Hi neighbor,

Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Windrose. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Windrose?

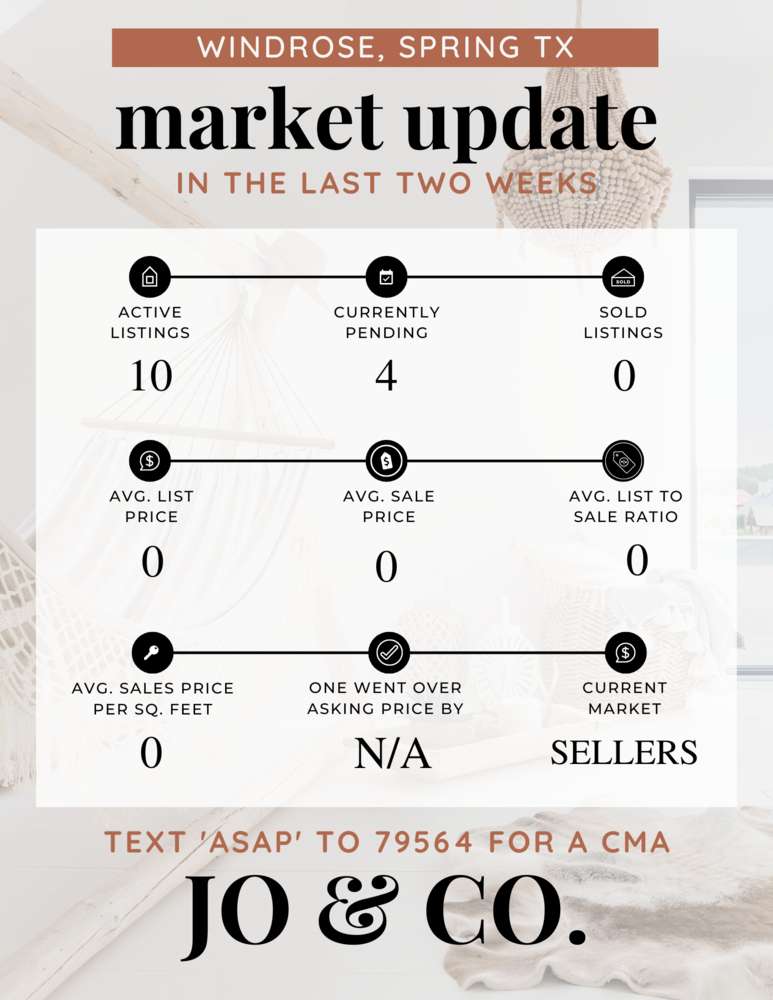

We currently have 4 homes pending, with 0 homes sold in the last two weeks.

Compared to the two weeks prior, no homes have sold in the Windrose neighborhood. This is most likely a coincidence, so we will be sure to keep an eye on it over the next couple of weeks. Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

If we look at how fast the move-in-ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting the neighborhoods. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Windrose.

Jo's Two Cents

What is being written and spoken in media right now to potential home buyers and sellers can be truly contradictory. One piece will be telling us how it is a bad time to buy, but then another will show us research that shows that right now is a great time to buy. While this can be a confusing time, one must sift through all the noise and determine what is right for them, personally.

There are so many decisions before today's buyers and sellers, but one thing is certain, people need somewhere to live, so an active real estate market isn't going anywhere. Decisions are on both sides of real estate: buy now, sell now, buy later, sell later, save more money, buy new construction since builders are offering huge incentives and buy downs, reduce price, or just sit. And another certain, I want to make sure you have before you, is that Jo & Co. will be here waiting for you. We will be your resource, no matter the temperature of the real estate market.

Good and Bad

Bad: According to the chief economist for Realtor.com, as quoted in The New York Times, a borrower with a 10 percent down payment paying the national median sales price would pay nearly $1,000 per month more than in August 2021.

Bad: Home sales have been falling across the country, according to the National Association of REALTORS®, and we have been no different in Houston with total single-family home sales declining 17 percent last month.

Good: The silver lining is that property values have increased substantially during the pandemic, so even a slight decline isn’t expected to erase the gains, according to most analysts.

Good: Another factor that should help the real estate market is stricter underwriting practices that were put into place after the 2008 subprime mortgage crisis.

Good: Homeowners are more willing to offer down payment assistance.

Good: New data shows that the most advantageous time to buy a home is right now…

- According to a report from real estate research firm Attom, October is the best month for homebuyers.

- It should be noted that the research is based on a “typical” year, and I think we can all agree that these past couple of years have been anything but typical.

- That being said, October saw homebuyers paying the smallest premium (3 percent) on homes purchased.

- May saw the highest premium of 11 percent higher than Attom’s valuation of the homes.

