Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Bridgeland. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

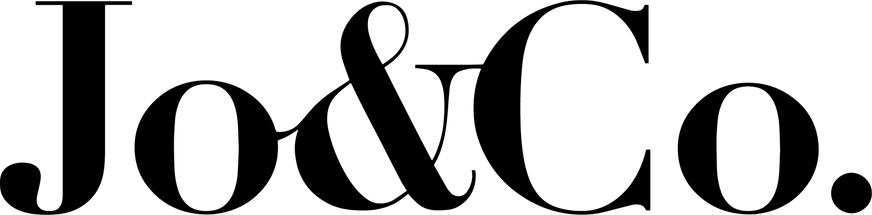

What is happening in the real estate market in Bridgeland?

We currently have 119 homes pending, with 26 homes sold in the last two weeks, averaging a sale price of $191 a square foot. Twenty-six homes sold over the asking price, with one home selling 3.3% above the listing price.

Compared to the two weeks prior: Homes sold are up from 21 homes sold to 26 homes sold. Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money)

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Bridgeland.

My Two Cents: What I learned this week

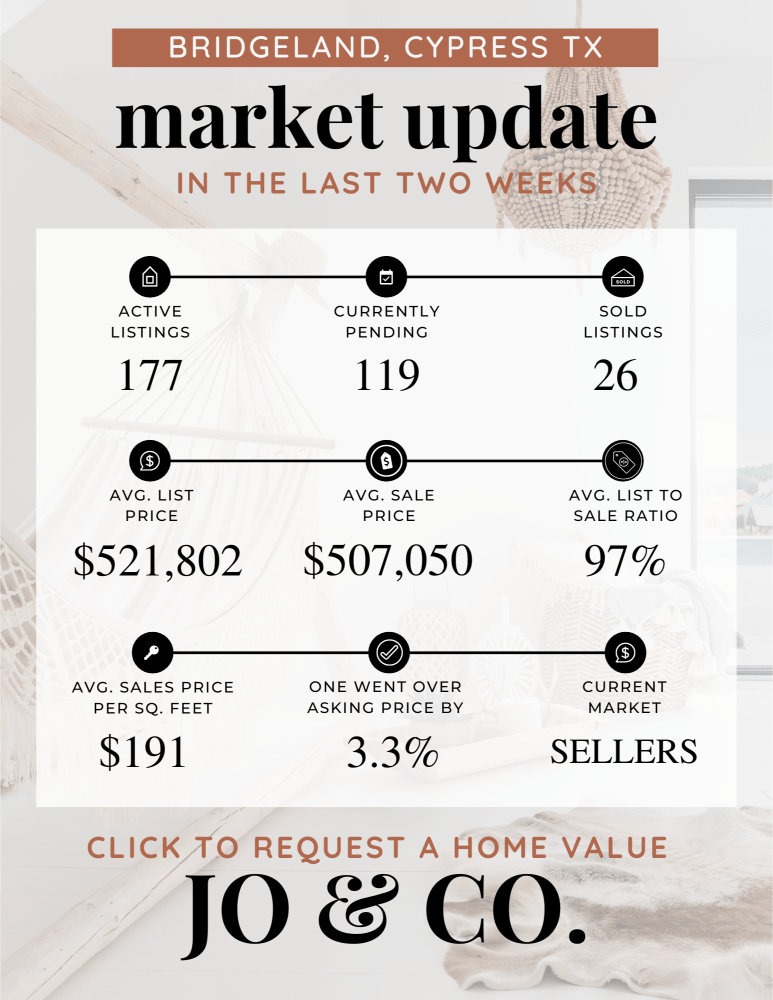

Last week brought some encouraging news for the Texas housing market: mortgage rates are on the decline. Notably, the 10-year Treasury yield, which significantly influences mortgage rates, dipped below 4.3% for the first time since September, according to Freddie Mac.

This downward trend continued with the 30-year fixed mortgage rate, which averaged 7.22% for the week ending November 30, as reported by Freddie Mac's Primary Mortgage Market Survey. This rate marks a noticeable decrease from the previous week's 7.29%. However, it's still a bit higher than the 6.49% we saw during the same period last year. For those looking to buy homes in Texas, this shift suggests a slightly more favorable environment for borrowing.

Adding to this optimistic outlook, HousingWire's Mortgage Rates Center indicated that the average 30-year fixed rate on conventional loans, as tracked by Optimal Blue, was 7.1% as of Thursday. This movement in rates points to an increasingly affordable scenario for aspiring homeowners in Texas's active housing market.

Freddie Mac's chief economist, Sam Khater, has highlighted a positive trend for buyers, noting that the level of mortgage application activity has recently matched that of mid-September. This suggests a modest yet significant rise in demand, hinting at a more competitive market in Texas, especially given the limited inventory available.

