Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Magnolia, Texas, specifically a market update for the neighborhood of Lake Windcrest. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Lake Windcrest?

We currently have 4 homes pending, with 2 homes sold in the last two weeks, averaging a sale price of $236 a square foot. Two homes sold over the asking price, with one home selling 3% above the listing price.

Compared to the two weeks prior: Homes sold are up from 1 home sold to 2 homes sold and the average sales price is also up: 1,082,165 ($773,500 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

If we look at how fast the move-in ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Lake Windcrest.

Jo's Two Cents

In the last three months, we have seen 3 homes sell in Lake Windcrest, with an average sales price of $964,500. This time last year 15 homes sold with an average list price of $798,467. About 80% of our market has disappeared, but as you can see, the data still shows us that on average, the home seller is getting over $150,000 more for their home this year compared to last year, and we have 5 homes pending with an average list price of $1,030,800. I personally wouldn't let the “slowness” and “high-interest rates” scare you or deter you from selling right now. Inventory is unbelievably low, making any beautiful home that hits the market, sure to sell in the first week or two if listed at the right price and marketed well.

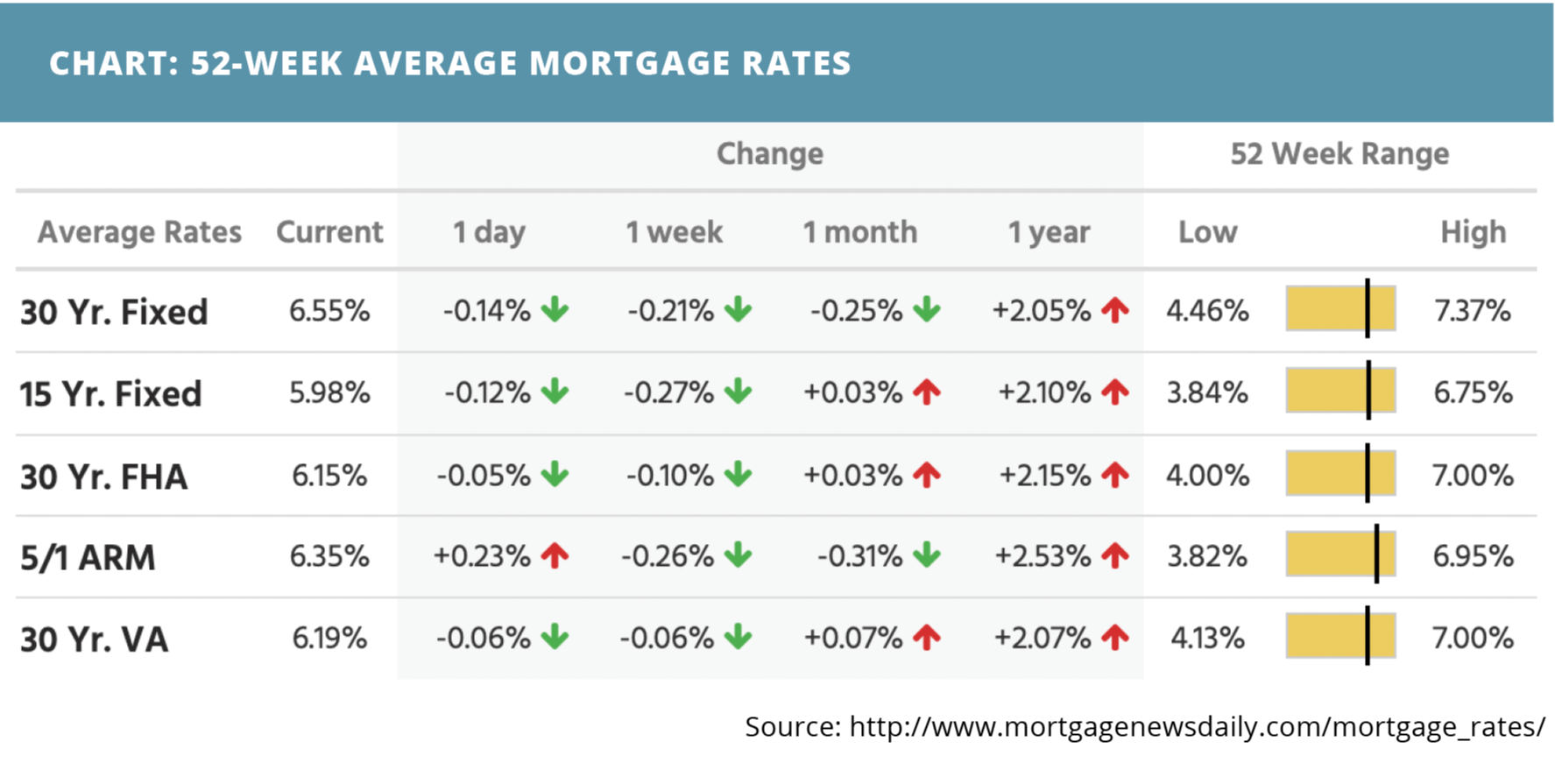

What is happening in the real estate market nationally?

Mortgage rates ended last week at a relatively unchanged level from the beginning of the week. Inflation continued to cool in February, as did retail sales. Mortgage application submissions increased. Home builder sentiment, housing starts, and building permits all outperformed. Both continuing and initial jobless claims.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Things are looking up for first-time buyers. Read Now >>

- Prioritizing curb appeal and outdoor features may pay off handsomely. Read Now >>

- ARMs and Jumbo Loans are gaining popularity. Read Now >>

Market Recap

-

The consumer price index (CPI) rose 0.4% month-over-month and 6% year-over-year in February. This marked the slowest annual pace of CPI inflation since 2021. Unfortunately, the core CPI, stripping food and energy, rose 0.5% month-over-month. This was slightly higher than the 0.4% expected and proves that inflation is still stubbornly high.

-

Mortgage application submissions rose 6.5% during the week ending 3/10. Demand for purchases increased 7% while refinance demand increased 5%.

-

Retail sales slipped 0.4% month over month in February – a lower-than-expected decline.

-

The National Association of Home Builders (NAHB) housing market sentiment index revealed that home builder confidence climbed by two points to reach level of 44 in March, despite the expected decline.

