Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Spring Creek Oaks. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Spring Creek Oaks?

We currently have 5 homes pending, with 1 homes sold in the last two weeks, averaging a sale price of $132 a square foot. One homes sold over the asking price.

Compared to the two weeks prior, we haven’t seen big changes in the market. The average sales price in the neighborhood is $484,365. Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can request your free home evaluation here or email us here.

I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways! And the educated buyer still knows, they need to buy ASAP. The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Spring Creek Oaks.

My Two Cents: What I learned this week.

I love bringing y'all things I learned this week, so here is a recap…

1. Global Love for Texas: Even with rising rates, our beloved Texas seems to have caught the eye of international homebuyers. From April 2022 to March 2023, they've poured in a cool $4.3 billion! It’s worth noting that Texas now proudly stands as the third most popular state for global buyers, trailing only Florida and California. The majority of these buyers hail from Mexico, and impressively, half of them were able to make all-cash transactions. That's some serious commitment to the Lone Star state.

2. Affordability in Houston: Now, while our state is receiving international attention, local folks in Houston have been facing some challenges. A significant portion, nearly 60%, found it tough to buy a house here pre-pandemic. And although home prices have seen a slight reduction recently, other costs, like higher mortgage rates, insurance premiums, and taxes, have chipped away at that affordability. It’s a delicate balance, and a pinch on the wallet for many. Now there are still lots of ways and areas where we can find more affordable homes, with new construction being the best option, or a home that isn't perfect in an established neighborhood, so please don't be discouraged.

3. Mortgage Blues: On a broader scale, mortgage demand has tanked to its lowest since 1995, mainly due to those pesky rising interest rates. When Lawrence Yun from NAR points out that both inventory and mortgage rates have been unfavorable to buyers, it's hard not to nod in agreement.

4. Natural Disasters and Insurance: Nature’s fury has been at the forefront lately, and it’s affecting our insurance policies. With climate change ushering in extreme weather patterns, big insurers are pulling back from covering certain disasters. From Hurricane Idalia to fires in Maui, nature’s tantrums are making companies rethink their offerings. It's becoming a puzzle for homeowners — to insure or not to insure?

5. Houston’s Housing Post-Pandemic: We all remember the pandemic-induced buying frenzy, thanks to those dreamy 5% mortgage rates. However, times are changing. Interest rates are climbing, and house sales in Houston are stabilizing, moving towards what we experienced pre-pandemic in 2019. According to Cathy Trevino, the HAR chair, we might be settling into a “new normal”, and those tantalizing pandemic rates might remain a distant dream.

6. The Money Ceiling Conundrum: Here's something that's been taking up a lot of my bandwidth lately – the potential dramatic change in school property taxes for Texas homeowners, specifically our senior citizens and disabled homeowners. This shift promises that many will see their tax ‘drop to $0 or very close to $0'! Now, doesn’t that sound enticing?

But here's the deal: understanding this isn't straightforward. It's like diving into a math riddle that never seems to solve itself. I've spent hours poring over this, consulting with experts, running the numbers, and yet the math just kept zigzagging.

So, for the uninitiated, if you have a homestead and cross that magical age of 65 or become disabled, you encounter what's called “the ceiling” for school property taxes. It's not the one you stare at when daydreaming, but a money-saving barrier that ensures your school tax doesn’t skyrocket even if your home’s value does. Now, with the new property tax relief, the big question is how this will impact those with “the ceiling”?

Senator Paul Bettencourt’s office (he's the mastermind behind the tax relief legislation) jumped in with a solution. They provided a formula that, in simple terms, can significantly reduce the tax bill for those homeowners. With this new formula, it’s suggested that a large chunk of Texas homeowners might just find their school tax bill near or even at zero!

Yet, after all the math acrobatics, I remain cautiously optimistic. Seeing will be believing, so I’m eagerly waiting to get a glimpse of those tax bills in the coming months.

