Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Windrose. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Windrose?

We currently have 3 homes pending, with 1 home sold in the last two weeks, averaging a sale price of $140 a square foot. One home sold over the asking price.

Compared to the two weeks prior: Homes sold are slightly down from 2 sold, and the average sales price is down as well. This is most likely a coincidence, so we will be sure to keep an eye on it over the next couple of weeks. Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

If we look at how fast the move-in-ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting the neighborhoods. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Windrose.

Insight From Jo

Hello again, friends!

Hope your week is off to a great start. I wanted to pull back the curtain and share what I’m seeing in the greater Houston area real-estate landscape over the last couple of weeks — the good, the steady, and what’s shifting. Because whether you’re thinking of buying, selling, or just keeping an eye on things, awareness is power.

What’s Trending (and What It Means)

Inventory is hanging around at more comfortable levels.

We’re not in the fire-sale days of pastel price increases or frantic bidding wars everywhere — instead there’s a little more breathing room. For buyers, that means more time to look and make decisions without being pushed into a corner. For sellers, it means the time to prepare and polish matters more than ever.

Slight value softening in some segments—but not across the board.

Across Greater Houston, the average home values are down modestly (for example the average value in Houston is about $262 K, down ~3.2% year over year) according to recent data.

That said: homes in top-condition, desirable neighborhoods are still getting strong interest and holding value. So this “softening” largely applies to homes that need updates or are in less sought-after zones.

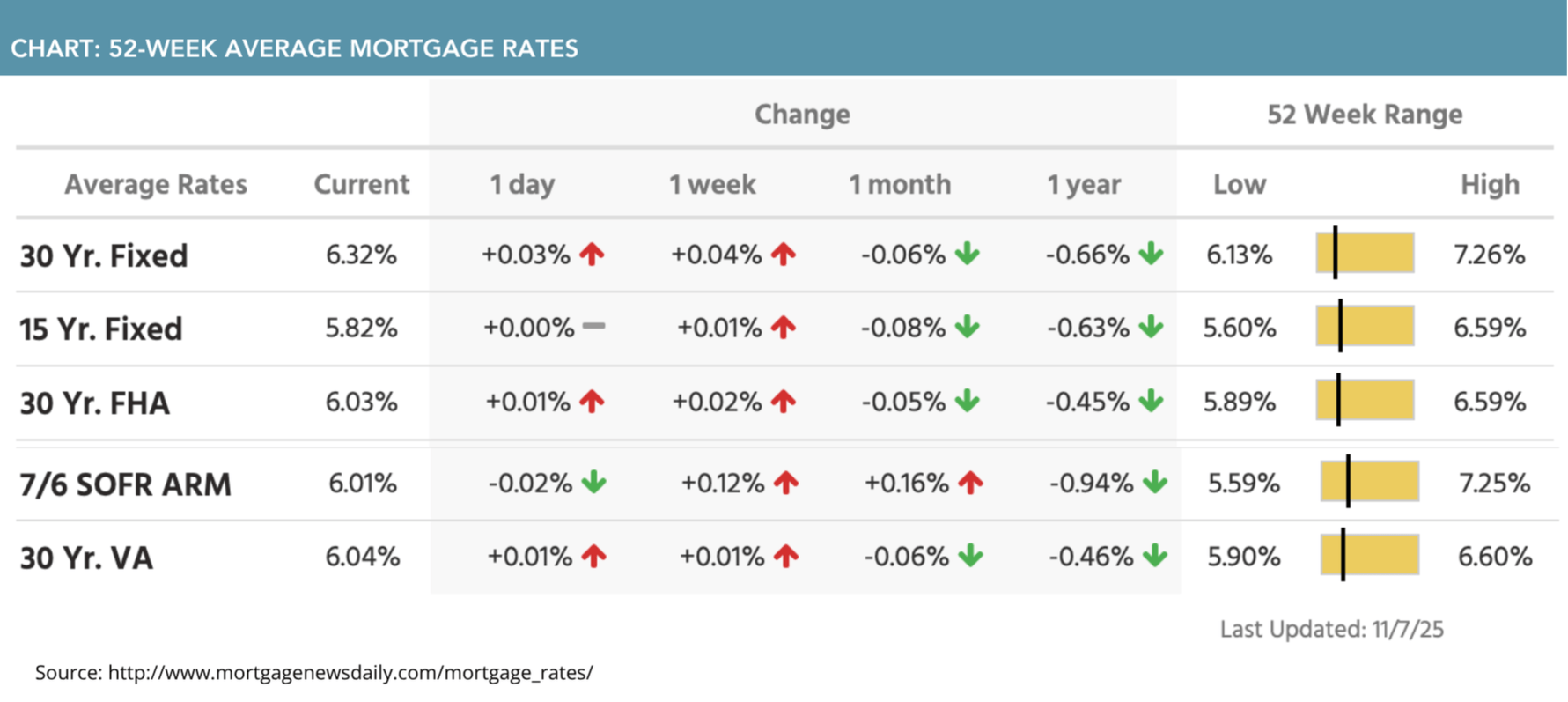

Mortgage rates remain in the mid-6% neighborhood.

