Hi neighbor, Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the 77379 Zip Code. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in 77379?

We currently have 42 homes pending, with 20 homes sold in the last two weeks, averaging a sale price of $145 a square foot. Twenty homes sold over the asking price, with one home selling 5% above the listing price.

Compared to the two weeks prior: Homes sold are up from 14 homes sold to 20 homes sold. Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money)

Check out the graphic below for a larger overview of the real estate market for the last two weeks in 77379.

Jo's Two Cents

Did you know that historical data shows that homeowners over the past decade have become 40 times wealthier than renters? Unsurprisingly, NAR (the National Association of REALTORS®) has reported that the median-priced home gained $190,000 in value, which means the conventional homeowner became 40 times wealthier than if they had stayed as a renter.

This week, the US central bank raised the interest rates to the highest level in 16 years to battle inflation in attempts to stabilize prices. Even with interest rates being in the 5s and 6s, home buyers have not slowed down, and prices of homes in our area have not seen decreases. And the main culprit is the low levels of affordable inventory.

In the last 90 days, in The Woodlands, 433 homes have sold or gone under contract, with over half of them going under contract the first week they hit the market, and 51% sold at or over list price. One could assume 50-60% of these homes at a minimum received multiple offers, although I think the number is higher. I am personally seeing a record number of buyers, and their biggest complaint is their struggle to find the perfect homes. Less and less perfect homes are coming on the market. The only way my clients have been able to combat this is by buying new construction.

In Montgomery county, we have seen 2507 homes sell or go under contract. In Fort Bend county that number is 1596, and in Harris county 4263. So what are the most popular new construction neighborhoods so far this year?

- Sunterra (326)

- Tavola (255)

- Bridgeland (235)

- Cross Creek Ranch & Cross Creek West (224)

- Marvida (218)

- Tamarron (165)

- Sienna (160)

- Elyson (134)

- Jordan Ranch (133)

- Harper's Preserve (123)

- Meridana (111)

- Cane Island (100)

- Artavia (98)

- Woodforest (97)

- Magnolia Ridge (97)

- Balmoral (97)

- Amira (95)

- Creekside Farms (92)

- The Woodlands Hills (84)

- Grand Central Park (81)

- Sendero (80)

- The Highlands (76)

- Veranda (76)

- Candela (70)

- Pomona (71)

- Towne Lake (61)

If you are thinking about selling, maybe one of these new construction neighborhoods could be your next home? And if you are thinking about buying, let me help you, find the perfect neighborhood and home for you!

What is happening in the real estate market nationally?

