Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Cypress, Texas, specifically a market update for the neighborhood of 77389. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in 77389?

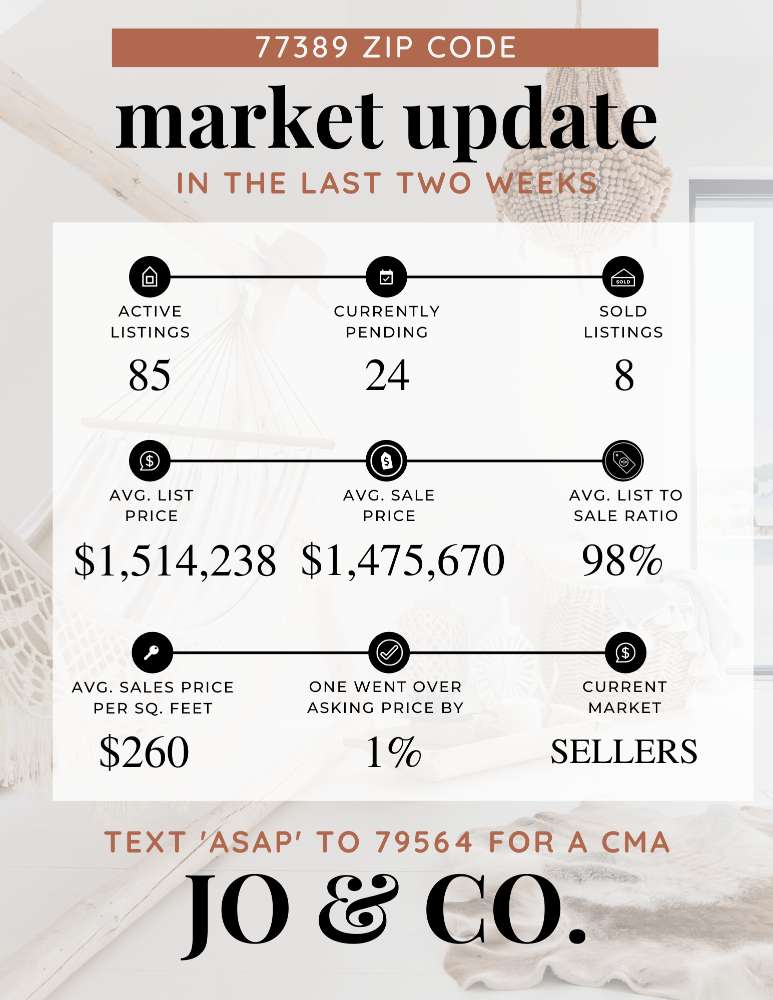

We currently have 24 homes pending, with 8 homes sold in the last two weeks, averaging a sale price of $260 a square foot. Eight homes sold over the asking price, with one home selling 1% above the listing price.

Compared to the two weeks prior: Homes sold are slightly down from 10 sold, but the average sales price is up to $1,475,670 ($856,950 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

If we look at how fast the move-in-ready (modern) homes are going (must not be overpriced), the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in 77389.

My Two Cents: What I learned this week

With another week behind us, I want to chat about the market. The Fed is not missing a beat and the market is dancing right along, leading to some of the nicest mortgage rates we’ve seen in a while. Feels like we’re all waving a goodbye to those rate hike worries for now. Or maybe it is just wishful thinking. But I love that there is hope in the air.

So, the Fed’s kept their foot steady on the pedal, holding rates right at their 22-year high. Looks like the long-term rates’ little jump has started to slow things down all on its own, possibly doing the Fed’s work for them. The bond market, acting like fans at a sold-out show, really cheered on this decision and Jerome Powell’s reassuring words, letting rates take a wee breather.

Then there’s the Treasury, hinting at a more streamlined borrowing plan for the year’s home stretch. Here’s the deal: offering fewer long-term bonds means there’s less pressure to bump up interest rates to attract buyers. It’s a nifty ‘less is more’ approach, and the bond market is eating it up.

It’s not all smooth sailing, though – the ISM Manufacturing Report let out a bit of a groan, marking a year of contraction. Not the best news for the industry, but hey, in the quirky world of bonds, a little economic sour can actually sweeten rates. And don’t forget, we’re all in this global economic jam session together. Europe’s cooler-than-expected inflation tune is helping keep our long-term rates in a mellow rhythm.

