Hi neighbor, Today I will be sharing with you our perspective on the local real estate market here in Katy, Texas, specifically a market update for the 77493 Zip Code. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in 77493?

We currently have 176 homes pending, with 36 homes sold in the last two weeks, averaging a sale price of $182 a square foot. Thirty-Six homes sold over the asking price, with one home selling 13% above the listing price.

Compared to the two weeks prior: Homes sold are up from 18 homes sold to 36 homes sold and the average sales price is also up: $587,691 ($563,195 previously). Every home is different, with different features, so don’t forget to ask us for your annual equity review if you are curious about your personal home. You can text AER to 79564 or email us here.

If we look at how fast the move-in ready homes are going, the demand in this area has not surpassed the supply, making it still a great time to sell. Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting every neighborhood. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways!

The most desirable homes in the area are still selling the first weekend or first week they hit the market (a really good coming soon campaign, like we do at Jo & Co. allows you to sell faster, for more money).

Check out the graphic below for a larger overview of the real estate market for the last two weeks in 77493

Jo's Two Cents

I assume you know who Opendoor is. Opendoor is an online company that buys and sells residential real estate. Headquartered in San Francisco, it makes instant cash offers on homes through an online process, makes repairs on the properties it purchases, and relists them for sale. For many months of the last few years, they have manipulated our real estate market in positive and negative ways. And today I want to share with you what they are up to right now.

- According to a column by Mike DelPrete in Inman, Opendoor is selling homes for less than it paid for the first time in its existence.

- People in the industry have talked about whether buying would be as successful in a down or even normal market. Zillow exited the buying market last year and instead partnered with Opendoor. It was a classic example of “if you can’t beat them, join them.”

- Now, DelPrete reports that the buy-to-sale premium of Opendoor has reached a record, negative low.

- Opendoor is selling around 2,000 houses per month with an average sale price of $400,000. A buy-to-sale loss of two percent amounts to a $16 million loss.

- As I type this, Opendoor has the second-largest number of listings for sale in the HAR MLS with 652 properties for sale. It is also ranked fifth in terms of year-to-date listing side transactions.

- Opendoor Exclusives, where the parent company, which is not an MLS subscriber, puts properties up for sale for 14 days before they go into the MLS under Opendoor Brokerage, are only active in Austin, Dallas-Fort Worth, and Houston currently. It will be interesting to see how successful that effort is and whether they expand to other markets.

- DelPrete also reports that Opendoor is racking up seller concessions and buyer agent bonuses to unseen levels.

I believe a lot of things have created the situation described above. I view it as a perfect storm. And what are the components of this perfect storm? The individuals in charge of buying the homes are not invested and they are purchasing homes above market value, the homes being purchased are lemons with lots of issues that are not repaired before being listed, and there is something “wrong” with many of these homes that only a local would pick up on. I feel for the Opendoor founders and investors, but their loss is your gain. If you are looking for a deal, you might want to look at an Opendoor listing.

Also on my mind these days is the excessive talk of doom in the real estate world in relation to our futures. Too much of the real estate and economic news these days isn’t overly positive. I do recognize that there is a market shift, but I also recognize this has created new and different opportunities. And what is actually happening is a normalization of the market. I truly believe that. As do all others who aren't trying to sell newspapers or throw their clickbait in your face.

And I have some good news to share with you. But first I think it is super important to study the real estate market on a micro level.

So it was reported by the First American Real House Price Index, as reported by Inman News (real estate news provider), that the number of US housing markets considered ‘overvalued' quadrupled in 2022. But the good news is that Houston was not on the list that included 19 housing markets. Markets that were on the list include six markets in California, Tampa, Miami, Austin, and San Antonio.

What is happening in the real estate market nationally?