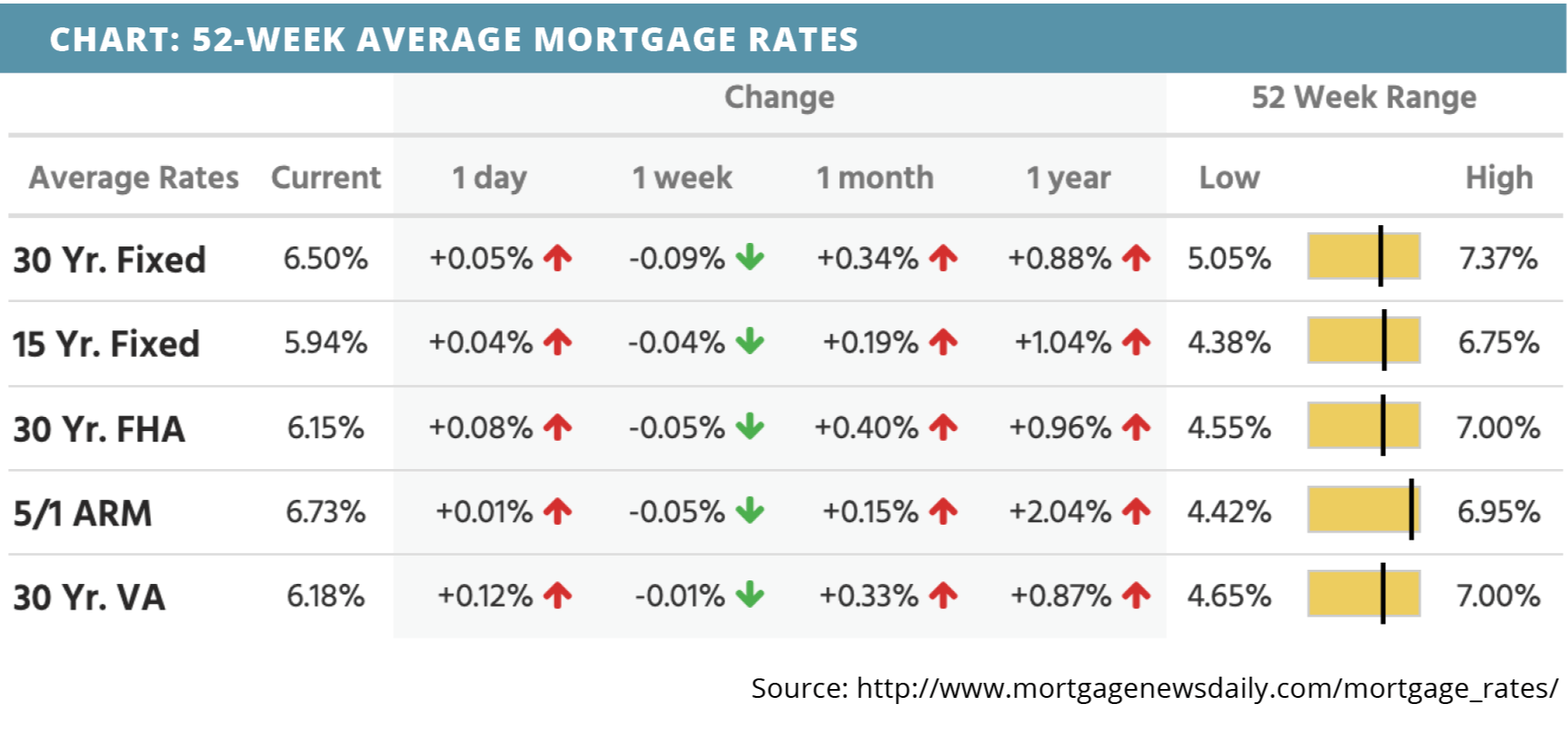

Mortgage rates trended lower last week despite strong jobs data and another federal funds rate hike from the Federal Reserve. Construction spending increased in March, while job openings fell to the lowest level in two years. Mortgage application submissions decreased, and ADP nonfarm employment was higher than expected in April. Continuing jobless claims fell while initial jobless claims increased. The employment situation was better than expected in April.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Millennial homeowners shift toward renovating instead of selling. Watch Now >>

- FHFA’s Michael Shemi answers LLPA questions. Listen Now >>

- Realtors hope for busy spring season following Fed’s signal of a pause in hikes. Read Now >>

Market Recap

-

Construction spending increased 0.3% month-over-month in March, higher than the 0.1% increase that was expected.

-

Job openings fell more than expected in March, down to 9.59 million, which is the lowest level in nearly two years. The pullback is a positive sign for inflation and rates, as the Fed has been closely watching the labor market for signs of labor slack – the lower the job openings, the better (for rates).

-

Mortgage application submissions fell 1.2% during the week ending 4/28. The Refinance Index increased 1% while the Purchase Index decreased 2%.

-

ADP nonfarm employment climbed to a level of 296,000 during April, nearly double the expected level. Pay growth, on the other hand, slowed, which is positive for combatting inflation.

-

The Federal Open Market Committee (FOMC) voted to raise the benchmark interest rate by another 0.25%, yet the language in the statement was an encouraging shift.

-

Continuing jobless claims decreased by nearly 40,000 during the week ending 4/22 while initial jobless claims increased to a level of 242,000 during the week ending 4/29.

-

The employment situation largely outperformed expectations in April. Average hourly earnings increased 0.5% vs. 0.3% expected. The average workweek remained unchanged at 34.4 hours. Government payrolls were expected to decline but increased 23,000. Manufacturing payrolls were expected to decline as well but ended up climbing by 11,000. Nonfarm payrolls climbed by 253,000 vs. the 180,000 expected. Private payrolls were at 230,000. The participation rate increased to 62.6%, while the unemployment rate decreased to 3.4%.

Review of Last Week

GOOD JOBS NOT GOOD ENOUGH… Friday's unexpectedly upbeat April jobs report sparked a market rally, but wasn't enough to send the Dow and the S&P 500 into positive territory, though the Nasdaq eked out a gain.

The Fed hiked rates an expected quarter percent, implied they'd keep them there a while, wouldn't say when they'd start rate cutting, but stressed that the “U.S. banking system is sound and resilient.”

Then April's better-than-forecast 253,000 nonfarm payrolls, bump in hourly earnings, and drop in the unemployment rate, gave support to the idea that we could still see a soft landing for the economy.

The week ended with the Dow down 1.2%, to 33,674; the S&P 500 down 0.8%, to 4,136, and the Nasdaq UP 0.1%, to 12,235.

Bonds overall finished up a smidge, the 30-Year UMBS 5.5% ending UP 0.11, at $100.88. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate ticked down. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… The National Association of Realtors reports 63% of agents surveyed found promoting energy efficiency is very or somewhat valuable, and 48% said consumers were interested in sustainability.

Market Forecast

INFLATION, JOBLESS CLAIMS, CONSUMER SENTIMENT… April reports are expected to show inflation is still elevated. The Consumer Price Index (CPI) is forecast up a bit from the prior month, as well as the Producer Price Index (PPI) of wholesale prices. Initial Unemployment Claims should increase a little, while University of Michigan Consumer Sentiment is predicted to stay historically low.

Summary

The CoreLogic Home Price Index (HPI) reported year-over-year home price growth fell to 3.1% in March, hitting its lowest appreciation rate in 11 years. Monthly price growth fell to 1.6%.

Although construction spending was up overall in March, residential spending came in a tick below February at a still respectable $827.2 billion annual rate. Given the low existing home inventories, builders are optimistic but cautious.

Realtor.com’s latest weekly report saw active inventory 39% above a year ago. Sellers have more competition, but homes are still spending 15 fewer days on the market than before the pandemic.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.