Hi neighbor, Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Terranova. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Terranova?

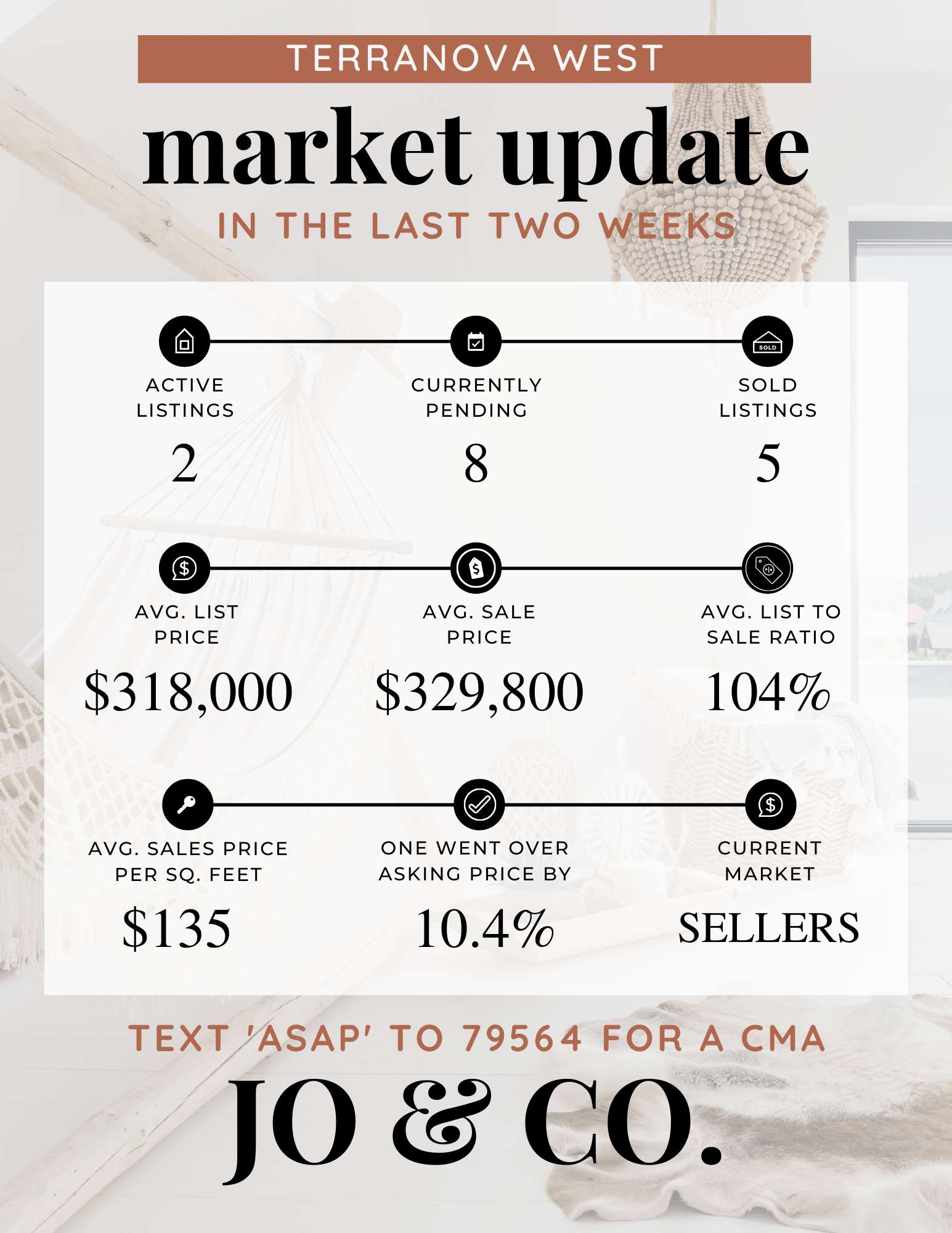

We currently have 8 homes pending, with 5 homes sold in the last two weeks, averaging a sale price of $135 a square foot. All homes sold over asking price, with one home selling 10.4% above the listing price. Compared to this time last year you are seeing huge gains. We are seeing buyers flock to areas like TerraNova with established neighborhoods and tons of character. We are seeing a large shift in young families energizing older communities. Historically many communities like TerraNova find a large majority of homeowners choosing to age in place. Thanks to unprecedented rising prices we are seeing some of these folks coaxed out earlier than intended. We are not at all saying that a younger community is better, or that older people should move out. The fact is older people, many on a fixed income aren't able to, nor find the value in replacing high ticket items in a home. This contributes to lower price per SqFt and lower overall neighborhood values. Thanks to the current market we are seeing this cycle interrupted, and older neighborhoods becoming pillars of the community again, not just a great value.

