Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Cypress, Texas, specifically a market update for the neighborhood of Cypress Creek Lakes. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Cypress Creek Lakes?

We currently have 11 homes pending, with 2 homes sold in the last two weeks, averaging a sale price of $156 a square foot. Two homes sold over the asking price, with one home selling 1% above the listing price.

Compared to the two weeks prior, we haven’t seen big changes in the market. The average sales price in the neighborhood is $498,750. Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways! And the educated buyer still knows, they need to buy ASAP. The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Cypress Creek Lakes.

Jo's Two Cents

Did you know that historical data shows that homeowners over the past decade have become 40 times wealthier than renters? Unsurprisingly, NAR (the National Association of REALTORS®) has reported that the median-priced home gained $190,000 in value, which means the conventional homeowner became 40 times wealthier than if they had stayed as a renter.

This week, the US central bank raised the interest rates to the highest level in 16 years to battle inflation in attempts to stabilize prices. Even with interest rates being in the 5s and 6s, home buyers have not slowed down, and prices of homes in our area have not seen decreases. And the main culprit is the low levels of affordable inventory.

In the last 90 days, in The Woodlands, 433 homes have sold or gone under contract, with over half of them going under contract the first week they hit the market, and 51% sold at or over list price. One could assume 50-60% of these homes at a minimum received multiple offers, although I think the number is higher. I am personally seeing a record number of buyers, and their biggest complaint is their struggle to find the perfect homes. Less and less perfect homes are coming on the market. The only way my clients have been able to combat this is by buying new construction.

In Montgomery county, we have seen 2507 homes sell or go under contract. In Fort Bend county that number is 1596, and in Harris county 4263. So what are the most popular new construction neighborhoods so far this year?

- Sunterra (326)

- Tavola (255)

- Bridgeland (235)

- Cross Creek Ranch & Cross Creek West (224)

- Marvida (218)

- Tamarron (165)

- Sienna (160)

- Elyson (134)

- Jordan Ranch (133)

- Harper's Preserve (123)

- Meridana (111)

- Cane Island (100)

- Artavia (98)

- Woodforest (97)

- Magnolia Ridge (97)

- Balmoral (97)

- Amira (95)

- Creekside Farms (92)

- The Woodlands Hills (84)

- Grand Central Park (81)

- Sendero (80)

- The Highlands (76)

- Veranda (76)

- Candela (70)

- Pomona (71)

- Towne Lake (61)

If you are thinking about selling, maybe one of these new construction neighborhoods could be your next home? And if you are thinking about buying, let me help you, find the perfect neighborhood and home for you!

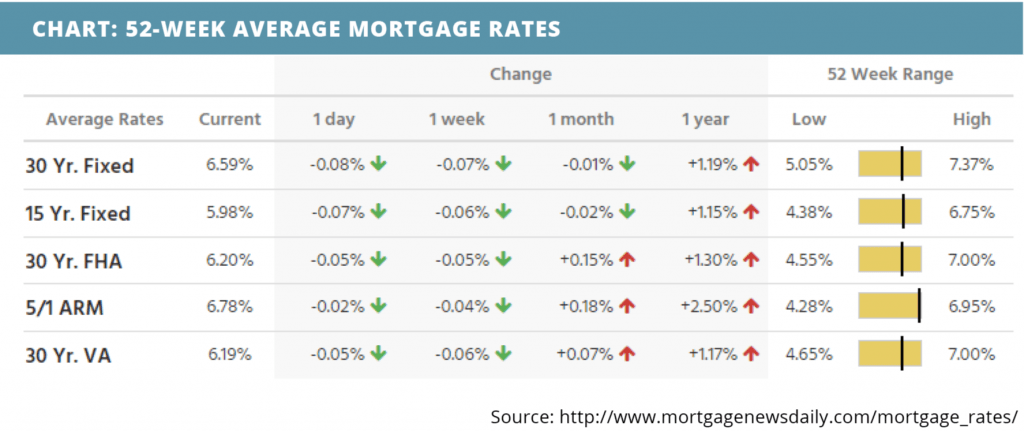

What is happening in the real estate market nationally?

