Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Cypress, Texas, specifically a market update for the neighborhood of Fairfield. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Fairfield?

We currently have 17 homes pending, with 5 homes sold in the last two weeks, averaging a sale price of $150 a square foot. Five homes sold over the asking price, with one home selling 3% above the listing price.

Compared to the two weeks prior: The number of homes sold is still the same, but the average sales price is up $495,000 ($385,445 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways! The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Fairfield.

Jo's Two Cents

In the last three months, we have seen 43 homes sell in Fairfield, with an average sales price of $385,768. This time last year 52 homes sold with an average sales price of $393,606. If we look at 77433 as a whole, 448 homes sold this time last year at an average sales price of $450,660. In the last 3 months, 447 homes have sold at an average price point of $486,438. This is illustrating demand is right on track, showing the market hasn't really gone anywhere, and sellers are paying over on average $35,000 more for homes in 77433. I personally wouldn't let the “slowness” and “high-interest rates” scare you or deter you from selling right now. Inventory is unbelievably low, making any beautiful home that hits the market, sure to sell in the first week or two if listed at the right price and marketed well.

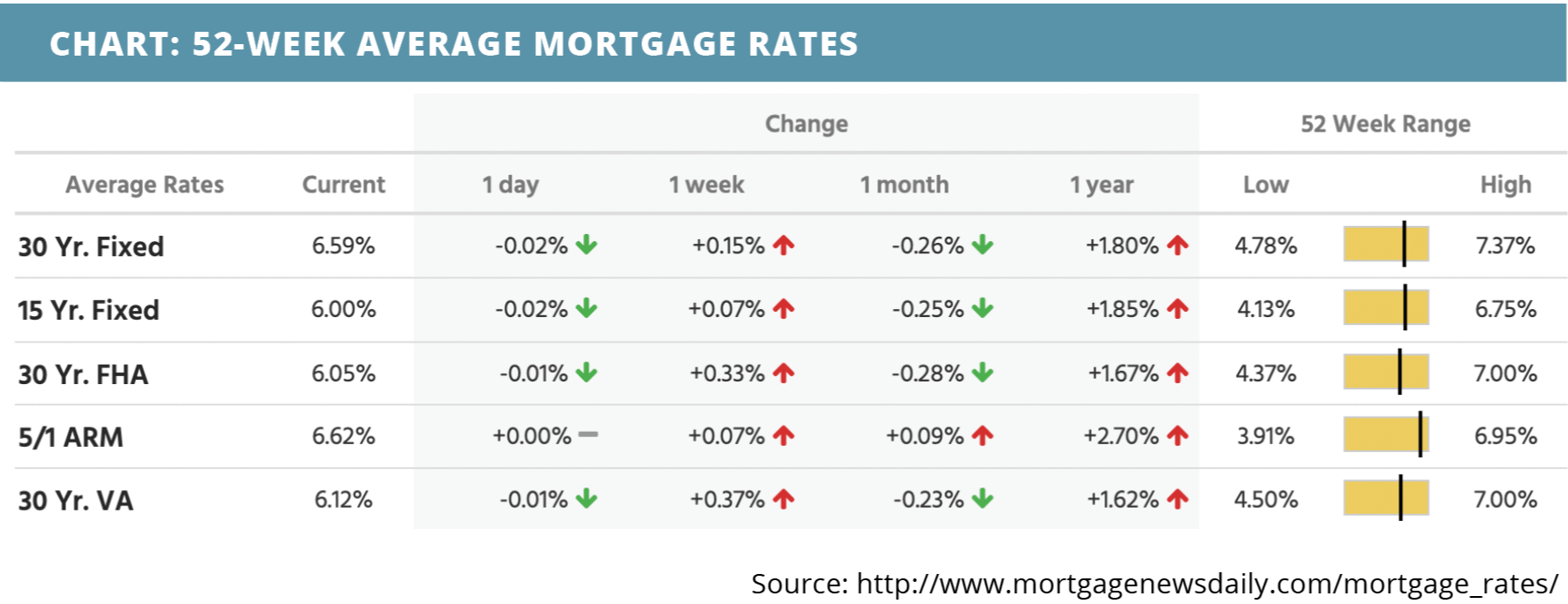

What is happening in the real estate market nationally?