The potential savings sound promising. Bettencourt’s estimates hint at an average two-year savings ranging from $2,578.61 to $2,919.33 depending on your homeowner category. Sounds delightful, right?

But there’s a caveat. It’s not set in stone. While lawmakers and the governor are on board, this proposition still awaits the green signal from Texas voters this November. So, the game's not over; it’s halftime.

If approved, this could revolutionize the way homeowners contribute to school districts. And while there are concerns about depriving schools of funds, it’s heartening to see that the state, with its budget surplus, plans to compensate for the next two years.

The landscape of our housing market, from international interest to local tax intricacies, continues to evolve. These are exciting yet challenging times. Stay informed, ask questions, and let’s hope for clarity in the coming months. Until next week, happy home pondering!

What is happening in the real estate market nationally?

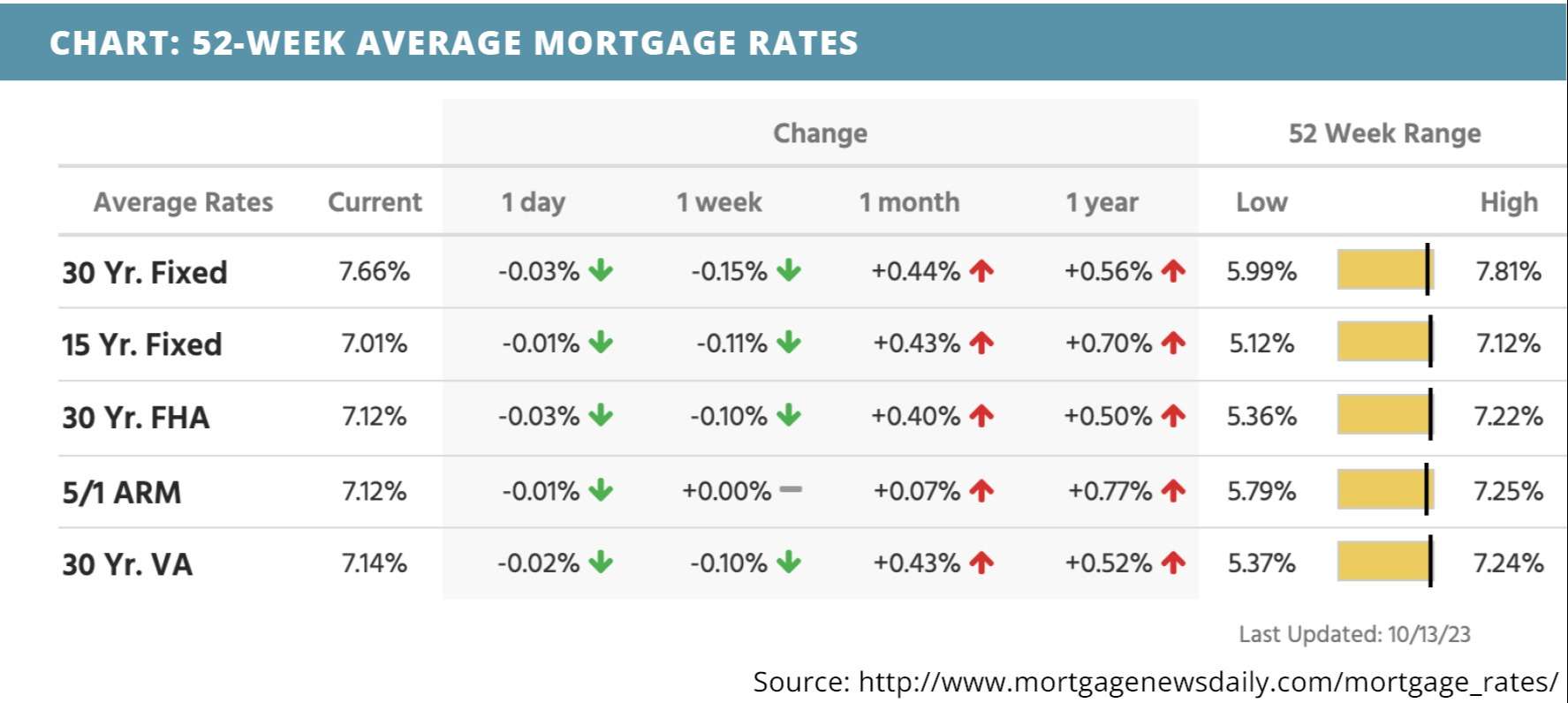

Mortgage rates saw a downward trend last week due to the Israel-Gaza conflict and a “marked shift in tone from several Federal Reserve speakers,” noted Matthew Graham of Mortgage News Daily. Mortgage application submissions increased, continuing jobless claims increased, and initial jobless claims were unchanged. Though the consumer price index for September was higher than expectations, it did show inflation trending in the right direction

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Core inflation makes the case for a Fed rate pause. Read Now >>

- Redfin says all hope is NOT lost for the housing market. Read Now >>

- Adjustable-rate mortgage demand spiked last week. Here's Why >>

Market Recap

-

Mortgage application submissions increased a composite 0.6% during the week ending 10/6.

-

The Refinance Index rose 0.3% and the seasonally adjusted Purchase Index increased 1%.

-

Continuing jobless claims were at 1,702,000 during the week ending 9/30, an increase of 30,000. Initial jobless claims were unchanged at 209,000 during the week ending 10/7.

-

The consumer price index (CPI) from September was slightly higher than expected at 0.4% month-over-month and 3.7% annually. The core consumer price index was unchanged. Though the numbers were higher than expected, there were some positive signs in September’s CPI report. One: used vehicle prices, a big driver of inflation in the early days of the Covid pandemic, were down 8% from a year ago. Another is that inflation is moving in the right direction.

