobless claims were at a level of 1,834,000 during the week ending 10/28, a 22,000 climb from the week before. Initial jobless claims were at a level of 217,000 during the week ending 11/4, a 3,000 drop from the week before. Both continuing and initial jobless claims were higher than expected.

Review of Last Week

LET'S DO IT AGAIN… Following its best week of the year, the market put on a positive showing again, as technology stocks drove up the major indexes, the Nasdaq and S&P 500 posting their best finishes since September.

Fed Chair Jerome Powell did put a damper on the festivities, when he told an International Monetary Fund panel he was wary of “head fakes” from inflation, and “the 2% goal was not assured.”

But the yield on 30-year Treasuries declined for the third straight week, a good sign for lower interest rates. And September import and export numbers showed strength in both our economy and the appeal of U.S. goods abroad.

The week ended with the Dow UP 0.7%, to 34,283; the S&P 500 UP 1.3%, to 4,415; and the Nasdaq UP 2.4%, to 13,798.

Bond prices dipped a tad overall, with the 30-Year UMBS 6.5% off just .01, to $100.10. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate fell for the second week in a row. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Fannie Mae found only 29% of homeowners with a mortgage were staying in their homes longer than planned and only 21% of those said a low mortgage rate was the primary reason, so the lock-in effect is delaying a move for only 6% of all mortgage borrowers.

Market Forecast

HOME BUILDING, INFLATION, RETAIL SALES… Four heavy hitter economic reports this week, starting with October Housing Starts expected to continue increasing, though Building Permits should recede slightly. Economists forecast the October Consumer Price Index (CPI) will show inflation diminishing (yay!), but prices are still high enough to cause a predicted slowdown in Retail Sales.

Summary

Inventory growth in November is rare, but Altos Research reports 62,000 new listings last week, up 0.7% from the prior week, with 9,000 under contract. Although 39.2% of listings have had a price cut, prices are still above last year.

CoreLogic found single-family home prices rose in September for the third month in a row and are up 4.5% year-over-year, the largest annual gain since February. But they forecast yearly growth will slow to 2.6% by next September.

The Mortgage Bankers Association recorded purchase mortgage applications up 3% last week, reversing three weeks of declines. Even applications for refinances were up 2% from the week before.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.