-

In February, building permits surged a giant 13.8% month-over-month to a level of 1.524 million. They were expected to fall to a level of 1.340 million. Housing starts also surged, up 9.8% month-over-month to a level of 1.450 million – they were projected to decline as well.

-

Continuing jobless claims fell to a level of 1,684,000 during the week ending 3/4. Initial jobless claims fell as well, dropping to a level of 192,000 during the week ending 3/11.

Review of Last Week

ROLLER COASTER MOSTLY UP… It was a volatile week on Wall Street as traders put their money into big names far from the banking sector, pushing the S&P 500 and Nasdaq up nicely, while the Dow slipped only a tick.

Investors were concerned about the recent bank failures, but many took comfort in the swift actions by the Fed, the Treasury, and the FDIC to support depositors and quell fears that could cause a bank run.

We did get weaker than expected retail sales in February, but CPI inflation fell to 6.0%, the smallest annual increase since September 2021, while initial jobless claims sank back below 200,000.

The week ended with the Dow down 0.1%, to 31,862, the S&P 500 UP 1.4%, to 3,917, and the Nasdaq UP 4.4%, to 11,631.

Bonds overall made strong gains, the UMBS 5.5% up 1.08 in the last two weeks, to $100.29. The national average 30-year fixed mortgage rate headed down in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Freddie Mac notes, “turbulence in the financial markets is putting significant downward pressure on rates,” sparking buyer demand. Last week, purchase mortgage applications rose a seasonally adjusted 7%.

Market Forecast

NEW AND EXISTING HOME SALES, THE FED RATE DECISION… Reports on the February housing market are expected to show Existing Home Sales on the rebound, but New Home Sales flat or posting a small decline. The biggest focus will be on Wednesday's FOMC Rate Decision. The Fed is expected to hike just a quarter percent, though we could see the central bankers take a pause.

Summary

Increasing for the first time in six months, housing starts shot up 9.8% in February, with both single-family and multi-unit projects posting gains. Building permits did even better—up 13.8%, the largest monthly gain in two years.

Home builders are clearly feeling more optimistic. The homebuilder sentiment index headed up for the third straight month, indicating the housing market is starting to find its footing in the present mortgage rate environment.

Realtor.com reports active inventory keeps climbing—up 61% from a year ago. Homes are spending more time on the market than last year, but they’re still selling quicker than before the pandemic, suggesting continuing buyer demand.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.