Hi friends! As you might have noticed, we over at Jo & Co., are strong supporters of home ownership for all, and know that the first step holders are first time home buyers. That is why we love educating buyers about down payment assistance programs and assisting them in purchasing a home with down payment assistance.

There are many down payment assistance programs out there, and I touched on these back in 2017. The one program that I have been focusing on lately is TSAHC. I featured TSAHC in my blog post on March 8th, where I answered the questions, What does my credit score need to be & how much do I need for a down payment? If you haven't gotten a chance to read it, you should check it out.

To recap, when using TSAHC for down payment assistance, and if you qualify (there is an income maximum), they can receive up to a 5% grant, and you can finance FHA or conventional, although you must have a minimum credit score of 620. Here are the program benefits of TSAHC.

Program Benefits

- A 30-year fixed interest rate mortgage loan, several rates and loan options available

- Down payment assistance (DPA) provided as a grant (never needs to be repaid) or repayable second lien loan

- DPA available for up to 5% of the loan amount

- You do not have to be a first-time homebuyer

- Available statewide through a network of participating lenders.

- Income limits vary by county. Expanded income and purchase price limits available in targeted areas.

First-time buyers can also apply for a mortgage interest tax credit known as a Mortgage Credit Certificate.

VIEW TSAHC LOAN AND DOWN PAYMENT ASSISTANCE OPTIONS

LEARN MORE ABOUT MORTGAGE CREDIT CERTIFICATES

Previously worked with families..

