Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of 77386. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in 77386?

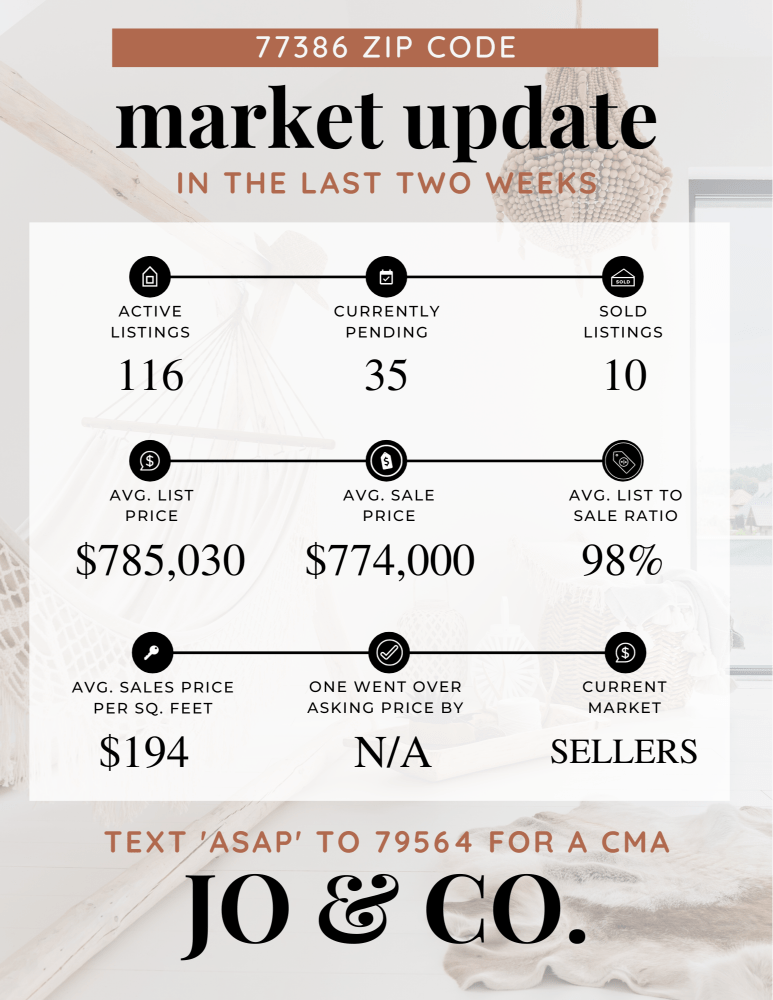

We currently have 35 homes pending, with 10 homes sold in the last two weeks, averaging a sale price of $194 a square foot. Ten homes sold over the asking price.

Compared to the two weeks prior: Homes sold are up from 7 homes sold to 10 homes sold. Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money)

Check out the graphic below for a larger overview of the real estate market for the last two weeks in 77386.

