Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Cypress, Texas, specifically a market update for the neighborhood of Rock Creek. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Rock Creek?

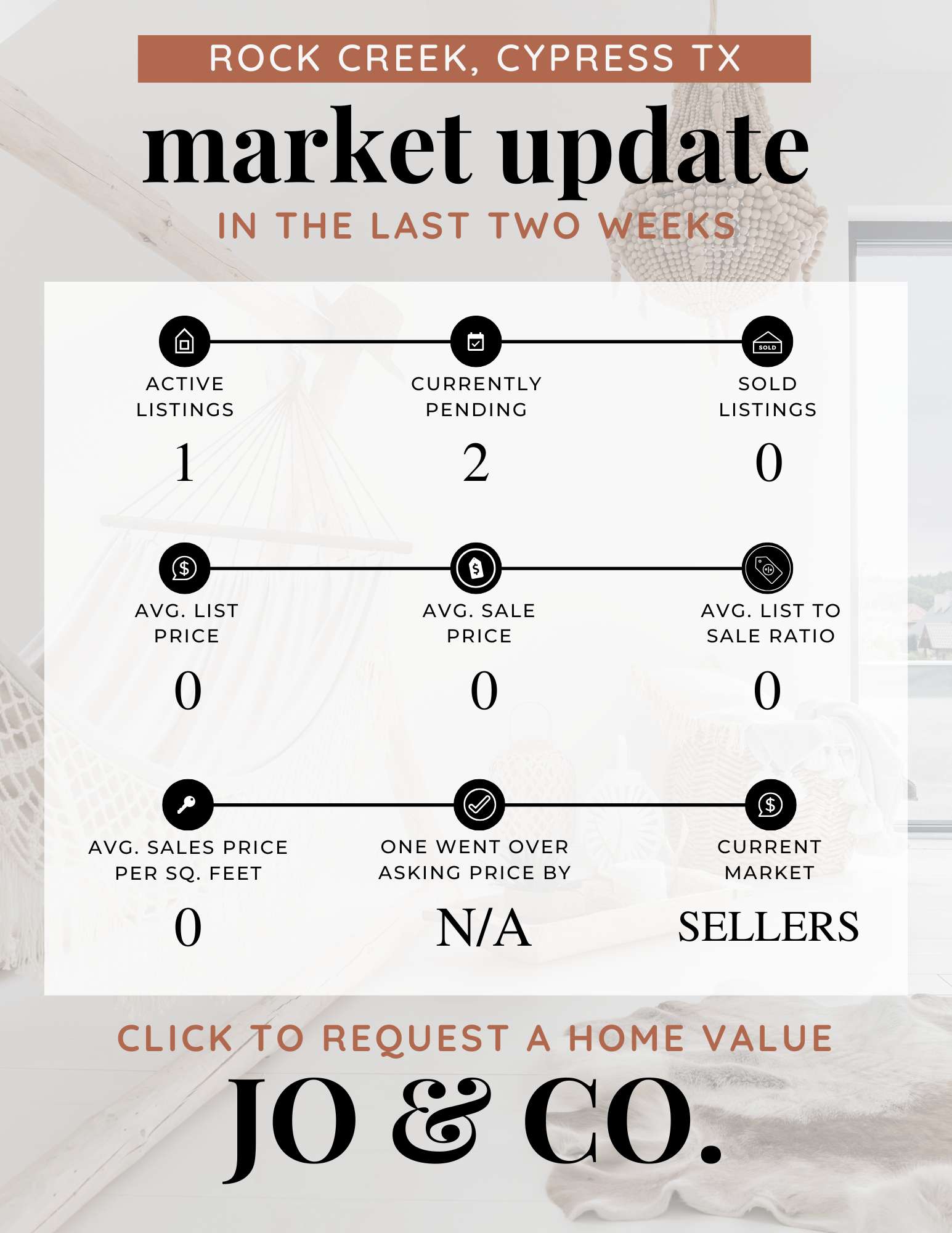

We currently have 2 homes pending, with 0 home sold in the last two weeks.

