Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Cypress, Texas, specifically a market update for the neighborhood of 77389. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in 77389?

We currently have 22 homes pending, with 14 homes sold in the last two weeks, averaging a sale price of $225 a square foot. Fourteen homes sold over the asking price, with one home selling 3% above the listing price.

Compared to the two weeks prior: Homes sold are up from 10 homes sold to 14 homes sold and the average sales price per square foot is also up: $225 ($201 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

If we look at how fast the move-in ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in 77389.

Did you know?

If you can't afford to buy a house in Houston, you're part of the majority, report finds.

⁃ Houston Chronicle Article Summary

• According to a report from HAR, nearly 60 percent of Houstonians can't afford to buy a house in the area.

• Prior to the pandemic, approximately 58 percent of households in the region could afford to buy a median-priced house in the second quarter 2019.

• In the second quarter of this year, only about 40 percent could.

• Calculating the monthly payment including standard insurance and taxes for a 30-year, fixed-rated mortgage with a 6.5 percent interest rate, the average buyer could expect to pay about $2,400 for a median-priced home in Houston during Q2 of 2023.

• That is about $170 per month more than one year ago.

• The average household income needed to afford the median-priced home rose about $6,400 from last year to $96,000.

• When compared to other large metros in the state, Houston was still more affordable than Austin or Dallas, which would need an annual income of $136,400 and $107,200, respectively.

• “Rising interest rates continue to weigh on potential homebuyers who are faced with the challenge of balancing affordability and opportunity,” said HAR Chair Cathy Treviño.

The looming crisis that's going to crush homeowners from coast to coast

⁃ Business Insider Article Summary

• California faces the highest wildfire risk among all states, with more than 1.2 million homes at risk of wildfire damage.

• Leading insurers like State Farm, Allstate, American International Group, and Chubb are halting new home insurance policies due to the growing catastrophe exposure and risk in California.

• Florida has a different risk profile, with a third of its population living in flood-prone areas and facing hurricane risks.

• A U.S. Army Corps of Engineers study predicts 3 feet of sea-level rise in Florida, causing an estimated $24 billion in damage annually.

• Home insurance costs in Florida are soaring, with average policies now costing about $4,200, more than double the national average of $1,700.

• More than 13% of homeowners in Florida are uninsured, twice the national average.

• Louisiana, Oregon, and Colorado also experience increased wildfire and flooding risks.

• Hawaii's recent wildfires destroyed over 2,200 structures, and blizzards have doubled in the past two decades.

• Since 2013, winter weather caused $2 billion in property damage, leading to higher insurance rates in affected states.

• Nationwide, average home insurance costs have risen by 21% since 2015 and are expected to increase by 9% this year.

• Climate-related risks are pushing insurers to reevaluate their business in high-risk states, leading to policy changes and higher costs.

• Despite the risks, some residents are committed to staying, even in the face of climate-related challenges.

Jo's Two Cents

What I am seeing…

• Prices have continued to rise.

• New construction has continued to be one of the smartest choices for buyers all around the Houston Suburbs, especially in Montgomery County.

• Large amounts of poorly renovated homes and large amounts of homes that aren’t move in ready, continue to sit on the market.

• Inventory of move in ready homes are sitting at a low. Which we predict will continue for the next 45 days.

