Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Houston, Texas, specifically a market update for the neighborhood of 77070. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in 77070?

We currently have 2 homes pending, with 1 home sold in the last two weeks, averaging a sale price of $172 a square foot. One home sold over the asking price.

Compared to the two weeks prior: The number of homes sold is still the same, but the average sales price is up to $435,000 ($413,500 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways! The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in 77070.

Insight From Jo

Hello friends and happy new week

I wanted to check in and share what I am seeing this week across the greater Houston real estate market. Things are continuing to settle into a steady rhythm, and that creates some really interesting opportunities depending on where you stand as a buyer or a seller.

What I am seeing this week

Inventory is still giving buyers more breathing room.

We continue to see a healthier number of homes available compared to the frenzy of previous years. Buyers have more options and more space to think through decisions. Sellers are learning that preparation, condition, and strong presentation are what truly stand out right now.

Home values feel steady with light pressure in some pockets.

In parts of Greater Houston, pricing is still showing slight year over year softening, especially in homes that need updates or are priced too aggressively. Meanwhile, homes that are well cared for and in great locations are still moving and holding their value well.

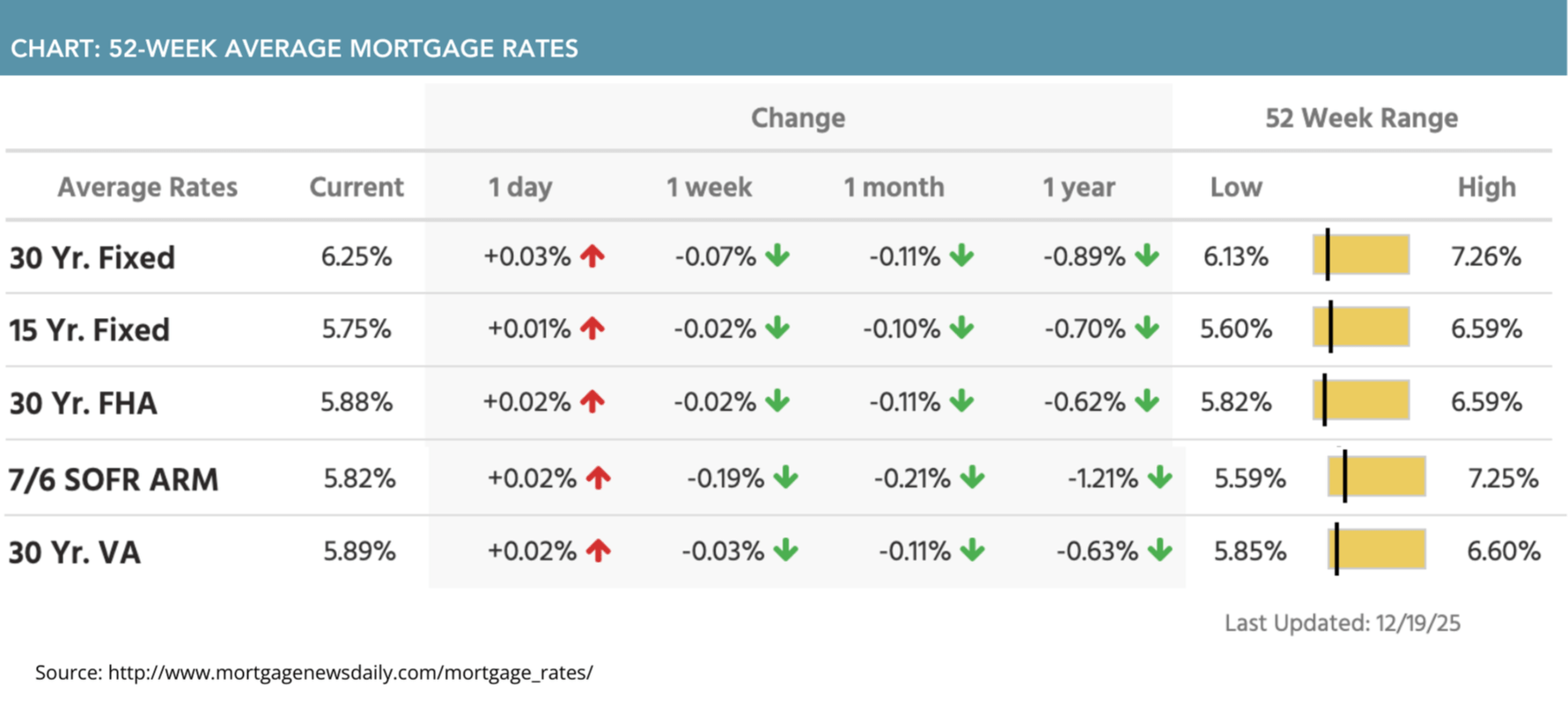

Mortgage rates remain in the mid 6 percent range.

Rates have been fairly stable lately. Buyers are adjusting their expectations around payment and price, and sellers are becoming more aware of what today’s payment environment means for affordability and demand.

Fall activity continues to favor serious movers.

Buyers right now are more intentional. They are shopping with purpose, not just browsing. Homes are spending a little more time on the market, and price adjustments remain part of the conversation. This creates room for thoughtful negotiations on both sides.

What this means for buyers this week

-

You still have more leverage than we saw in recent years, especially on homes that have been sitting.

-

The most desirable homes are still competitive, so being prepared matters. Pre-approval and clear buying goals continue to be key.