Compared to the two weeks prior, no homes have sold in Rock Creek neighborhood. This is most likely a coincidence, so we will be sure to keep an eye on it over the next couple of weeks. Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

If we look at how fast the move-in-ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting the neighborhoods. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Rock Creek.

Insight From Jo

This month, purchase mortgage applications are up 24% compared to the same time last year — marking the strongest level we've seen in the past 15 months. 🎉 This is great news for sellers, especially with inventory levels on the rise. More buyer activity means more eyes on listings, and potentially more offers.

But this season isn’t just shaping up well for sellers — it’s looking promising for buyers too. While interest rates haven’t dropped dramatically, there’s growing optimism that we’ll see more favorable rate adjustments as we head into summer. If that happens, it could create a healthy, balanced market for everyone.

In the meantime, I’m continuing to recommend new construction opportunities to my clients who are ready to make a move now. Many builders are still offering attractive incentives, including below-market interest rates, closing cost assistance, and quick move-in options — making it a smart path for buyers who don’t want to wait.

Whether you're thinking about buying or selling, I’m here to help you navigate your next step with confidence.

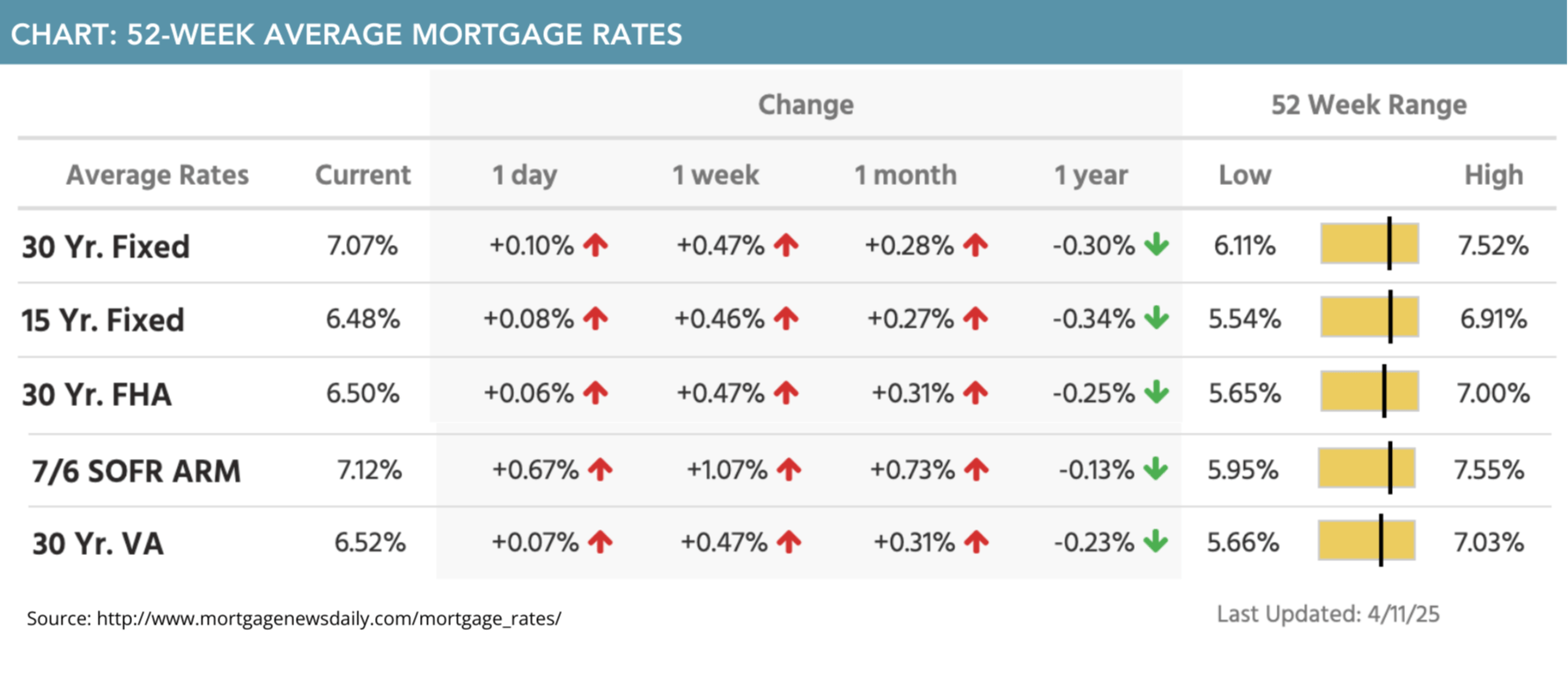

What is happening in the real estate market nationally?

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Housing data to keep your eye on during market volatility. Listen Now >>

- What role do foreign investors play in rate volatility? Watch Now >>

- Is now a good time to access home equity? Read Now >>

Market Recap

-

Mortgage application submissions surged 20% during the week ending 4/4. The Refinance Index increased 35% from the previous week and was 93% higher than the same week one year ago. The seasonally adjusted Purchase Index increased 9% from one week earlier and was 10% higher than a year ago.

- Continuing jobless claims were at a level of 1,850,000 during the week ending 3/29, which was a decrease of 43,000 from the week before. Initial jobless claims were at a level of 223,000 during the week ending 4/5, which was an increase of 4,000 from the week before.

