Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Cypress, Texas, specifically a market update for the neighborhood of Cypress Creek Lakes. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Cypress Creek Lakes?

We currently have 10 homes pending, with 4 homes sold in the last two weeks, averaging a sale price of $170 a square foot. Four homes sold over the asking price.

Compared to the two weeks prior: Homes sold are up from 2 homes sold to 4 homes sold and the average sales price is also up: $552,250 ($498,750 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

If we look at how fast the move-in ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Cypress Creek Lakes.

Jo's Two Cents

The interest rates the last couple of weeks have been playing games, but all analysts are still pointing to interest rates dropping significantly this summer. I personally am not holding my breath, but still hopeful.

Sales (clients going under contract) at Jo & Co. were super strong the months of March and April. We are seeing a little slow down, but we expect things to pick back up once graduations and the last day of the semester are behind us.

New construction sales are still our strongest. Nationally this is a huge trend in cities with high amounts of inventory. Montgomery and Fort Bend our our most popular counties, with the Harris county portions holding Katy and Cypress in the top three list. The most popular school districts have been Katy ISD and Cypress ISD.

The biggest reasons why folks are choosing new construction is low cost of maintenance, low electricity bills, large builder incentives, many options to choose from, flexible close dates, master planned community amenities, a high concentration of people in the same stage of life, and who doesn’t love brand new!

In general though, the greatest problem affecting the real estate market is the lack of inventory. So a really popular question on the mind of others is, “if I sell my home, where do I go?” And lucky for us in the Houston area, new construction is a big option. I would never encourage someone to sell, if the home they desired wasn’t also available.

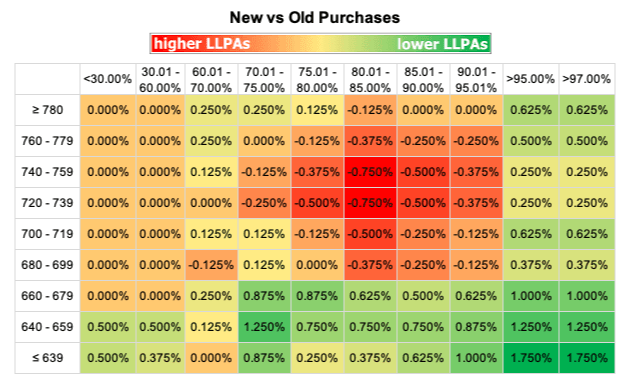

Correcting LLPA Misinformation

You may have seen conflicting stories regarding the changes due to Loan Level Price Adjustments (LLPAs). LLPAs are risk-based pricing adjustments charged during loan origination that vary based on credit score, loan-to-value (LTV) ratio, the type of mortgage, and other factors.

We wanted to set the record straight for you. First, the changes only affect Conventional loans. Yes, LLPA fees for Conventional loan borrowers with higher credit scores increased slightly this year. However, the fees are still greater for borrowers with lower credit. The changes do not penalize homebuyers with good credit. The small percentage adjustments were made to help make homeownership more accessible for those with lower credit, but is not rewarding borrowers with low credit.

It is typical for these types of adjustments to be made. This chart highlights the percentage fee changes:

In general, here is a high-level summary of the new pricing matrix changes on Conventional purchase loans:

- Includes new credit bands beyond a 740 score (previously, anyone with a FICO score of 740 would pay the same fees as someone with a score of 780).

- Borrowers with better credit will still pay less than someone with worse credit.

- Borrowers with credit scores between 680 and 779 with down payments between 10% and 20% will see a fee increase.

- First-time homebuyers with low or moderate household income pay no added fees whatsoever.

- All borrowers who put less than 5% down across all FICO scores will benefit.

Questions? I would love to connect you with a local lender to help clear up any confusion.

What is happening in the real estate market nationally?

