Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Memorial Northwest. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Memorial Northwest?

We currently have 8 homes pending, with 3 homes sold in the last two weeks, averaging a sale price of $133 a square foot. Three homes sold over the asking price, with one home selling 1.2% above the listing price.

Compared to the two weeks prior: The number of homes sold is still the same, but the average sales price is up $564,333 ($441,667 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways! The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Memorial Northwest.

Jo's Two Cents

Nationally inventory dipped to record lows in the last few weeks, with the total number of homes for sale declining 15 percent year over year, making the largest annual decline in two years according to industry analysts. New listings fell 30.6% year over year but despite this, demand is steadily ticking up and now we are seeing the resurgence of bidding wars, something that has pushed the median sales price in the U.S. to $426,056 for June. This is only 1.5% away from the record all-time high of $432,397 from May 2022. And we are seeing these bidding wars locally. Every house, excluding new construction, that I have helped clients purchase recently were involved in a multiple-offer situation. But don't worry, we still won all of our bids in June.

What is happening in the real estate market nationally?

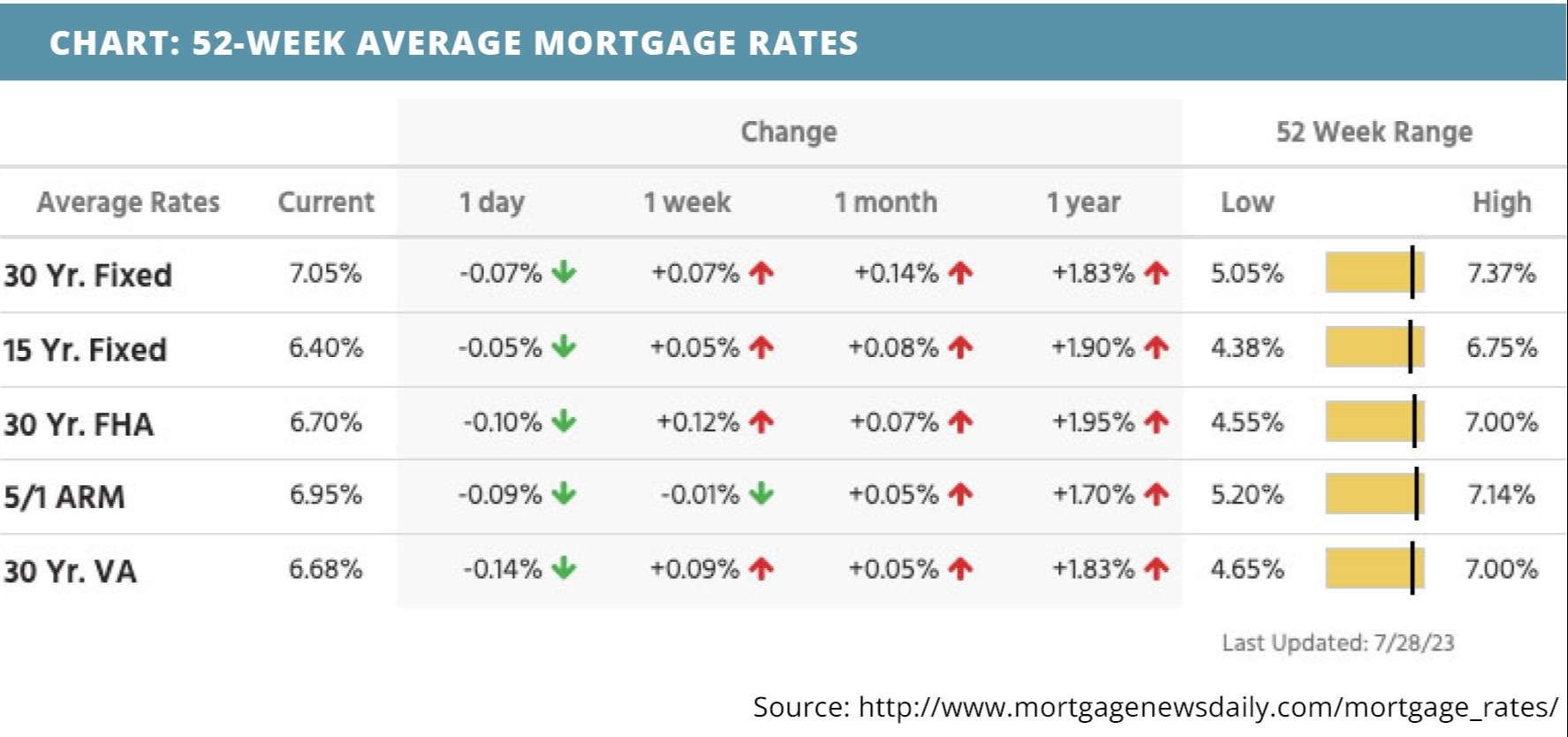

Mortgage rates trended slightly higher last week – mostly from strong economic data on Thursday. The Federal Open Market Committee (FOMC) voted to raise the benchmark interest rate again at their most recent meeting. May’s home price index readings were mixed. Mortgage application submissions decreased. New home sales slipped in June, jobless claims decreased, and the GDP estimate was higher than expected. Pending home sales climbed, inflation cooled, personal income fell, and consumer spending climbed higher.

