Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Auburn Lakes. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Auburn Lakes?

We currently have 9 homes pending, with 1 home sold in the last two weeks, averaging a sale price of $134 a square foot. One home sold over the asking price.

Compared to the two weeks prior, we haven’t seen big changes in the market. The average sales price in the neighborhood is $549,999. Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways! And the educated buyer still knows, they need to buy ASAP. The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Auburn Lakes.

Jo's Two Cents

The media coverage of the real estate market has been pretty doomsday. Mortgage rates have increased this week, and 21% of Americans in a recent Gallup poll think it is a bad time to buy a house. But the good news is that the median sales price of a home was up 32 percent in the first quarter of 2023 from the same period in 2020 according to Census data. And inventory in the most desirable areas is at a record low. I personally still think it is a great time to sell due to that low inventory and a great time to buy if you are patient and need a home.

Did you know?!

Texas is the fastest-growing state in the nation.

The Real Deal

- The only state with more than three of the nation’s fastest-growing cities is Texas.

- In fact, six of the 15 fastest-growing cities in the U.S. are in Texas, according to the U.S. Census Bureau.

- Central Texas saw people flocking to the region, as three of the fastest growing were on the outskirts of Austin.

- Georgetown, Texas was the fastest-growing city for the second year in a row with a population growth of 14.4 percent in 2022.

- San Antonio also experienced rapid growth, with 18,889 people added, which ranked it as the third fastest-growing city in terms of pure volume.

- The Houston-The Woodlands-Sugar Land metro area had the second largest increase with 124,281 new residents.

- All four of the Texas Triangle cities of Dallas, Austin, Houston, and San Antonio were in the top 10 of the list for population for the first time.

- Texas also ranked number one in terms of housing growth with Harris County adding 32,700 housing units.

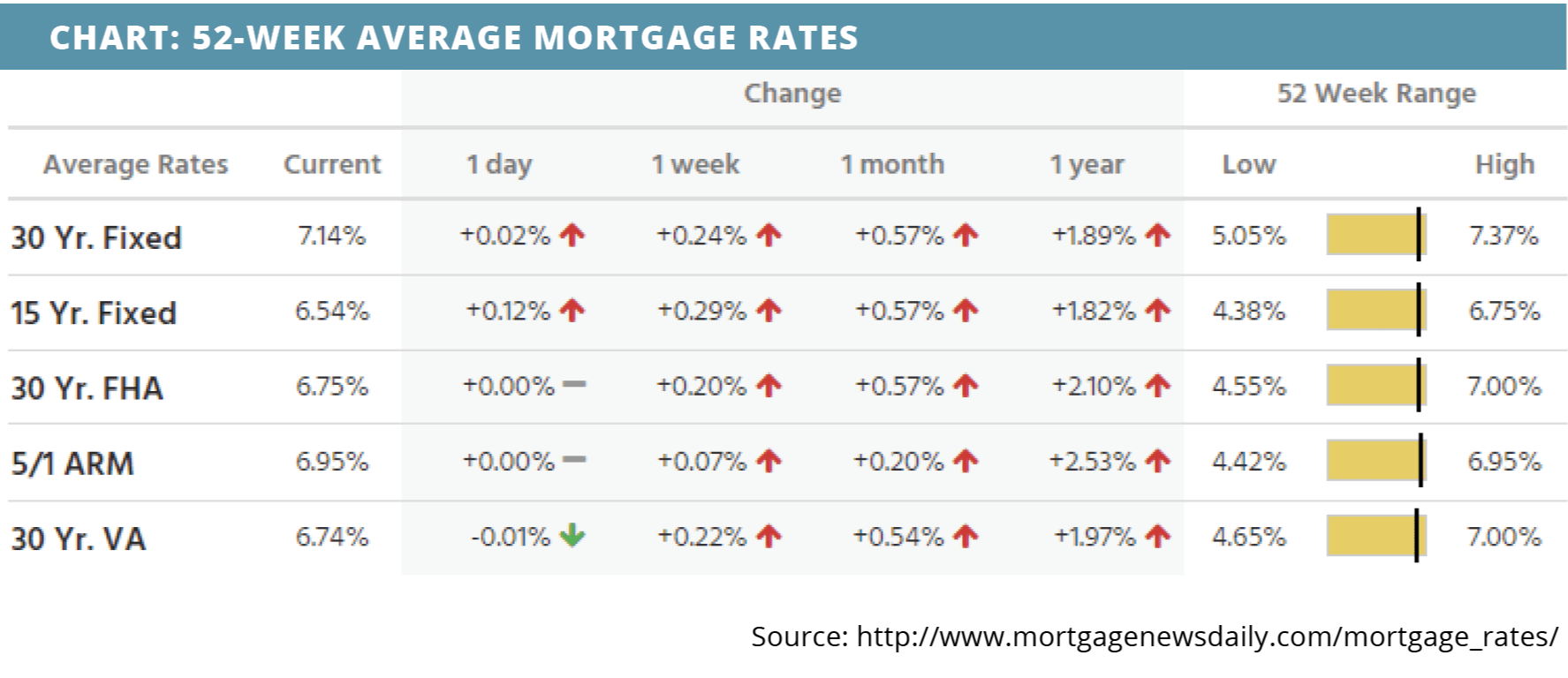

The 30-year mortgage rate just hit 7%. Here’s how much it will cost homeowners.