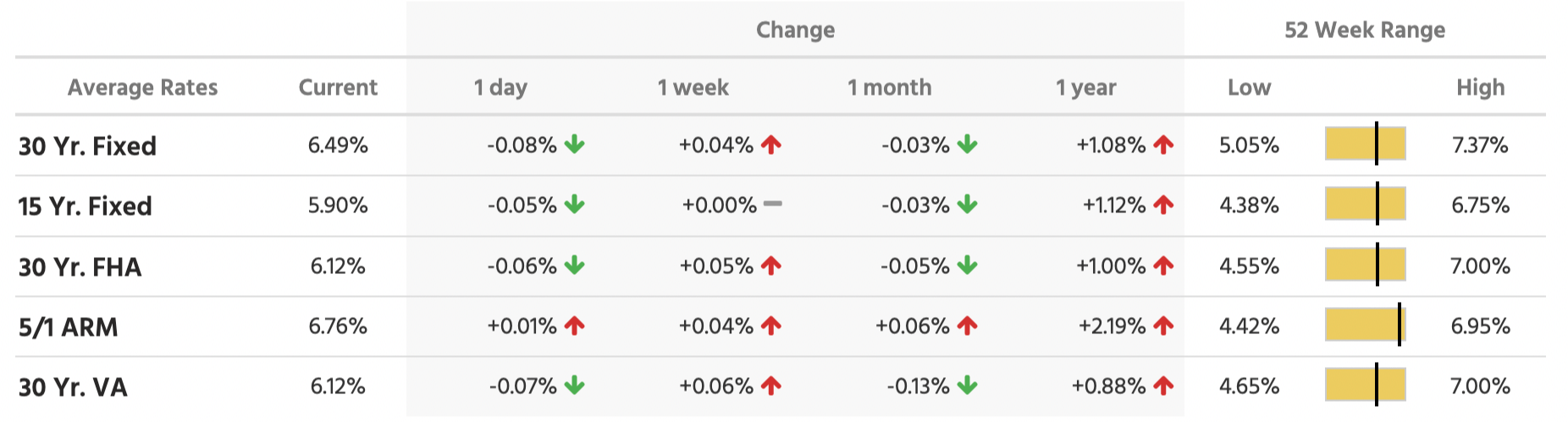

Last week, mortgage rates remained relatively unchanged after fluctuating higher and lower. Mortgage application submissions increased. The consumer price index for April was mostly in line with inflation expectations. Continuing jobless claims and initial jobless claims both increased.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- FHFA cancels upfront DTI fee scheduled to start on August 1. Read Now >>

- HUD invests $837 million in energy efficient and climate friendly renovations for multifamily housing. Read Now >>

- Hopeful home buyers are more hopeful about the housing market for one big reason. Read Now >>

Market Recap

-

Mortgage application submissions increased a composite 6.3% during the week ending 5/5. The Refinance Index increased 10% while the Purchase Index increased 5%.

-

The consumer price index (CPI) for April increased 0.4% month-over-month and 4.9% year-over-year, which was mostly as expected. The core CPI increased 0.4% and 5.5% month-over-month and year-over-year.

-

Continuing jobless claims increased by 12,000 during the week ending 4/29, bringing the total number of continuing claims to 1,813,000. Initial jobless claims increased by roughly 20,000 during the week ending 5/6, bringing the total number of initial claims to 264,000.

Review of Last Week

INFLATION WANES, CONSUMERS WORRY… Traders sent the Dow and S&P 500 down for the week, though the tech-y Nasdaq gained, as inflation abated but consumer concerns about the economy grew.

University of Michigan Consumer Sentiment fell precipitously in April, threatening to cut the spending that supports 70% of the economy. Yet Consumer Price Index inflation, at 4.9%, hit its lowest rate in two years.

That gave investors hope the Fed may be finished with hikes and start cutting rates in a few months. They also felt good that 78% of companies reporting Q1 earnings have beaten expectations.

The week ended with the Dow down 1.1%, to 33,301; the S&P 500 down 0.3%, to 4,124, and the Nasdaq UP 0.4%, to 12,285.

Bond prices receded overall, the 30-Year UMBS 5.5% ending down 0.27, at $100.61. The national average 30-year fixed mortgage rate inched down again in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… New data reports 55% of the potential homebuyers surveyed see this year’s market as more competitive than last year's, yet 54% want to buy when they planned or even speed up their home purchases.

Market Forecast

HOME BUILDING, EXISTING HOME SALES, RETAIL SALES… Builders are expected to report a tad fewer Housing Starts in April, but Building Permits are forecast up a bit. Analysts predict April Existing Home Sales will slide, given tight inventories. Retail Sales should come in ahead for April, showing consumers are still helping the economy.

Summary

The spring housing market is heating up. The Mortgage Bankers Association reported purchase mortgage applications rose 5% compared to the week before. Even refinancing applications spiked 10% from the prior week.

This is happening even as the National Association of Realtors reports that almost seven out of ten metros saw home prices rise the first three months of the year after roughly half a year of moderate price declines.

A new Zillow study supports this, reporting home values climbed 1% from March to April, as buyer demand for limited inventory is re-igniting the sellers’ market. Higher rents are also bringing more buyers onto the scene.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.