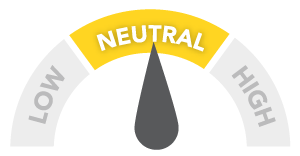

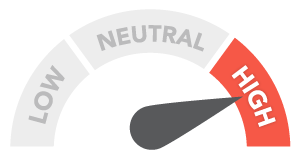

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Real estate agents see light at the end of the tunnel. Read Now >>

- Fed Chair Powell comments on housing inventory. Watch Now >>

- Here’s what can help home sales. Read Now >>

Market Recap

-

May’s FHFA house price index increased 0.7% month-over-month and 2.8% annually. Both levels were higher than expected.

-

The 20-city Case-Shiller home price index increased 1% month-over-month in May – lower than the 1.5% expected climb, but higher than the previous month’s increase. Annually, prices fell 1.7%.

-

Mortgage application submissions fell a composite 1.8% during the week ending 7/21. Refinance application submissions slipped 0.4% and purchase application submissions decreased 3%.

-

New home sales were at a seasonally adjusted annual rate of 697,000 in June, a 2.5% decline from May. Though the decline was lower than expected, it comes after a nice surge in May.

-

As expected, the Federal Open Market Committee (FOMC) voted to raise the benchmark interest rate by another 0.25%. Markets had largely prepared for this decision and even welcomed the news from Federal Reserve Chairman Jerome Powell’s press conference.

-

Continuing jobless claims were at a level of 1,690,000 during the week ending 7/15, a 60,000 decline from the week before. Initial jobless claims declined as well, falling by 7,000 to end at a level of 221,000 during the week ending 7/22.

-

The GDP estimate for quarter two climbed 2.4%, a higher-than-expected increase. This strong data in combination with jobless claims influenced higher rate trends.

-

Despite an expected decrease, pending home sales inched up 0.3% in June.

-

The core PCE index, measuring inflation without food and energy costs, remained at 0.2% month-over-month in June. Annual inflation on the index saw a drop to 4.1% from 4.6% the month before – this is the lowest annual level in two years. Personal income was below expectations in June, rising 0.3% vs. the 0.5% expected. Consumer spending increased 0.5% in June – a notable increase from 0.2% the month before and the 0.4% expected.

Review of Last Week

GOLDILOCKS IN VIEW… Traders started seeing a Goldilocks economy on the horizon—warm enough to stave off a recession, but cool enough to quash inflation—and stocks headed north again.

This happened while the Fed announced an expected quarter percent rate hike, and Chair Powell refused to rule out another hike in the future, or to say when the central bank may begin bringing rates down.

Goldilocks data featured warming Durable Goods Orders, Personal Income, Personal Consumption (consumer spending), and Q2 GDP increasing to 2.4%, with inflation cooling to a 3% by the Fed’s favorite PCE measure.

The week ended with the Dow UP 0.7%, to 35,459; the S&P 500 UP 1.0%, to 4,582; but the Nasdaq UP 2.0%, to 14,317.

With money moving over to stocks, bond prices moved down, the 30-Year UMBS 5.5% falling 0.85, to $98.30. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate was up a little after its big decline last week. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Consumer confidence surged to a two-year high in July. Freddie Mac noted: “Rising consumer confidence often leads to greater spending, which could drive more consumers into the housing market.”

Market Forecast

CONSTRUCTION SPENDING, MANUFACTURING, SERVICES, JOBS… For June, Construction Spending should continue on its upward path overall, and we'll check the residential part. July ISM Manufacturing is expected to show contraction, but ISM Non-Manufacturing is forecast to show the big services sector still expanding. Economists predict a modest increase in Nonfarm Payrolls for July, with the Unemployment Rate holding at 3.6%.

Summary

The National Association of Realtor’s June Pending Home Sales index of signed contracts on existing homes saw its first gain since February. The NRA noted, “The recovery has not taken place, but the housing recession is over.”

New Home Sales posted a small decline in June after increasing three straight months. But the trend is upward, with sales 28.4% above last July’s low. Plus, the median sale price is 16.4% down from its peak late last year.

The national Case-Shiller Home Price Index rose a tick in May, but is still down slightly from last June’s peak. May’s FHFA index of prices for homes bought with conforming mortgages was up a bit and bested its high set last June.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.