Review of Last Week

UNCERTAIN… The Israel-Hamas war added to Wall Street’s uncertainties, yet the Dow broke a three-week losing streak, the S&P 500 scored back-to-back weekly gains, and the Nasdaq barely dipped.

Money flowed to the safe haven of bonds, lowering Treasury yields (and rates), which helped stocks. But University of Michigan Consumer Sentiment sank, due to high food and energy prices and inflation expectations.

Wholesale price inflation rose by the PPI, and CPI consumer price inflation was unchanged. On the plus side, earnings season kicked off with good results, and the Philadelphia Fed President said the FOMC is likely done raising rates.

The week ended with the Dow UP 0.8%, to 33,670; the S&P 500 UP 0.4%, to 4,328; and the Nasdaq down 0.2%, to 13,407.

Bonds closed out the week up overall, though the 30-Year UMBS 6.0% finished unchanged, at $97.31. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate edged up a tad. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… The Mortgage Bankers Association reported that purchase mortgage applications were up last week, as adjustable-rate mortgage demand hit 9.2% of all applications, the biggest share since November 2022.

Market Forecast

HOME BUILDING, EXISTING HOME SALES, RETAIL SALES… Analysts are predicting an uptick in home builder activity with September's Housing Starts report, although Building Permits may be down a little from August. September Retail Sales should continue to grow, showing consumers are still doing their bit to boost the economy.

Summary

Moody’s Investors Service reveals new home sales made up 14% to 15% of total transactions over the last three quarters, up from 10% in pre-pandemic years. They project new home prices will dip 10% this year and 4% more in 2024.

Analysts at nSkope report: “Real estate has returned to a lifestyle-driven market. Those who seemingly want more (or less) space, and access to better schools along with job or relationship-driven moves are driving listing inventory.”

Data firm Black Knight: “August marked the second consecutive month in which annual home price appreciation trended higher in every one of the 50 largest U.S. markets, mirroring the sharp reacceleration we’re seeing at the national level.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.