-

Homes that need cosmetic updates can offer strong value right now if you are open to improvements.

-

Keep your monthly budget front and center. The smartest buyers are focusing on comfort and long-term stability.

What this means for sellers this week

-

Homes that show well continue to win buyers’ attention. Clean, bright, and well staged listings feel like the safest choices for buyers right now.

-

Pricing correctly from the start matters more than ever. Overpricing is leading to longer days on market and multiple reductions.

-

This is still a great time to prepare your home for a strong fall showing period while motivated buyers are active.

-

Serious buyers are still out there. They just expect value, condition, and realistic pricing.

My two cents

We are still sitting in a smart, strategic market. It is no longer rushed or emotional like it once was. The buyers who are winning are confident, prepared, and patient. The sellers who are winning are honest about pricing, thoughtful about condition, and clear about their goals.

If you are buying, this is a moment to move forward with confidence instead of fear.

If you are selling, this is still a market where great results are possible with the right plan.

This week’s market is not about speed. It is about alignment, timing, and strong guidance.

What is happening in the real estate market nationally?

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Will housing affordability improve in 2026? Listen Now >>

- Housing relief initiatives in White House address. Read Now >>

- Mortgage rates trend lower toward October lows. Read Now >>

Market Recap

- The National Association of Home Builders (NAHB) housing market index climbed by one point in December, rising to a level of 39. Current sales conditions increased by one point as well, climbing to a level of 42. Sales expectations for the next six months increased one point to a level of 52 while the prospective buyer traffic remained unchanged at a level of 26. Approximately 67% of builders reported using sales incentives, the highest percentage since COVID.

- The weekly ADP nonfarm employment change increased by 16,250, which was higher than the previous week’s increase of 2,750.

- The Bureau of Labor Statistics (BLS) released the employment situation reports from October and November last week. Average hourly earnings inched up 0.4% month-over-month in October and 0.1% in November. The average workweek held steady at 34.2 hours in October but rose to 34.3 hours in November. Government payrolls declined by 157,000 in October following a gain of just 4,000 in September. In November, government payrolls slipped by another 5,000. Manufacturing payrolls shed 9,000 jobs in October following a decline of 5,000 in September. They declined once again in November, dropping by another 5,000. Nonfarm payrolls decreased by 105,000 in October but increased by 64,000 in November. Private payrolls increased by 52,000 in October and 69,000 in November. The participation rate increased slightly in November, up to 62.5%. The unemployment rate increased as well, rising to 4.6%.

- Retail sales were unchanged month-over-month in October but up 3.46% year-over-year. Both levels were below expectations.

- Mortgage application submissions decreased by 3.8% during the week ending 12/12. The Refinance Index decreased 4% while the Purchase Index slipped 3%.

- Continuing jobless claims were at a level of 1,897,000 during the week ending 12/6, which was an increase of 67,000 from the week before. Initial jobless claims were at a level of 224,000 during the week ending 12/13, which was a decrease of 13,000 from the week before.

- Inflation on the consumer price index was at a level of 2.7% annually in November, which was lower than expected. Core inflation was lower than expected as well.

- Existing home sales were at a level of 4.13 million in November, an increase of 0.5% from the previous month.

Review of Last Week

TOPSY-TURVEY… It was a classic up-and-down week for stocks until cooling inflation and waning AI worries buoyed traders' optimism enough to book weekly wins for the S&P 500 and the Nasdaq, though the Dow edged lower.

The delayed October and November jobs reports portrayed a weakening jobs market, although the small gain in the unemployment rate was due to a welcome 323,000 increase in the labor force.

Plus, the delayed November Consumer Price Index showed inflation cooling to 2.7%, with core inflation, excluding food and energy prices, down to 2.6%, the lowest since 2021. All this bodes well for more cuts from the Fed.

The week ended with the Dow down 0.7%, to 48.135; the S&P 500 UP 0.1%, to 6,835, and the Nasdaq UP 0.5%, to 23,308.

For the week, bonds ended flat overall, the 30-Year UMBS 5.0% UP just 5 basis points, to 99.19. Freddie Mac reported the national average 30-year fixed mortgage rate dropped slightly in their weekly survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… After the FHFA raised conforming loan limits, HUD raised FHA loan limits to $541,287 in low-cost areas, $1.249 million in high-cost areas, and $1.873 million in Alaska, Hawaii, Guam, and the Virgin Islands.

Market Forecast

NEW HOME SALES, GDP, JOBLESS CLAIMS… In the absence of prior monthly data, there are no forecasts for November New Home Sales. Analysts expect the GDP-Advanced read for Q3 will show the economy growing in a healthy 3% neighborhood. Weekly Initial Unemployment Claims should stay low.

Wednesday, Christmas Eve, the stock market will close at 1 p.m., the bond markets at 2 p.m. All financial markets will be closed Thursday, Christmas Day.

Summary

|

Existing Home Sales gained in November, hitting a nine-month high. The median price is just 1.2% higher than year ago, as affordability iimproves—wage growth has consistently outpaced home price gains over the past year. The National Association of Home Builders confidence index inched higher in December, and the report notes, “future sales expectations have been above the key breakeven level of 50 for the past three months.” A new survey found that among buyers and sellers planning to enter the market soon, about 86% think 2026 will be a good year to make their move—and 75% of the agents surveyed agree. |

|---|

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.