My Two Cents: What I learned this week

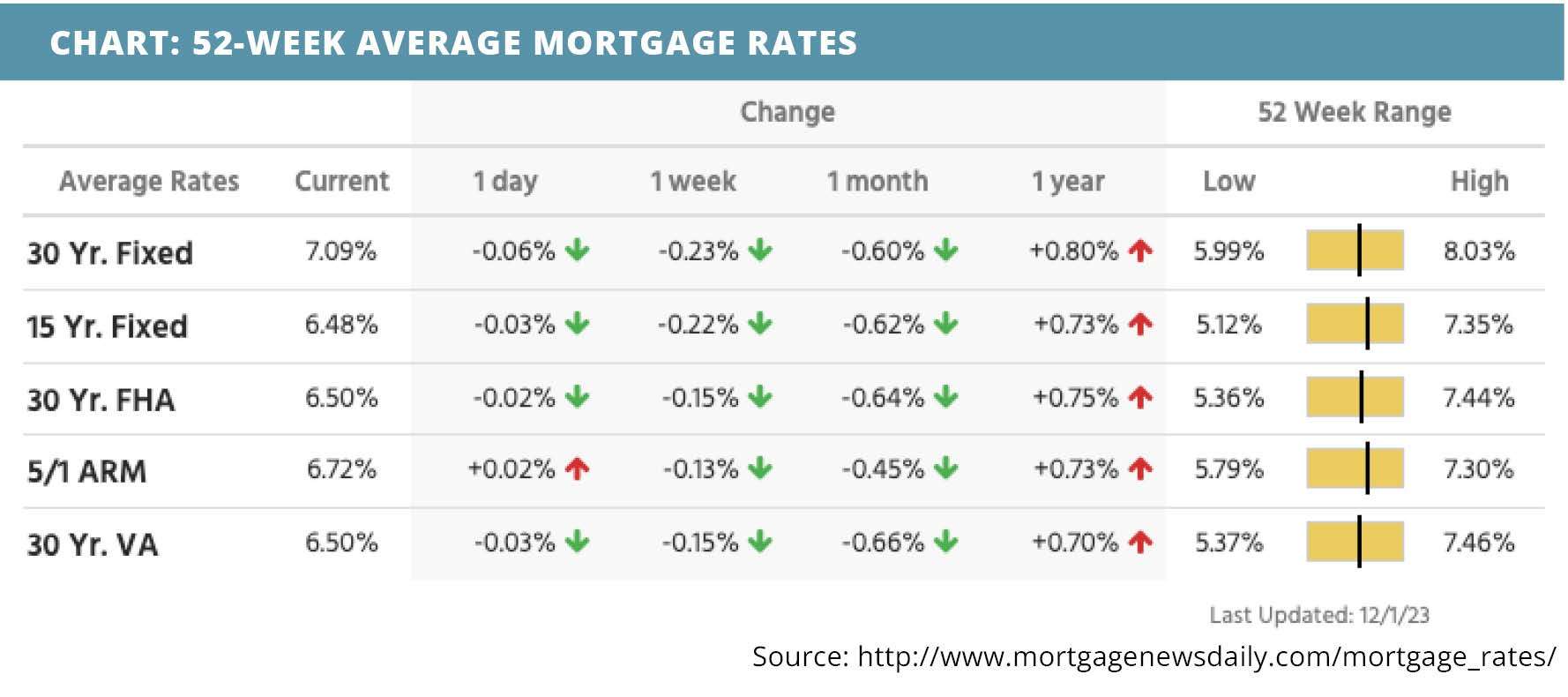

Last week brought some encouraging news for the Texas housing market: mortgage rates are on the decline. Notably, the 10-year Treasury yield, which significantly influences mortgage rates, dipped below 4.3% for the first time since September, according to Freddie Mac.

This downward trend continued with the 30-year fixed mortgage rate, which averaged 7.22% for the week ending November 30, as reported by Freddie Mac's Primary Mortgage Market Survey. This rate marks a noticeable decrease from the previous week's 7.29%. However, it's still a bit higher than the 6.49% we saw during the same period last year. For those looking to buy homes in Texas, this shift suggests a slightly more favorable environment for borrowing.

Adding to this optimistic outlook, HousingWire's Mortgage Rates Center indicated that the average 30-year fixed rate on conventional loans, as tracked by Optimal Blue, was 7.1% as of Thursday. This movement in rates points to an increasingly affordable scenario for aspiring homeowners in Texas's active housing market.

Freddie Mac's chief economist, Sam Khater, has highlighted a positive trend for buyers, noting that the level of mortgage application activity has recently matched that of mid-September. This suggests a modest yet significant rise in demand, hinting at a more competitive market in Texas, especially given the limited inventory available.

Regarding future interest rate decisions, there's some uncertainty about the Federal Reserve's plans. However, current investor sentiment is leaning towards no increase in rates at the upcoming Federal Open Markets Committee meeting on December 13. This expectation is supported by recent economic data that has exceeded forecasts. The CME FedWatch Tool echoes this sentiment, showing a 95.6% probability that the Fed will maintain current rates.

Looking forward to 2024, Bright MLS projects a decrease in mortgage rates to around 6.5% by the second quarter. This forecast, combined with an anticipated 14% increase in housing inventory by the end of Q2, offers a hopeful outlook for the Texas real estate market. Such changes suggest potential relief for buyers and an increase in available options.