Mortgage rates trended higher in the beginning of last week as the banking drama cooled off and bond demand stabilized. Home price appreciation was higher than expected in January. Mortgage application submissions ticked up. Pending home sales surprisingly increased. Jobless claims inched higher. The Q4 GDP estimate slipped slightly. Inflation on the PCE index was lower than expected in February, as was consumer spending. Personal income surpassed expectations.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Don’t expect the housing market to crash. A rebound is coming, according to experts. Read Now>>

- Home prices cool in January. Watch Now >>

- Baby boomers edge out millennials as top buying force. Read Now >>

Market Recap

-

Home price appreciation on the FHFA house price index climbed 0.2% month-over-month in January. They were expected to decline 0.2%. Compared to January 2022, prices were up 5.3%.

-

According to the 20-city Case-Shiller home price index, home price appreciation fell 0.4% month-over-month in January. They were expected to fall 0.5%. Year-over-year expectations were on point at 2.5% — a stark drop from 4.6% the month before.

-

Mortgage application submissions rose a composite 2.9% during the week ending 3/24. Refinance application submissions climbed 5% while purchase application submissions 2%.

-

Continuing jobless claims increased slightly during the week ending 3/18, rising by 4,000 to reach a level of 1,689,000. Initial jobless claims jumped as well, rising by 7,000 to reach a level of 198,000.

-

The GDP estimate for the fourth quarter of 2022 decreased slightly to 2.6% from the previous estimate of 3.2%.

-

Inflation was lower than expected on February’s PCE index. Month-over-month, inflation rose 0.3% vs. the 0.5% expected. Annual inflation was at a level of 5%. The core PCE index, stripping food and energy, was at 0.3% month-over-month and 4.6% year-over-year. All levels on both the core index and regular index fell below expectations. Consumer spending fell below expectations as well, up just 0.2%. Personal income, however, was higher than expected at 0.3%.

Review of Last Week

OUT LIKE A LION… March ended well on Wall Street, with stock prices roaring ahead for both the week and the quarter. Worries about the health of the banking sector have obviously receded.

University of Michigan Consumer Confidence dipped in March, yet the Conference Board's Consumer Confidence read held up well the week after the bank drama, though it still registered some future growth concerns.

The leonine finish to the month was jump started Friday by some pleasing inflation data. The PCE Price Index fell from January's 5.3% to February's 5.0%, while the Fed's favorite Core PCE number went from 4.7% to 4.6%.

The week ended with the Dow UP 3.2%, to 32,274; the S&P 500 UP 3.5%, to 4,109, and the Nasdaq UP 3.4%, to 12,222.

Bond prices slipped a little overall, the UMBS 5.5% down 0.06, to $101.01. The national average 30-year fixed mortgage rate decreased for the third straight week in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Attom Data reports that home flips last year reached 8.4% of all home sales, their highest level since 2005, even as flippers’ median gross profit dipped to $67,900, a 26.9% ROI, a 14-year low.

Market Forecast

CONSTRUCTION SPENDING, MANUFACTURING, SERVICES, JOBS… Total Construction Spending is expected to come in flat for February, but we'll monitor the residential part. The ISM Manufacturing and Non-Manufacturing Indexes for March are forecast to fall, though Non-Manufacturing (the dominant services sector) should remain in growth territory. The March jobs report is predicted to show Nonfarm Payrolls down and the Unemployment Rate holding.

The NYSE, Nasdaq, and bond markets will be closed this Friday, April 7, in observance of Good Friday.

Summary

The February Pending Home Sales index of signed contracts on existing homes headed north for the third straight month. The National Association of Realtors noted, “the housing sector’s contraction is coming to an end.”

In line with this, the Mortgage Bankers Association reported demand for purchase loans moved up for the fourth week in a row, as mortgage rates continued to slide back from their 2023 highs.

Buyer demand is also growing as home prices ease. The S&P CoreLogic Case-Shiller Home Price Index in January fell month-over-month for the seventh straight month, though it’s still up modestly year-over-year.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.