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Terranova.

What is happening in the real estate market nationally?

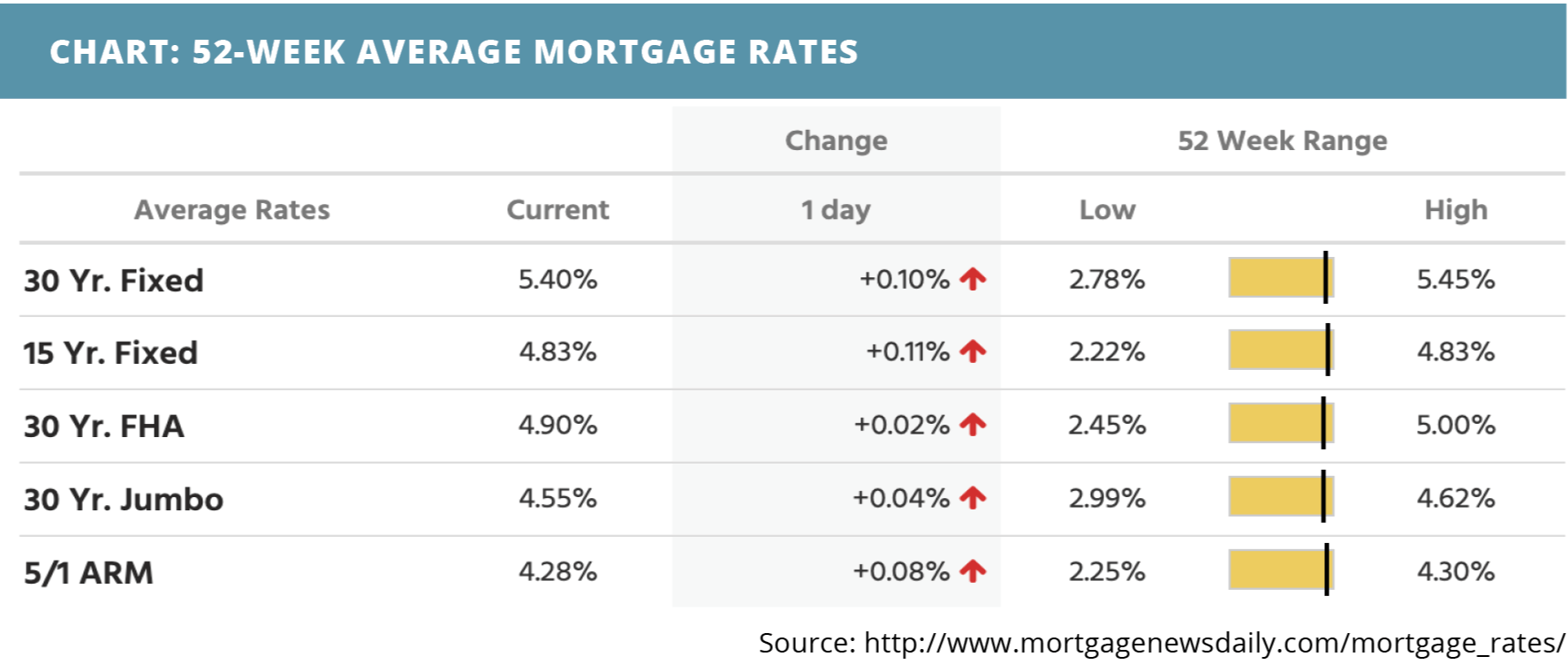

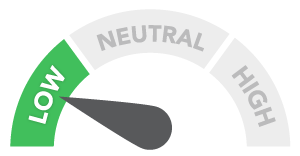

Mortgage rates saw a brief trend downward last week as the lockdowns in China affected different economic factors. Home prices appreciated at a faster pace on both price indexes. New home sales fell as did pending home sales, suggesting a stabilization in the market. Mortgage application submissions decreased. Continuing jobless claims remained relatively unchanged while initial jobless claims fell. The GDP estimate for quarter one of 2022 fell as well. Inflation continued to climb on the PCE price index. Personal income and consumer spending climbed as well.