Mortgage rates trended lower toward the beginning of last week. Home price appreciation climbed slightly in February. New home sales jumped in March. Mortgage application submissions increased. Continuing jobless claims decreased and initial jobless claims decreased. The Q1 GDP estimate for 2023 fell. Core inflation rose, personal income remained unchanged, and consumer spending rose.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Dave Stevens discusses the risk from LLPA changes. Listen Now >>

- Buyers are unfazed by rate trends. Read Now >>

- New home sales beat expectations in March. Watch Now >>

Market Recap

-

The FHFA house price index increased by 0.5% month-over-month in February and 4% year-over-year – both higher than expected.

-

The 20-city Case-Shiller home price index inched up 0.1% month-over-month in March and 0.4% year-over-year. Both increases were higher than expected, but the 0.4% annual rise is much lower than the 2.6% annual rise in March.

-

New home sales surged beyond expectations in March, rising 9.6% month-over-month to reach a seasonally-adjusted annual rate of 683,000 – a notable step ahead of the 630,000 expected by economists. The rise comes as a relief to the inventory-starved market.

-

Mortgage application submissions climbed 3.7% during the week ending 4/21. The Refinance Index increased 2%, while the Purchase Index climbed 5%.

-

Continuing jobless claims decreased to a level of 1,858,000 during the week ending 4/15. Initial jobless claims decreased to a level of 230,000 during the week ending 4/22.

-

The GDP estimate for Q1 was at 1.1%.

-

Pending home sales fell 5.2% in March, suggesting a decrease of closed sales in the coming months.

- In March, inflation on the core PCE index remained unchanged month-over-month and increased 4.6% annually. Consumer spending in March rose 3.7% and personal income increased by 0.3%

Review of Last Week

AWESOME APRIL… Ending the week firmly ahead, the Dow posted its best monthly gain in three months, while the S&P 500 and the Nasdaq both logged strong gains, as good economic data outweighed the not-so-good.

The Fed's favorite inflation index rose a tiny 0.1% in March, while the yearly rate dropped from 5.1% to 4.2%. But that's still more than double the Fed's 2% inflation target, so expect another rate hike this week. Not so good.

GDP showed the economy grew an underwhelming 1.1% in Q1. But, hey, key Q1 corporate earnings reports came in better-than-expected, and declining initial jobless claims are staying well below recession levels.

The week ended with the Dow UP 0.9%, to 34,098; the S&P 500 UP 0.9%, to 4,169, and the Nasdaq UP 1.3%, to 12,227.

Bond prices overall also moved up, although the 30-Year UMBS 5.5% slipped 0.34, to $100.77. The national average 30-year fixed mortgage rate inched up in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… According to the NAHB Housing Trends Report, 18% of adults surveyed in Q1 said they plan to buy a home in the next 12 months. That's the largest percentage of prospective buyers since the report began in 2018.

Market Forecast

CONSTRUCTION SPENDING, MANUFACTURING, SERVICES, THE FED, JOBS… Expect a rise in Construction Spending overall, but we'll watch the residential number. ISM Manufacturing should keep showing contraction, but ISM Services is forecast to show that sector still growing. Fed watchers predict the FOMC Rate Decision will be another quarter percent hike. April Nonfarm Payrolls should modestly rise, along with the Unemployment Rate.

Summary

New Home Sales jumped almost 10% in March, posting the strongest monthly gain since March last year. It was the fourth straight monthly increase, as builders continue to benefit from the lack of existing home listings.

Evidence of that? The Pending Home Sales index of signed contracts on existing homes fell 5.2% in March. Yet buyer demand is strong, with about a third of listings getting multiple offers and 28% selling above list price.

Meanwhile, annual home price growth dropped from 3.7% in January to 2.0% in February’s S&P CoreLogic Case-Shiller National Home Price Index, with the monthly price gain a miniscule 0.2%.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.