Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Imperial Oaks. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Imperial Oaks?

We currently have 11 homes pending, with 7 homes sold in the last two weeks, averaging a sale price of $158 a square foot. Seven homes sold over the asking price, with one home selling 2% above the listing price.

Compared to the two weeks prior: Homes sold are up from 5 homes sold to 7 homes sold and the average sales price per square foot is also up: $158 ($139 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

If we look at how fast the move-in ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Imperial Oaks.

Jo's Two Cents

Interest rates started pushing above 7% this week, and on the showing side, we have seen a slow in real estate. We won’t see the results of these increases for another 30 days on the closed side, but we will feel it soon enough.

Inventory is still low, and the most desirable neighborhoods will still see some competitive offers. But homes needing updates that aren’t move in ready will stay on the market for record lengths. This is because of the instability in the economy. If people have massive amounts of cash, they are going to hold on to as much as possible. Making renovations not a top desire right now.

But in other news:

- A significant influx of people from outside the U.S. are moving to Texas and purchasing homes, as Texas has become a top location for foreign investors, particularly from Mexico.

- According to NAR, Texas had the second-largest share of U.S. home purchases by foreigners from April 2022 to March 2023, tied with California, and following Florida (23%).

- Texas was the primary destination for homebuyers from Mexico with approximately half of all Mexican buyers in the U.S. choosing Texas.

- Texas home purchases from Mexico increased from 1,735 in 2022 to 4,059 in 2023.

- Texas is also among the top three states for homebuyers from both China and India.

- Foreign buyers contributed $53.3 billion to U.S. residential purchases between April 2022 to March 2023, which represents 2.3% of the $2.3 trillion volume of existing-home sales.

- A total of 84,600 foreign buyers acquired homes during this period, equating to 1.8% of all sales.

- About half of the foreign buyers in 2023 were residing in the U.S.

- The countries with the most buyers of U.S. properties were China (11,000 buyers), Mexico (9,300 buyers), Canada (8,500 buyers), India, (5,900 buyers), and Colombia (2,500 buyers).

- Canada was previously number one but fell to third in the most recent report.

- Among the buyers with the highest median sales price were those from China who had the highest median sale price at $723,200, often purchasing in high-cost areas like California and New York.

- Meanwhile, Mexican buyers had a median purchase price of $278,100, the lowest among the top five countries.

MarketWatch

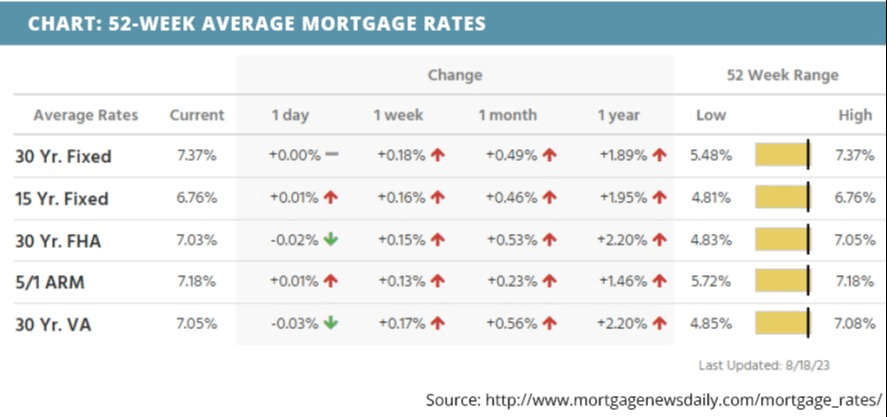

- The 30-year mortgage rate is currently hovering around 7%, as home prices continue to rise.

- In July, 82% of consumers believed it was a “bad time to buy a home,” an increase from 78% in June according to Fannie Mae.

- With relatively few homeowners showing interest in selling, prices will potentially remain elevated.

- Sixty-four percent of those surveyed said it was a good time to sell, unchanged from the previous month.

- The sentiment of a “good time to sell” has remained steady in recent months.

- This steady sentiment indicates that the low number of homes for sale will likely persist.

- Sales of previously-owned homes dropped by 3.3% in June, with the shortage of homeowners selling being cited as the primary reason for the decline, according to NAR.

- The price of a typical resale home was $410,200, the second-highest since 1999.

- Even as there are fewer homes available for sale nationally (contrary to rising inventory in the Houston market), roughly 40% of respondents expect home prices to increase in the upcoming year.

What is happening in the real estate market nationally?

Mortgage rates increased last week. Retail sales increased in July and mortgage application submissions decreased. Housing starts and building permits were impressive in July. Continuing jobless claims rose while initial jobless claims fell.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- CMG Financial’s Paul Akinmade Recognized as 2023 HousingWire Marketing Leader. Read Now >>

- HousingWire lead analyst discusses the Fed’s mindset about housing. Listen Now >>

- What’s trending in outdoor amenities? Read Now >>

Market Recap

-

Retail sales surged in July, rising 0.7% month-over-month vs. the 0.4% expected.

-

Mortgage application submissions fell a composite 0.8% during the week ending 8/11. The Refinance Index slipped 2% while the seasonally adjusted Purchase Index fell 0.2%.

-

Housing starts and building permits had an impressive turnout in July. Housing starts were at a seasonally adjusted annual rate of 1,452,000, a 3.9% increase from June. Building permits were expected to decline but ended up increasing 0.1%.

-

Continuing jobless claims were at a higher-than-expected level of 1,7167,000 during the week ending 8/5, a 30,000 increase from the week before. Initial jobless claims were at a level of 239,000 during the week ending 8/12, a drop of 11,000.

Review of Last Week

COOL ON WALL STREET… While much of the country experienced a summer heatwave, it's been a cool August on Wall Street, with stocks sinking all month on interest rate and global growth concerns.

Last week, minutes from the Fed’s July meeting sounded like rates might stay higher for longer, with maybe one more hike thrown in. Global growth worries came from a batch of weaker than expected economic data out of China.

But it looks like we may avoid a recession. Retail Sales went up 0.7% in July, so consumer spending remains healthy. And a gain in Industrial Production showed the economy continues growing despite the Fed rate hikes.

The week ended with the Dow down 2.2%, to 34,501; the S&P 500 down 2.1%, to 4,370; and the Nasdaq down 2.6%, to 13,291.

Bonds headed south too, the 30-Year UMBS 5.5% falling 0.98, to $97.22. The national average 30-year fixed mortgage rate moved up again in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Analysts say the leading housing market indicators predict home prices will stay flat or move slightly higher for the next 12 months. Zillow is forecasting 6.5% home price growth through July 31 next year.

Market Forecast

NEW AND EXISTING HOME SALES, POWELL SPEAKS… With the continuing tight inventory of pre-owned homes, Existing Home Sales are expected to tread water in July, while New Home Sales should keep gaining. Friday, Fed Chair Jerome Powell will be speaking at the central bank's annual Jackson Hole Economic Policy Symposium, so we'll listen for signs of future Fed rate moves.

Summary

Following the June decline, Housing Starts shot back up 3.9% in July—5.9% higher than a year ago. Plus, single-family starts gained 6.7% for the month—9.5% year-over-year—good news about these much-needed units..

July Building Permits only eked out a 0.1% gain over June, but builders already have their hands full, with a near record number of projects in the pipeline. But they remain cautious, their confidence index slipping in August.

An online real estate database reported the value of all U.S. real estate hit an all-time high of $46.8 trillion in June. Baby boomers dominate other generations, holding $18 trillion of that housing wealth.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.