Ahead, we’ll keep an eye out to see if this market melody keeps playing. No big economic headlines are expected soon, but with a few Treasury auctions coming up, it’s anyone’s guess if these chill rates will stick around. The mortgage market is like a big band with bond prices leading, and they’ve been hitting some encouraging notes lately – suggesting maybe, just maybe, we’re tuning out of a long-term downtrend. Here’s to hoping for more of these good vibes as we sail into next week. Keep it light, friends!

What is happening in the real estate market nationally?

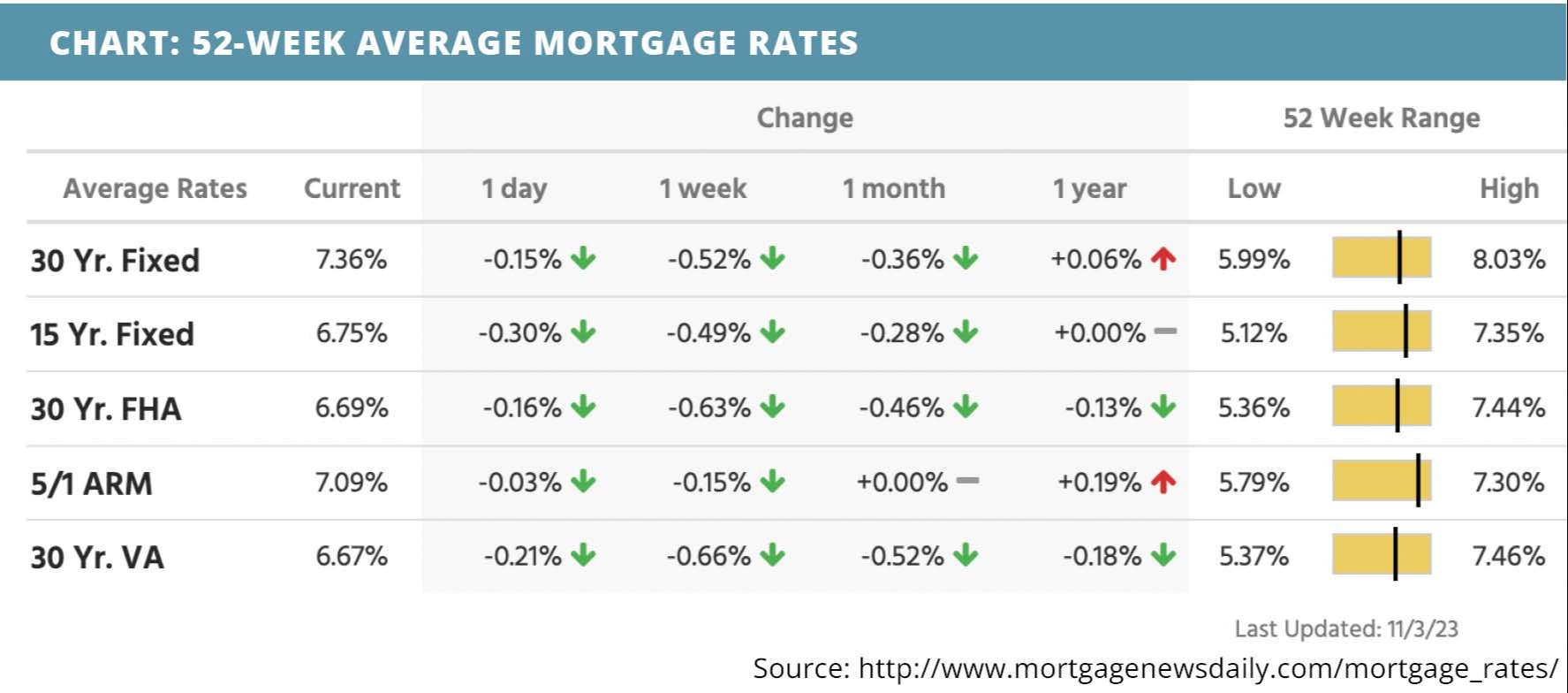

Mortgage rates caught a sweet break last week and made some notable downward progress. Home prices were still appreciating in August, mortgage applications slipped, employment reports showed signs of cooling, construction spending increased in September, jobless claims climbed higher, and of course, the Federal Reserve did not hike the benchmark rate.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable New

- Data shows glimmers of hope ahead for home sales. Read Now >>

- Demand for adjustable-rate mortgages increases. Read Now >>

- Home prices remain steady despite rates. Watch Now >>

Market Recap

-

The FHFA house price index inched up 0.6% month-over-month in August, lower than the previous month but higher than expected. Annually, the index was at 5.6%, which was much higher than the previous month’s level of 4.6%.