- The logic makes sense as we always see a strong summer selling season. Then, perhaps home sellers become more willing to negotiate after the summer if their homes didn’t sell.

- In case you were wondering, last year November, December and January all saw 4 percent premiums, according to the article in Inman News, and continue to increase through the spring and into summer.

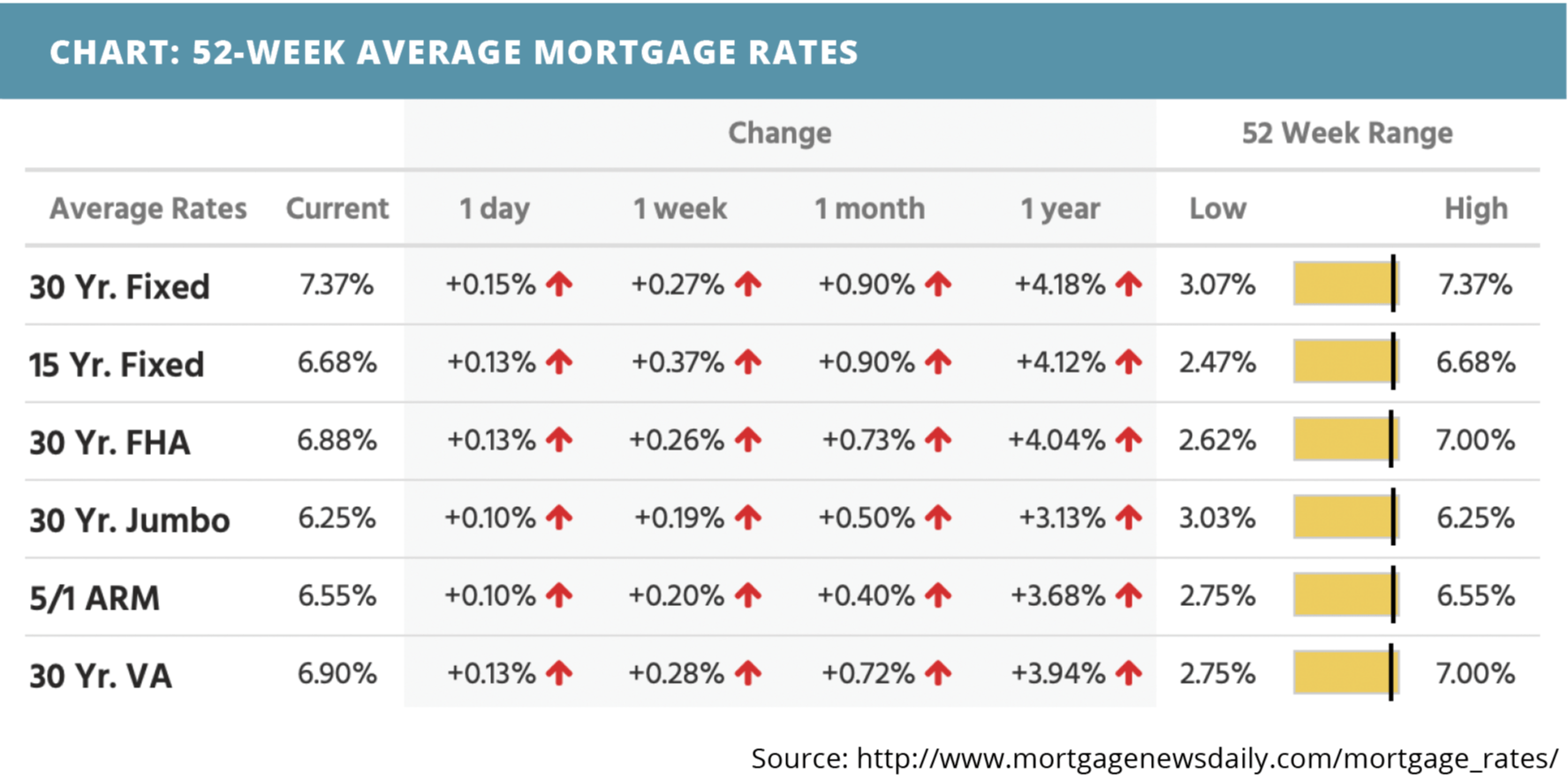

Bad: Mortgage rates could continue to rise to 8.5% according to NAR

- As if the significant increase in mortgage interest rates this year wasn’t already enough, National Association of Realtors chief economist Lawrence Yun predicted that interest rates could reach 8.5 percent, if they pass the 7 percent mark (which has happened since he spoke).

- According to Bloomberg, as reported by The Real Deal, Yun presented his findings at the National Association of Real Estate Investors.