Texas's real estate sector could soon experience a revitalization, with mortgage rates expected to continue their downward trajectory and inventory levels likely to rise. This environment presents a valuable opportunity for potential homebuyers in the state, promising a more vibrant market soon.

December will be one of my top 3 best months of the year, so I know I am hopeful for what we might see in the new year. Hugs, Jo.

What is happening in the real estate market nationally?

Mortgage rates continued to decline last week, moving them toward the lowest levels in nearly three months. New home sales declined in October, as did pending home sales. Home prices appreciated in September. In weekly news, mortgage application submissions increased, as did jobless claims. The GDP for Q3 surged beyond expectations while the personal consumption expenditures (PCE) index underperformed in October, marking cooler inflation. Consumer spending and personal income inched up slightly.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable New

- FHA proposes changes to 203(k) program. Read Now >>

- Consumers are still investing in home improvement. Watch Now >>

- Realtor.com predicts buyers will see rate relief in 2024. Read Now >>

Market Recap

-

New home sales slipped by 5.6% in October, which could partly be a normal result from the shocking increase the previous month.

-

The FHFA house price index climbed 0.6% month-over-month in September, a higher-than-expected climb. Annual appreciation climbed to 6.1%.

-

The 20-city Case-Shiller home price index inched up 0.7% month-over-month and 3.9% year-over-year in September.

-

Mortgage application submissions inched up a composite 0.3% during the week ending 11/24. Though the Refinance Index slipped 9%, the seasonally adjusted purchase index increased 5%.

-

The GDP estimate for quarter 3 of 2023 surged 5.2% quarter-over-quarter. This is higher than the expected 4.9% and over two times the previous estimate of 2.1%.

-

Initial jobless claims were at 218,000 during the week ending 11/25, a 7,000 increase from the week before. Continuing jobless claims were at 1,927,000 during the week ending 11/18, an increase of roughly 80,000.

-

The personal consumption expenditures (PCE) index was unchanged month-over-month in October, lower than the expected 0.1% increase. Personal income was right on the mark at 0.2% moth-over-month, as was consumer spending.

-

Pending home sales were better than expected on October’s index. Though they fell 1.5%, they were expected to decline 2%.

Review of Last Week

WHAT A MONTH!… Stocks ended November with the S&P 500 hitting a new 52-week high, and the Dow breaking above 36,000 for the first time in nearly two years, as traders anticipated the Fed may start cutting rates next year.

The PCE Price Indexes showed inflation receded in October, and Fed Governor Christopher Waller commented the Fed might start lowering rates if inflation continues to ease over the next three to five months.

Wall Street also saw more data pointing to a soft landing for the economy, including moderation in income and spending, a relatively low level of jobless claims, and Q3 GDP revised upward to 5.2% economic growth.

The week ended with the Dow UP 2.4%, to 36,246; the S&P 500 UP 0.8%, to 4,595; and the Nasdaq UP 0.4%, to 14,305.

Bond prices also moved ahead solidly, the 30-Year UMBS 6.0% UP .85, to $100.12. The national average 30-year fixed mortgage rate dropped for the fifth consecutive week in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… The 2024 conforming loan limit for mortgages backed by Fannie Mae and Freddie Mac will be $766,550, up just 5.5%, due to the modest gain in home prices. For certain higher priced markets, the limit will be $1,149,825, north of $1 million for the first time.

Market Forecast

SERVICES SECTOR, CONSUMER SENTIMENT, JOBS… The services sector, almost 80% of the economy, is expected to still show expansion, by the November ISM Non-Manufacturing Index. But December University of Michigan Consumer Sentiment is forecast to remain historically low. November Nonfarm Payrolls should reveal some weakening in the labor market, though the Unemployment Rate is predicted to stay at 3.9%.

Summary

October sales of new single-family homes were up 17.7% from a year ago. But they did take a breather from their September gain, off 5.6% for the month. Buyers should be happy to see the median price down 17.6% from a year ago.

The Pending Home Sales Index of contract signings on existing homes slipped in October. But the National Association of Realtors (NAR) noted, “Home sales are rising in places where more inventory is available.”

The NAR added, “newly built home sales are up 4.5% year-to-date due to homebuilders’ ability to create more inventory.” They're doing just that. Residential Construction Spending posted a nice gain in October.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.