- If you haven’t heard, mortgage interest rates are up.

- The recent debt ceiling debate has only caused more economic uncertainty, which drives rates up.

- The 30-year fixed mortgage rate climbed to more than 7 percent this week, up from 6.95 percent last week, according to Mortgage News Daily.

- “Whatever the source, these higher rates are a difficult pill for buyers to swallow, and they give homeowners all the more reason to sit tight and avoid listing their homes,” said the senior economist at Zillow.

- An average of $121 has been added to monthly mortgage payments since last year.

- For those waiting for rates to come down, don’t hold your breath, said the chief economist at Bright MLS.

- “In the short term, the debt-ceiling debate has created uncertainty and will likely keep rates elevated, or perhaps push them even higher,” she explained.

- Zillow has stated that it expects the mortgage rate to move above 8 percent if the U.S. defaults on its debt.

What is happening in the real estate market nationally?

Mortgage rates trended higher last week with stronger-than-expected inflation and consumer spending data. New home sales increase in April, mortgage application submissions fell, continuing jobless claims slipped and initial jobless claims increased. The GDP estimate for quarter one slowed, pending home sales remained unchanged.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- What the MBA is saying about the market forecast for the rest of the year. Listen Now >>

- How homeowners insurance can help you out in surprising situations. Read Now >>

- Housing construction looks positive. Read Now >>

Market Recap

-

New home sales were at a seasonally adjusted annual rate of 683,000 in April, a higher-than-expected jump of 4.1% month-over-month.

-

Mortgage application submissions fell 4.6% during the week ending 5/19. Refinance application submissions decreased 5% while purchase applications decreased 4%.

-

Continuing jobless claims slipped by 5,000 during the week ending 5/13 to a level of 1,794,000. Initial jobless claims increased by 5,000 the following week to 229,000.

-

The GDP estimate for quarter 1 was slightly lower than before, rising 1.3% vs. 2.6% prior.

-

Pending home sales saw a 0% change in April but contract signings increased in three U.S. regions.

-

The core personal consumption expenditure (PCE) index reported an unexpected rise in April, rising 0.4% month-over-month vs. the 0.3% expected climb. Personal income was right in line with expectations, increasing 0.4% month-over-month. Consumer spending soared 0.8% month-over-month, double the expected increase.

Review of Last Week

TURBULENT TRADING… Concerns about the debt ceiling sent stocks down, but angst eased on Friday when reports a deal could be near sparked a rally that sent two of the three major indexes ahead for the week.

There were also concerns over rate hikes, as no less than four Fed members commented that the central bankers may not be done raising rates. One FOMC voter emphasized, “fighting inflation continues to be my priority.”

So, another hike may be coming, as the PCE Price Index, the Fed's favorite inflation measure, ticked up in April. Plus, the economy doesn't seem to be cooling much, with strong consumer spending providing plenty of support.

The week ended with the Dow down 1.0%, to 33,093; the S&P 500 UP 0.3%, to 4,205, and the Nasdaq UP 2.5%, to 12,976.

Bond prices had a down week overall, with the 30-Year UMBS 5.5% falling 0.94, to $99.06. The national average 30-year fixed mortgage rate continued up in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Realtor.com’s latest Monthly Housing Market Trends Report showed the number of homes actively for sale in April was 48.3% higher than last year, though still well below pre-pandemic levels.

Market Forecast

HOME PRICES, CONSTRUCTION SPENDING, JOBS… Home prices should decline by a small amount in the March S&P Case-Shiller Home Price Index. Overall Construction Spending is expected to increase in April, and we'll watch the residential part. The May jobs report is forecast to book modest gains in Nonfarm Payrolls, Average Hourly Earnings, and the Unemployment Rate.

U.S. financial markets were closed yesterday, May 29, in observance of Memorial Day.

Summary

April saw sales of new homes surge to a 13-month high, up 4.1% from March and 11.8% ahead of last year. Inventories have recently made substantial gains, and the median price is down 8.2% from a year ago.

The Mortgage Bankers Association reports new-home purchase applications rose year-over-year for the third straight month. They note: “the broader housing market is leaning more on new construction to boost for-sale inventory.”

Meanwhile, contract signings on existing homes were flat in April, although three of the four major U.S. regions saw monthly gains. Only the Northeast’s numbers decreased, pulling down the national average.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.