- The consumer price index came in below expectations in March. Month-over-month, the index slipped 0.1% despite predictions that it would increase by 0.1%. This brought the annual level of inflation to 2.4%, which was down from 2.8% the month before. Core inflation, which strips food and energy costs inched up 0.1% month-over-month despite predictions of a 0.3% increase. This brought the annual level of core inflation to 2.8%.

Review of Last Week

ROLLER COASTER UP… President Trump's 90-day suspension of reciprocal tariffs sent stocks to historic gains Wednesday, sharp losses Thursday, then a nice rebound Friday that left equities way ahead for the week.

Tariff-induced inflation fears left University of Michigan Consumer Sentiment at its lowest level since 2022, yet the March Consumer Price Index (CPI) reported the first monthly decline in consumer prices since COVID.

Annual CPI inflation dropped from 2.8% to 2.4%—even with higher tariffs already in place on steel, aluminum, and imports from China! Plus, low initial jobless claims showed a solid labor market and an expanding economy.

The week ended with the Dow UP 5.0%, to 40,213; the S&P 500 UP 5.7%, to 5,363; and the Nasdaq UP 7.3%, to 16,274.

Bond prices sank sharply, the 30-Year UMBS 5.5% dropping 2.06, to 98.17. The national average 30-year fixed mortgage rate continued to trend down in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Zillow says listings with 250 daily views, 10 daily shares, or five daily saves typically “move to pending status in a week”; and listings with 500+ daily views, 20 daily shares, or 10 daily saves “often sold for more than the list price.”

Market Forecast

HOME BUILDING, MORTGAGE APPLICATIONS, RETAIL SALES… Analysts expect Housing Starts to slow a trifle in March, but new Building Permits to hold at their prior pace. We check the MBA Mortgage Applications Index to hopefully see buyer activity staying on its spring climb. The forecast is for Retail Sales to gain in March, a sign consumer spending continues to grow the economy.

Summary

The Mortgage Bankers Association (MBA) reported purchase mortgage applications rocketed up 10% over the prior week, coming in 24% higher than a year ago—the strongest pace in 15 months. Spring homebuying has sprung!

The MBA also revealed its Mortgage Credit Availability Index (MCAI) increased in March to the highest level in more than two years. They say increases in the MCAI “are indicative of loosening credit.”

Data firm Intercontinental Exchange found home price growth slowing in 90% of U.S. markets, cooling to 2.7% in February, then dipping to 2.2% in March, as inventory levels rose to 27% above last year.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.