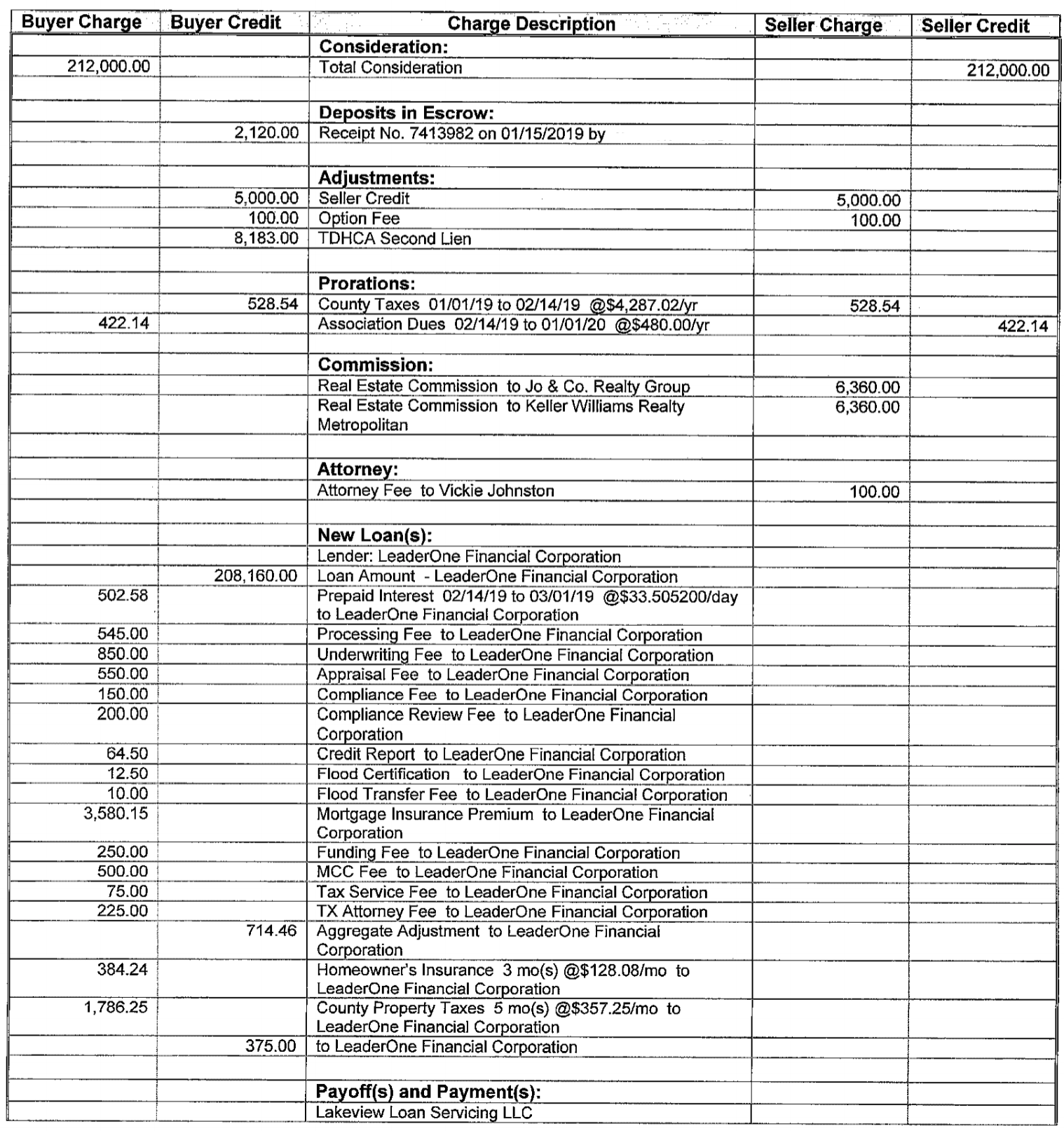

I have had a handful of families and clients use TSAHC. One family in particular, purchased a $212,000 home in Spring, TX 77379 on February 14th. This is the financial breakdown for their particular situation.

Settlement Highlights..

$212,000 Purchase Price

$2,120 Earnest Money Deposit

$5,000 Seller Credit

$100 Option Fee Deposit

$8,183 TSAHC (TDHCA) Credit

$417.59 CASH TO BUYER at Close

Actual Settlement Statement..

I think it is a really cool and rare opportunity to see a real (post close) statement. But there it is. Just as a disclosure, even though I removed their personal information, I did get permission from the buyer, prior to posting this statement.

I know and acknowledge that home ownership can be very expensive, and while this family didn't need any coupons, due to me negotiating $5,000 from the seller, and the TSAHC credit, I know sometimes, buyers need help.

Now it is near impossible to get an offer accepted without any money to you name, and it is even harder for a bank to lend you money, without a certain amount of reserves, it is possible to purchase a home with very little out of pocket.

At a minimum a buyer will need: 1% as the earnest deposit, money for the option period, and money for the inspection. So please keep this in mind if you are looking to purchase, and you haven't yet saved much money.

But like above, buying a house, could be less expensive then securing a rental home.

I recently, created a sheet of coupons with first time home buyers in mind, and you can read that blog post here. It is a great read for anyone new to purchasing a home or one considering if they want to purchase a home. Please note, anyone can use those coupons, so please share them.

And something really cool, is that I have a handful of lenders who are experienced working with TSAHC and first time home buyers. My favorite lenders to recommend for these down payment assistance programs are:

- Gary Warstler – Guaranteed Rate | 713-387-9873 | [email protected] | grarate.com/garywarstler

- Tim Colson – LeaderOne Financial | 281-507-8797 | [email protected] | timcolson.leader1.com

- Sue Gold – Movement Mortgage | 281-205-3995 | [email protected] | movement.com/lo/sue-gold

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Hugs, Jo.

Thoughtfully written for you by Jordan and the Jo & Co. Team.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

Links to check out..

➟ Our YouTube Channel :: http://byjoandco.com/youtube

➟ How do property taxes work in Texas? :: http://byjoandco.com/propertytaxesintexas

➟ Things to do in The Woodlands :: http://byjoandco.com/inthewoodlands

➟ Safest Neighborhoods in Houston :: http://byjoandco.com/safesthouston

➟ Best Neighborhoods in Houston :: http://byjoandco.com/bestneighborhoods

➟ Houston Texas Where to Live :: http://byjoandco.com/houstontexaswheretolive

➟ First Time Texas Home Buyer :: http://byjoandco.com/firsttimetexasbuyer

What next?!

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.

Visit the Jo & Co. YouTube Channel

At Jo & Co. we know that most people struggle with the home buying or selling experience. We are a brokerage, real people, that do more for you, by being with you every step of the way, so that you plant your roots in the right soil. One way that we go above and beyond is with the content we share on YouTube. Click the photo below to explore our channel.