- He is basing his forecast on resistance levels of borrowing costs after a key inflation indicator hit a 40-year high.

- After passing six percent within the last couple of months, the average rate for a 30-year fixed mortgage last week was just over 6.9 percent — a 20-year high.

- “Once one army makes a breakthrough, there’s a huge advance,” Yun said.

Bad: Some of Houston's fastest-growing suburbs are sinking, a new study finds

- According to an article from Fox Weather that cites a study from the University of Houston, our suburbs of Houston are sinking faster than the city itself.

- This could lead to increased risks of flooding and shaking in those areas, according to researchers.

- The study published in the journal Remote Sensing found that the gradual sinking of the ground is happening at a faster rate in cities like Katy to the west of Houston, The Woodlands to the north, and Fresno to the south.

- According to the U.S. Geological Survey, the sinking in the Houston area is primarily caused by the pumping of groundwater out of aquifers.

- “If current ground pumping trends continue, faults in Katy and The Woodlands will likely become reactivated and increase in activity over time,” researchers wrote in the study.

- About 2 million additional people live in the suburbs of the greater Houston area.

What is happening in the real estate market nationally?

Mortgage rates trended higher last week. Home builder sentiment slipped lower in October, mortgage application submissions decreased, building permits increased, and housing starts fell. Continuing jobless claims increased while initial jobless claims fell. Existing home sales

slipped slightly.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Buyers are in a much better position than a few months ago. Read Now >>

- How will inflation data continue to affect mortgage rates? Listen Now >>

- For-sale homes are spending more time on the market. Read Now >>

Market Recap

- Home builder sentiment decreased to a level of 38 in October, lower than the expected level of 44. All three components dropped on the NAHB housing market sentiment index – current sales conditions fell 9 points to 45, sales expectations in the next six months dropped 11 points to 35, and prospective buyer traffic decreased 6 points to 25.

- Mortgage application submissions fell 4.5% during the week ending 10/14. Refinance application submissions decreased by 7% and purchase application submissions decreased by 3%.

- Building permits increased 1.4% month-over-month in September to a seasonally adjusted annual rate of 1.56 million units. Experts had predicted a decrease to 1.53 million units. Housing starts fell 8.1% month-over-month to a seasonally adjusted annual rate of 1.44 million units.

- Continuing jobless claims increased by roughly 20,000 during the week ending 10/8, climbing to a level of 1.39 million. Initial jobless claims decreased by 12,000 to a level of 214,000 during the week ending 10/15.

- In September, existing home sales were at a seasonally adjusted annual rate of 4.71 million units, a 1.5% decline from August but a higher-than-expected level according to economists’ expectations.

Review of Last Week

PULL BACK… Stocks suffered a down week as traders contemplated a slowing economy and hawkish comments from no less than six Fed officials who basically said we've still got a ways to go before rate hikes cease.

The U.S. leading economic index (LEI) fell in October for the eighth month in a row, and the worry is that consumer spending is apt to slow amidst high inflation, rising interest rates, and concerns about job security.

But positive news came when the October Producer Price Index reported 8.0% wholesale price inflation, down from 8.4% in September. Plus, October Retail Sales surprised with 1.3% growth after a flat read in September.

The week ended with the Dow virtually flat, at 33,746; the S&P 500 down 0.7%, to 3,965; and the Nasdaq down1.6%, to 11,146.

Equity capital went to bonds, raising prices, though the 30-year UMBS 5.5% ended down 0.08, at $100.14. In Freddie Mac's enhanced Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate plunged 47 basis points (0.47%). Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… After the prior week’s data indicated inflation growth had slowed, bond prices rose and mortgage rates fell. Consequently, purchase mortgage applications shot up 4%, according to the Mortgage Bankers Association.

Market Forecast

A LOOK AT NEW HOME SALES, CONSUMER SENTIMENT, AND THE FED… For October, New Home Sales are forecast to slip a bit. The final November read for University of Michigan Consumer Sentiment is expected to still come in at an historically low level. We'll check out the FOMC Minutes from the Fed's last meet to see what they might reveal about future rate hikes.

U.S. financial markets will be closed this Thursday for Thanksgiving. Friday, the stock markets will close early, at 1 p.m., and the bond market at 2 p.m.

Summary

Existing Home Sales dipped 5.9% in October, blamed on affordability and mortgage rates. Median prices did rise year-over-year, but the good news is that mortgage rates recently dropped nearly half a percent.

Housing Starts dipped 4.2% and Building Permits slipped 2.4% in October, but both declined less than expected. In the past year, starts and permits for single-families are down, but up for multi-unit homes.

Yet builders are busy. The number of homes under construction is at the highest level since 1970. Plus, the backlog of projects authorized but not yet started is just below the record high going back to 1999.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.