Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Montgomery, Texas, specifically a market update for the neighborhood of 77316. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in 77316?

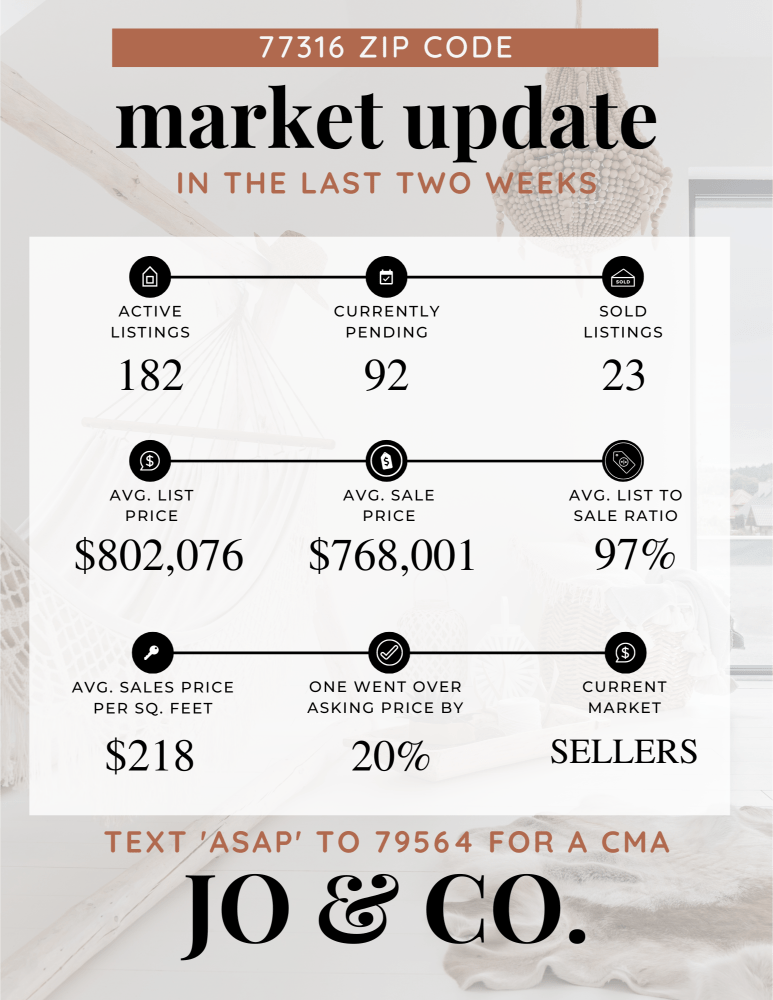

We currently have 92 homes pending, with 23 homes sold in the last two weeks, averaging a sale price of $218 a square foot. Twenty-Three homes sold over the asking price, with one home selling 20% above the listing price.

Compared to the two weeks prior: Homes sold are up from 19 homes sold to 23 homes sold and the average sales price is also up to $768,001 ($678,152 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

If we look at how fast the move-in ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in 77316.

My Two Cents: What I learned this week

Interests rates have been booping between 6% and 7% the last couple of weeks. But many buyers haven’t been deterred. I have spent the last 3 weeks showing homes every day, and got 4 under contract, with 3 in the wind.

It has been a mixture of new construction and resale, but I still feel confident in sharing with you that new construction is where a deal can still be made. At least for the next 45 days.

Here is a list of my favorite builders right now:

Toll Brothers is now offering 5.875%.

Lennar is offering 4.25%.

Village Builders is offering 4.25%.

Davidson Homes is offering 3.99%.

Highland Homes is offering 4.875% the first year.

Brightland Homes is offering 5.49%.

D.R. Horton is offering 4.5% FHA. (north of I-10).

Century Community offering 4.875% FHA, 4.875% VA, and 5.5% conventional.

Meritage Homes is offering 5.875%.

Starlight Homes is offering 5.99%.

Highland Homes is offering a 1 year rate buy down.

HistoryMaker is offering 3.99%.

M/I Homes is offering 5.25%.

Taylor Morrison 5.49% .

D.R. Horton is offering a move-in package and up to$10k towards closing costs.

Brightland Homes is offering 5.49% plus $10k toward closing costs and bottom line pricing.

J. Patrick is offering up to $20k in incentives.

Lennar does have a program that is 0% down

The Woodlands Hills is offering up to $10k towards closing costs.