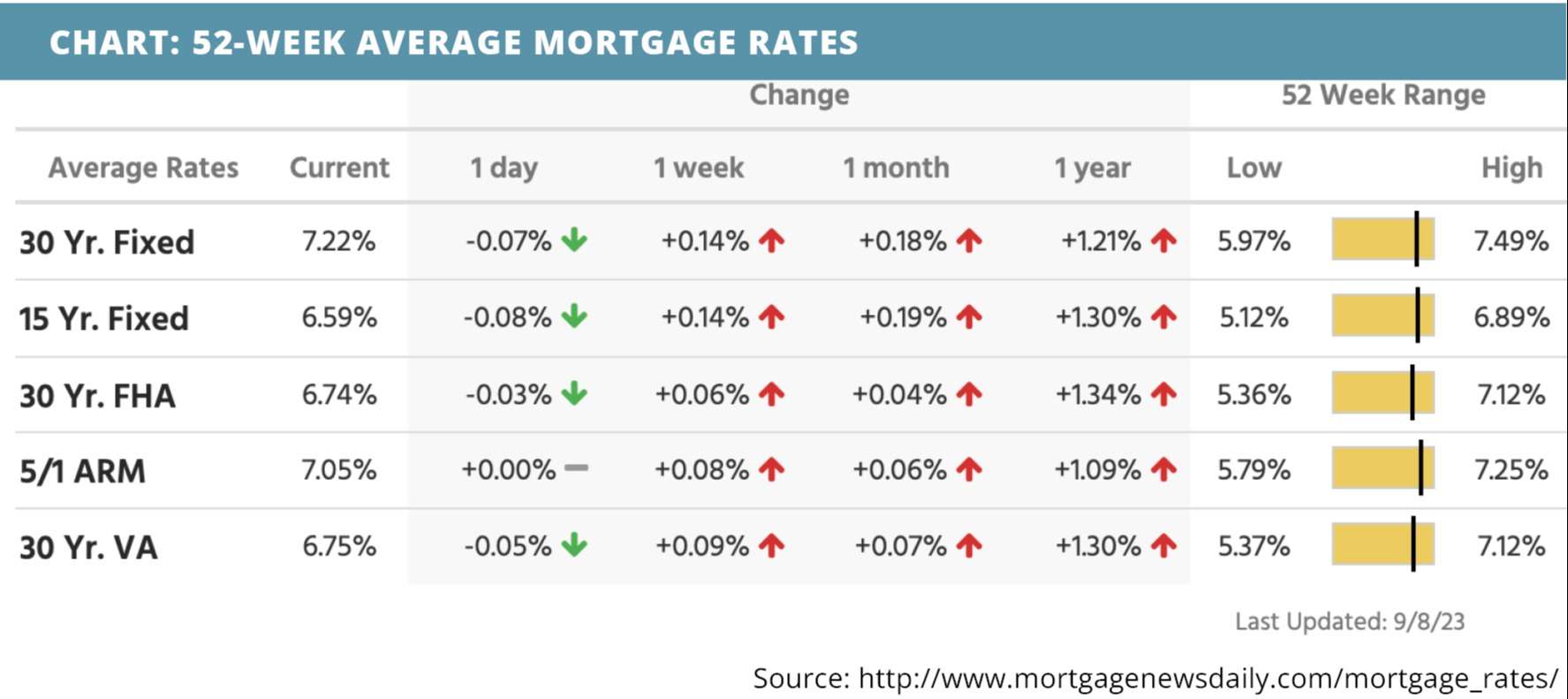

• In the last two weeks, we have seen interest rates break the 7% ceiling, but they are now below it.

• It is still a good time to buy because equity growth is still possible.

What is happening in the real estate market nationally?

Mortgage rates trended higher in the middle of last week due to strong economic data and the corporate bond market. Mortgage application submissions declined, as did jobless claims.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- CMG’s General Counsel, Shannon Leight, featured in Vanguard Law Magazine. Read Now >>

- Have mortgage rates peaked? Listen Now >>

- Americans are sitting on nearly 30 trillion in home equity. Read Now >>

Market Recap

-

Mortgage application submissions decreased a composite 2.9% during the week ending 9/1. While refinance application submissions slipped by 5%, purchase application submissions slipped by 2%.

-

Continuing jobless claims were at 1,679,000 during the week ending 8/26, a 40,000 decrease from the week before. Initial jobless claims were at 216,000 during the week ending 9/2, a 13,000 decrease from the week before.

Review of Last Week

STILL ON VACATION… Trading volumes were down in the holiday-shortened week, as Wall Street stayed in vacation mode past Labor Day. Continuing concerns over inflation and the economy left equities with a losing week.

A sharp bump in oil prices fueled inflation concerns, which had traders worried consumers would dial back their spending. Signs of a slowing economy came with exports and imports both down from a year ago.

Yet activity in the huge services sector accelerated in August, though prices also rose at a faster pace. But vehicle sales are up almost 14% from a year ago, and initial jobless claims sank to their lowest level since February.

The week ended with the Dow down 0.7%, to 34,577; the S&P 500 down 1.3%, to 4,457; and the Nasdaq down 1.9%, to 13,762.

Bonds mimicked equities, the 30-Year UMBS 6.0% falling 0.80, to $99.29. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate headed down again. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Realtor.com’s My Home dashboard will now show homeowners what they could earn if they put their home, or a room in it, on Airbnb. The dashboard also links directly to the short-term rental platform.

Market Forecast

INFLATION, RETAIL SALES, CONSUMER SENTIMENT… The August Consumer Price Index (CPI) is forecast up slightly, same as the Producer Price Index (PPI) for wholesale prices. August Retail Sales should also be a up little from July, showing consumers remain in the game. But those consumers aren't so happy, especially about inflation, so Preliminary University of Michigan Consumer Sentiment for September is expected to stay near August's low-range number.

Summary

More homebuyers are searching for homes in areas outside where they live. During Q2 this year, 60.3% of listing views in the top 100 metros went to homes in another metro, an increase over the prior quarter and prior year.

Home flippers keep making money. Flippers who sold in June typically got 61%—or $188,448—more than their original purchase price. This was down from 69% a year earlier, though still a substantial gain.

A recent study by an online real estate database found that nearly 40% of first-time homebuyers under the age of 30 used either a cash gift from family members, or an inheritance, to help fund their down payments.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.