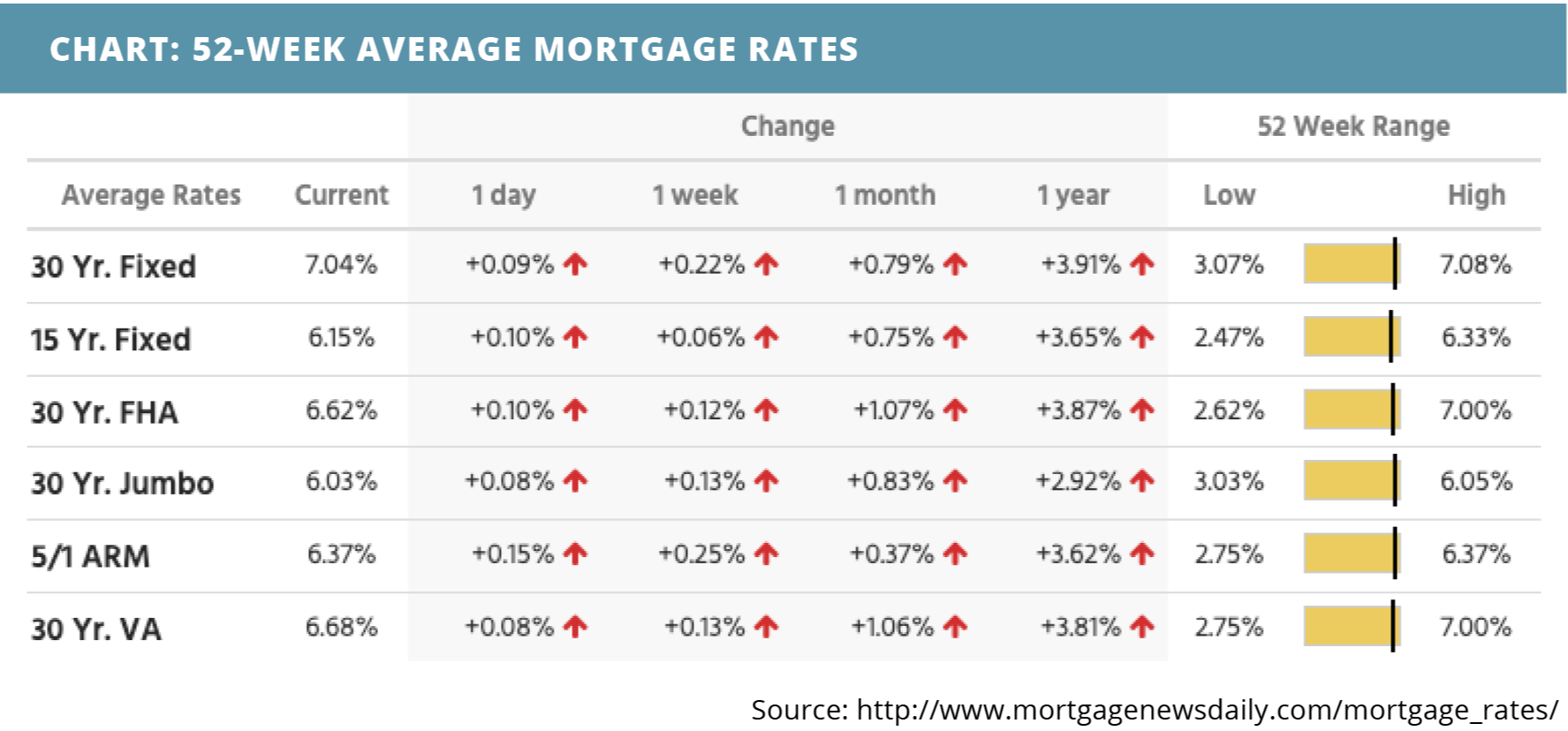

Mortgage rates trended higher last week after the release of strong economic jobs data. Construction spending dipped in August. Job openings on the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) took a dip, but ADP nonfarm employment and the other jobs reports came in higher than expected. Mortgage application submissions fell while jobless claims rose.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Demand for apartments saw its first Q3 dip in 30 years. Watch Now >>

- Home Prices finally starting to fall. Listen Now >>

- Climate change is playing an increasingly important role in home buyers’ decisions.

Read Now >>

Market Recap

- Construction spending slipped 0.7% month-over-month in August.

- Job openings took a huge 1.1 million drop in August’s reading on the Labor Department’s

Job Openings and Labor Turnover Survey (JOLTS). The seasonally adjusted rate of job openings at the end of August was 10.1 million. Total separations, quits, and hires were relatively unchanged. - Mortgage application submissions decreased 14.2% during the week ending 9/30. Refinance application submissions dropped 17% and purchase application submissions dropped 13%.

- ADP nonfarm employment was higher than expected in September, rising by 208,000.

- During the week ending 9/24, continuing jobless claims were at 1.36 million, a rise of

15,000. During the week ending 10/1, initial jobless claims were at 219,000, nearly an increase of 40,000. - Average hourly earnings were at 5% annually in September – a slight decrease from the month before. Month-over-month, earnings were unchanged at 0.3%. Average weekly hours for the workweek remained at 34.5. Government payrolls dropped by 25,000. Manufacturing payrolls added 22,000 jobs, a slight drop from the month before. Nonfarm payrolls exceeded expectations with an increase of 263,000. The participation rate was relatively unchanged at 62.3%. Private payrolls exceeded expectations at 288,000. The unemployment rate saw a slight drop to 3.5%

Review of Last Week

WHIPSAW WEEK… Stocks began the week rallying on the belief the Fed would soon go easy on rate hikes but ended with a big sell-off after a decent September jobs report indicated the Fed will have to stay aggressive.

The problem was, an unexpectedly low 3.5% unemployment rate indicated labor market strength that would keep the Fed boosting rates to cool down the economy and inflation. Stocks still booked nice weekly gains.

Earlier in the week, there was evidence of economic cooling with weaker-than-expected ISM Manufacturing and Construction Spending. But the ISM Services Index showed that huge sector of the economy solidly expanding.

The week ended with the Dow UP 2.0%, to 29,297; the S&P 500 UP 1.5%, to 3,640; and the Nasdaq UP 0.7%, to 10,652.

Bond prices went in the other direction, the 30-year UMBS 5.5% down 0.04, to $99.08. The national average 30-year fixed mortgage rate fell three basis points (0.03%) in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Realtor.com reports that for the week ending September 24, active inventory kept growing and is now 29% higher than a year ago, though we’re still not back to pre-pandemic levels.

Market Forecast

INFLATION, RETAIL SALES UP, CONSUMER SENTIMENT DOWN… Inflation should keep rising according to September's Consumer Price Index (CPI) and Producer Price Index (PPI) of wholesale prices. Retail Sales should be up a tick, but flat when you take out vehicle sales. University of Michigan Consumer Sentiment is expected to come in historically low (same old story).

The stock markets will be open today, but the bond market will be closed in observance of Columbus Day.

Summary

Residential Construction Spending slipped a tick (less than 1%) in August. But home builder spending is still 12.5% higher than a year ago, so, more new homes will keep coming onto the market.

ShowingTime reports the decline in home showing traffic is leveling off, as buyers get back into the market. What’s drawing them is less competition and more listings, so they have more options and more time to decide.

Black Knight’s home price index found home prices fell 0.98% in August after a 1.05% drop in July, the largest monthly price decline since 2009. The median home price is now down 2% below its June peak.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.