Newmark Homes is offering $21k that can be used as incentives.

Century Community up to 6% towards closing costs, plus move in package (w/d/f/b).

Meritage Homes up to $18k towards closing costs, plus move in package.

Starlight Homes is offering 5.99% rate with 7k with closing costs with preferred lender.

Highland Homes is offering $15k off price, $20k towards closing costs, and 1 year rate buy down.

Colina Homes is offering $12k plus OTP.

Chessman Homes is offering up to 6% toward closing costs.

Taylor Morrison 5.49% interest rate with 3% towards closing costs.

If you are wanting to take advantage of the last 4 weeks of a buyer’s market, please reach out to me.

Hugs, Jo.

What is happening in the real estate market nationally?

Mortgage rates trended higher last week. Single-family construction increased in February. Job openings were lower than expected in February, yet the ADP nonfarm employment change was higher than expected in March. Mortgage application submissions saw a composite decline a couple weeks ago. Continuing jobless claims decreased while initial jobless claims increased. The employment situation was largely better than expected.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Millennials are once again driving the home buying market. Read Now >>

- Home values will continue to appreciate as long as there’s limited supply. Watch Now >>

- How to explain the importance of the written buyer agreement. Read Now >>

Market Recap

-

Total construction spending slipped 0.3% month-over-month in February. This was a larger-than-expected drop. Single family construction spending jumped 1.4%. Annual construction spending increased 10.7%.

-

Job openings on the Labor Department’s JOLTS report were lower than expected in February at 8,756,000. The voluntary quits rate was lower as well.

-

Mortgage application submissions slipped a composite 0.6% during the week ending 3/29. The Refinance Index slipped 2% while the Purchase Index slipped 0.1%.

-

The ADP nonfarm employment change was at 184,000 in March. This was much higher than the 148,000 expected.

-

Continuing jobless claims were at a level of 1,791,000 during the week ending 3/23, a 20,000 decline. Initial jobless claims, on the other hand, were at a level of 221,000 during the week ending 3/30, which was an increase of 9,000.

-

The employment situation reports were largely better than expected in March. Average hourly earnings inched up 0.3% month-over-month, and the average work week climbed to 34.4 hours. Government payrolls climbed by 71,000 and manufacturing payrolls were unchanged. Private payrolls were nearly 100,000 over their expected growth at 232,000. Nonfarm payrolls were higher than expected as well at 303,000. The participation rate increased to 62.7% and the unemployment rate decreased to 3.8%.

Review of Last Week

WEAK WEEK… The major stock indexes all booked weekly losses, the Dow its worst since March of last year, in spite of a better-than-expected March jobs report, which sparked a big rally on Friday.

The U.S. added 303,000 new jobs in March, though most were part time, as full-time employment has in fact declined the past year. Still, the report could delay rate cuts, along with sticky PCE inflation and rising oil prices.

Yet ISM Manufacturing saw that sector expand after contracting for 16 months. The far larger services sector also expanded (though at a slower rate), and initial weekly jobless claims are still far from recession territory.

The week ended with the Dow down 2.3%, to 38,904; the S&P 500 down 1.0%, to 5,204; and the Nasdaq down 0.8%, to 16,249.

Bond prices were hit pretty hard too, though the 30-Year UMBS 5.5% fell only .13, to $99.08. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate showed little movement. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… CoreLogic reports that after reaching an all-time high in October 2023, the average down payment for an American home ended the year at 16%, equating to an average amount of about $84,000.

Market Forecast

MORTGAGE APPLICATIONS, INFLATION, FED MINUTES… We'll check the weekly MBA Mortgage Applications Index to gauge the spring housing market. Economists expect the March Consumer Price Index (CPI) and wholesale Producer Price Index (PPI) to report inflation still significantly above the Fed's 2% target. We'll also examine the FOMC Minutes from the Fed's March meet for indications of when rate cuts might begin.

Summary

Spending on residential construction increased 0.7% in February, and is up 6.3% for the year. The gain was led by a 1.4% monthly jump in single-family home building, which is now up 17.2% the past year.

Altos Research reports sellers are coming back—last week, new listings logged in 18% higher than a year ago. The total inventory of single-family homes is now 26% higher than a year ago, having climbed 20 weeks in a row.

In 2023, homeowner equity totaled almost $32 trillion, more than twice the $15 trillion in 2006, the previous peak. Sellers of course can use this equity for a larger down payment to reduce monthly payments on their next home.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.