Regarding future interest rate decisions, there's some uncertainty about the Federal Reserve's plans. However, current investor sentiment is leaning towards no increase in rates at the upcoming Federal Open Markets Committee meeting on December 13. This expectation is supported by recent economic data that has exceeded forecasts. The CME FedWatch Tool echoes this sentiment, showing a 95.6% probability that the Fed will maintain current rates.

Looking forward to 2024, Bright MLS projects a decrease in mortgage rates to around 6.5% by the second quarter. This forecast, combined with an anticipated 14% increase in housing inventory by the end of Q2, offers a hopeful outlook for the Texas real estate market. Such changes suggest potential relief for buyers and an increase in available options.

Texas's real estate sector could soon experience a revitalization, with mortgage rates expected to continue their downward trajectory and inventory levels likely to rise. This environment presents a valuable opportunity for potential homebuyers in the state, promising a more vibrant market soon.

December will be one of my top 3 best months of the year, so I know I am hopeful for what we might see in the new year. Hugs, Jo.

What is happening in the real estate market nationally?

Mortgage rates were relatively unchanged last week. Job openings and the ADP nonfarm employment change were lower than expected. Mortgage application submissions increased for the fifth consecutive week. Continuing jobless claims fell, while initial jobless claims inched up. The employment situation was stronger than expected.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Logan Mohtashami: can mortgage rates go below 6%? Listen Now >>

- Sports betting could affect the housing market? Watch Now >>

- Home prices may cool in 2024, but these metro areas will remain hot. Read Now >>

Market Recap

-

Job openings on the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) slipped by roughly 600,000 in October. While the previous month’s number of job openings was 9,350,000, October’s number was 8,733,000.

-

Mortgage application submissions rose 2.8% during the week ending 12/1, marking the fifth consecutive week of increases. Refinance application submissions surged 14% while the seasonally adjusted purchase index decreased 0.3%.

-

The ADP nonfarm employment change in November was lower than expected, coming in at 103,000 versus the expected level of 130,000.

-

Continuing jobless claims were at a lower-than-expected level of 1,861,000 during the week ending 11/25, thanks to a week-over-week decline of 60,000. Initial jobless claims were lower than expected as well during the week ending 12/2, rising by just 1,000 to reach a level of 220,000.

-

November’s employment situation was unfortunately stronger than expected. A stronger labor market generally will lead to higher rates in the current environment. Average hourly earnings doubled at 0.4% and the average workweek increased to 34.4 hours. Government payrolls were at 49,000, manufacturing payrolls were at 28,000, and private payrolls were at 150,000. All of those were lower than expected, but the headline report, nonfarm payrolls, were at 199,000, which was higher than expected. The participation rate was higher than expected as well at 62.8%, while the unemployment rate was lower than expected at 3.7%.

Review of Last Week

ON A ROLL… Stocks rose for the sixth straight week (something we haven't seen in four years!), as Friday's better-than-expected November jobs report pushed the three major indexes to modest gains.

Last month the economy added 199,000 jobs, unemployment fell to 3.7%, the labor force grew, and hourly earnings gained a healthy 0.4%. Low weekly jobless claims also pointed to a robust labor market.

The ISM services index showed the dominant sector of our economy still growing, while University of Michigan Consumer Sentiment registered its first gain in five months, as inflation expectations moderated among consumers.

The week ended with the Dow UP two points, to 36,248; the S&P 500 UP 0.2%, to 4,604; and the Nasdaq UP 0.7%, to 14,404.

Bonds overall ended slightly ahead, the 30-Year UMBS 6.0% UP .15, to $100.27. Freddie Mac's Primary Mortgage Market Survey reported the national average 30-year fixed mortgage rate decreased for the sixth straight week. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… A study by title company First American found that the median homeowner has 38 times the household wealth of a renter, noting that homeownership is “the largest source of total wealth among most households.”

Market Forecast

INFLATION, RETAIL SALES, THE FED… The November inflation rate is expected to continue moderating in both the Consumer Price Index (CPI) and the wholesale Producer Price Index (PPI). Economists forecast Retail Sales to dip in November as the economy slows. Wednesday, the Fed's FOMC Rate Decision should keep rates where they are for now.

Summary

Realtor.com reports 7.5% more homesellers listed their properties in November 2023 than in November a year ago —the first time newly listed homes posted an annual gain in almost a year and a half.

The Mortgage Bankers Association showed purchase mortgage applications up 35% week-over-week, unadjusted. Refinance applications saw their strongest week in two months, up annually two weeks straight for the first time in two years.

A recent survey from Fannie Mae found that nearly one in four consumers think home prices will fall over the next year. However, experts predict home prices will keep rising nationally for the next five years, just at a more normal pace.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.