-

The 20-city Case-Shiller home price index inched up 1% month-over-month in August, an increase from the 0.8% increase in July. Annually, the index surged 2.2% – exceeding expectations and greatly surpassing the previous months’ annual appreciation of 0.2%.

-

Mortgage application submissions slipped a composite 2.1% during the week ending 10/27. Refinance application submissions fell 4% while seasonally adjusted purchase applications fell just 1% from the week before.

-

The ADP nonfarm employment change was at 113,000 in October, lower than the 150,000 expected but higher than the 89,000 the month before.

-

Construction spending increased 0.4% month-over-month in September.

-

Job openings on the Job Openings and Labor Turnover Survey (JOLTS) were art 9,553,000 in September, which was slightly above expectations.

-

The Federal Open Market Committee (FOMC) voted to leave the benchmark interest rate unchanged, as expected.

-

Continuing jobless claims were at 1,818,000 during the week ending 10/21, roughly a 30,000 increase from the week before. Initial jobless claims were at 217,000 during the week ending 10/28, a 5,000 increase from the week before.

-

The employment situation largely underperformed in October, which is good news for rates. Average hourly earnings inched up 0.2% month-over-month, lower than previous months. The average workweek declined as well, slipping to 34.3 hours. Government payrolls increased the same amount as September, up by 51,000. Manufacturing payrolls shed 35,000 jobs. Nonfarm payrolls saw a big contraction, climbing by just 150,000 vs. 180,000 expected and nearly 300,000 from the previous month. Private payrolls were below expectations as well, rising by 99,000 vs the 158,000 expected. The participation rate decreased to 62.7% and the unemployment rate increased to 3.9%

Review of Last Week

RALLY CAPS ON!… With falling interest rates on Treasuries, less hawkish Fed comments, and data showing a slowing economy but no recession, traders put their baseball caps on inside-out and backwards and shot stocks up sharply.

Wednesday, the Fed voted unanimously to pause rate hikes. After the meeting, Fed Chair Powell's press conference comments were seen as less hawkish than feared, indicating more hikes might never happen.

Friday's October jobs report showed slower payroll and wage growth and a higher unemployment rate, which is what the Fed wants to see, and pointed to a recession-free, “soft landing” for the economy.

The week ended with the Dow UP 5.1%, to 34,061; the S&P 500 UP 5.9%, to 4,358; and the Nasdaq UP 6.6%, to 13,478.

Bond prices rose nicely too, with the 30-Year UMBS 6.5% UP 1.03, to $100.11. The national average 30-year fixed mortgage rate reversed course and dropped in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Realtor.com reports that new listings in the past week abruptly reversed course and came in 5.6% ahead of the same week a year ago. Plus, homes were on the market one day less compared to last year.

Market Forecast

MORTGAGE APPLICATIONS, JOBLESS CLAIMS, CONSUMER SENTIMENT… We'll keep an eye on the weekly MBA Mortgage Applications Index to see if the gains continue in new home purchases and adjustable-rate loans. Forecasts call for Initial Unemployment Claims to stay super low, as the labor market remains strong. The preliminary November read on University of Michigan Consumer Sentiment should reveal consumers still worry a lot about inflation.

Summary

Home building activity keeps…well, building. In September, residential builders spent at a seasonally adjusted annual rate of $872.0 billion, which was 0.6% ahead of August’s annual rate of $866.6 billion.

Home prices rose again in August, according to both the Case-Shiller index and the FHFA index of homes financed with conforming mortgages. The Case-Shiller National Composite stands at an all-time high.

Demand for new homes continues. A national online real estate database reports more than 30% of the homes for sale in the third quarter were new builds—the highest share for any third quarter on record.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.