They’ve eased a bit compared to peaks, but they’re not dropping overnight. For buyers, that means budgeting and readiness are still key. For sellers, knowing a buyer’s payment will feel the rate pressure helps set realistic expectations.

The fall season rhythm is setting in.

Traditionally this time of year brings more measured activity — you’ll see fewer bidding wars, more price reductions, and buyers who are serious vs. just “seeing what’s out there.” The data backs this: homes are taking a bit longer to sell and more are seeing reductions.

So if you’re considering a move — either buying or selling — this “slower but steady” environment can work in your favor.

What This Means for Buyers

• If you’ve been waiting for a “perfect time,” this might be it. The pressure lessens, you’ve got more choices, and you’re in a better spot to negotiate.

• That said: the best homes (great condition, awesome location, move-in ready) still draw competition. Being pre-approved, ready to move, and clear on your must-haves vs nice-to-haves will put you ahead.

• Don’t overlook homes needing a little love. The discount is there in some cases — if you’re ready to update and budget for it.

• With rates still elevated, keep your payment comfort zone front and center. A lower price isn’t always better if you’re stretching for “dream home” and it blows your monthly budget.

What This Means for Sellers

• Presentation + pricing = priority. In this more balanced market, homes that look and feel ready (fresh, clean, well-staged) get more attention.

• If your home is in a strong location and in good shape: you can absolutely secure a great outcome. If your home needs work, you might face more competition or need to price a bit more competitively.

• Now is a good time to prep: declutter, refresh key spaces (kitchen, baths), get professional photos, highlight what sets your home apart.

• Consider the listing timing: since fall brings more serious buyers, listing sooner rather than later could capture those motivated buyers before year-end. But don’t rush without being ready.

My Two Cents

Here’s what I believe: We’re in the sweet spot of a market transition from “seller-dominated frenzy” to something closer to “buyer available, seller still strong if ready.” The panic and speed of a few years ago is gone; what’s left is opportunity for those who act with intelligence and preparation.

If you’re a buyer: this week is your invitation to move from watching into action—with the right guidance, you can win.

If you’re a seller: this week is your cue to pull on all the levers—condition, location, pricing will determine your success more than ever.

Ultimately: this market is about strategy over speed. The clients I see winning are those who know what they want, work with a trusted adviser (that’s where I come in), and act when the right moment appears.

What is happening in the real estate market nationally?

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Labor data is driving mortgage rates, even in the shutdown. Listen Now >>

- Mortgage rates have reached an inflection point. Watch Now >>

- Home buyer data shows urgency in fight for affordability. Read Now >>

Market Recap

-

Mortgage application submissions slipped 1.9% during the week ending 10/31. The Refinance Index decreased 3% from the previous week but was 151% higher than the same time last year.

- The seasonally adjusted Purchase Index declined 1% from one week earlier. October’s ADP nonfarm employment change increased by 42,000 from the month before after falling by 30,000 in September.

Review of Last Week

PULLBACK… The three major stock indexes retreated for the week, but it wasn't because Wall Street was worried about the economy, Fed rate cuts, or the financial health of America's publicly owned corporations.

Without much economic data to chew on, thanks to the government shutdown, traders wondered if all the hoopla around AI had pushed stock valuations too high and took the opportunity to sell holdings and grab some profits.

ADP did report 42,000 new private sector jobs, ISM Services showed solid growth in October, and 82% of the S&P 500 companies reporting Q3 earnings beat estimates, on track to post 12% earnings growth overall.

The week ended with the Dow down 1.2%, to 46987; the S&P 500 down 1.6%, to 6,729; and the Nasdaq down 3.0%, to 23,005.

Bonds also tipped south, the 30-Year UMBS 5.0% slipping 1 basis point, to 99.16. In Freddie Mac’s weekly Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate remained near its lows for the year. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… A new NAR survey found sellers who used an agent earned an average net profit of $138,477, about $6,200 more than sellers who went it alone. Small wonder, the share of those sellers has fallen to a record low 5%.

Market Forecast

MORTGAGE APPLICATIONS, INFLATION, RETAIL SALES… We'll check on homebuyer activity in the latest MBA Mortgage Applications Index. If the October Consumer Price Index (CPI) isn't delayed, economists expect inflation to keep moderating. But the October Retail Sales report is expected to be delayed by the government shutdown, so there are no forecasts.

Tuesday, November 11, the bond markets will be closed in observance of Veterans Day, but the stock markets will be open.

Summary

Freddie Mac’s Chief Economist noted that in the current market, on a median-priced home, a homebuyer could “save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

The National Association of Realtors (NAR) reports that in Q3, typical American families spent, on average, 24.8% of their income on mortgage payments, down from 25.6% the previous quarter and down from 25.2% the year before.

The Mortgage Bankers Association found homebuyer purchasing power rose in September. The median monthly payment applied for by buyers slid lower for the fourth straight month, to $2,067.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.