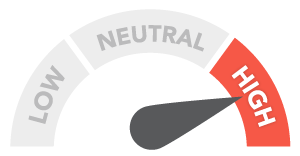

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Can 3D printed homes help boost housing inventory? Listen Now >>

- It will take time for rates to rebalance the market, but relief could be coming soon. Read Now >>

- Is a calmer market coming? Watch Now >>

Market Recap

- The 20-city Case-Shiller home price index rose at an accelerated pace in February, up 2.4% month-over-month and 20.2% year-over-year. This compares to January’s increases of 1.7% month-over-month and 18.9% year-over-year.

- The FHFA house price index appreciated at a faster pace in February as well, up 2.1% month-over-month and 19.4% year-over-year.

- New home sales fell in March, dropping 8.6% month-over-month to a seasonally adjusted annual rate of 763,000.

- Mortgage application submissions decreased a composite 8.3% during the week ending 4/22. The Refinance Index decreased 9% and the Purchase Index fell 8%.

- Pending home sales saw a slight improvement in March, decreasing at a decelerating pace of 1.2%. In February, the index fell 4% month-over-month.

- Continuing jobless claims remained relatively unchanged at a level of 1.41M during the week ending 4/16. Initial jobless claims dropped to a level of 180,000 during the week ending 4/23.

- The GDP estimate for Q1 of 2022 fell 1.4%.

- Inflation according to the PCE price index – the Federal Reserve’s preferred method of measuring inflation – increased 0.9% month-over-month in March and 6.6% year-over-year. Personal income rose 0.5% month-over-month and consumer spending soared 1.1% month-over-month.

Review of Last Week

APRIL IS THE CRUELLEST MONTH… The opening line of T.S.Eliot’s 1922 poem The Waste Land aptly describes April 2022 for stocks. The Dow and the S&P 500 saw their worst April since 1970, the Nasdaq its worst April since 2000.

Corporate earnings reports came in mixed, inflation continued higher, and stagflation reared its ugly head as the Advance GDP read showed economic growth in Q1 decreased a 1.4% annual rate.

University of Michigan consumer sentiment booked one of its lowest reads in the last 10 years but posted its first gain this year. Also positive were rising Personal Income and Spending and business investment in Durable Goods.

The week ended with the Dow down 2.5%, to 32,997; the S&P 500 down 3.3%, to 4,132; and the Nasdaq down 3.9%, to 12,335.

Bonds slipped a bit overall, the 30-year UMBS 4.0% ending down just 0.01, to $99.08. After moving up for seven straight weeks, the national average 30-year fixed mortgage rate went down slightly in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… A recent survey of prospective homebuyers found that two thirds would be ready to put in an offer within three days of a showing they liked, and one fifth would be willing to make an offer immediately.

Market Forecast

ALL UP: CONSTRUCTION SPENDING, MANUFACTURING, SERVICES, JOBS, THE FED RATE… It'll be nice to see Construction Spending growing, along with the manufacturing and services sectors of the economy, according to the ISM Manufacturing and Non-Manufacturing Indexes. We should see more Nonfarm Payrolls added in April, though Hourly Earnings will still lag well behind inflation. To rein that in, the FOMC Rate Decision is expected to be a half percent rate hike, for the first time since 2000.

Summary

New Home Sales fell for the third straight month, down 8.6% in March, 12.6% below a year ago. The latest decrease was put to declining affordability and limited supply, although the month saw a 15,000-unit increase in inventories.

The NAR's March Pending Home Sales index of signed contracts on existing homes dipped for the fifth month in a row, “implying that multiple offers will soon dissipate and be replaced by much calmer and normalized market conditions.”

Freddie Mac added: “Swift home price growth and the fastest mortgage rate increase in over 40 years is finally affecting purchase demand.” They expect this to “soften home price growth to a more sustainable pace later this year.”

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/.

• Download our Moving to Texas ebook: http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook: http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks.

• Schedule a phone call or appointment with us: http://byjoandco.com/appointment.

• Email us! [email protected]

• Looking for a buyer’s agent? Fill out our buyer questionnaire: http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.