Hi neighbor, Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Champion Forest. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Champion Forest?

We currently have 11 homes pending, with 7 homes sold in the last two weeks, averaging a sale price of $139 a square foot. Seven homes sold over the asking price, with one home selling 18% above the listing price.

Compared to the two weeks prior: Homes sold are up from 5 sold to 7 sold. If we look at how fast the move-in-ready homes are going the supply in this area has not surpassed the demand, making it still a great time to sell. We cannot pinpoint another time in history where you were almost guaranteed to get 8-12% more than your home's current market value.

I just want to make sure to note, how mind-blowing it is that homes are selling 7% to 18% over the asking price (over market value) in our neighborhood.

Buyer agents around Houston are seeing a slow in the real estate market, but it isn’t affecting the neighborhoods with such high demand, like Champion Forest, so that is good news for anyone that waited until summer to sell. I know the interest rates rising has been one deterrent from some buyers purchasing right now, but that isn’t your ideal buyer anyways! And the educated buyer still knows, they need to buy ASAP.

P.S. The median days on market is 3 days, with most homes selling during the first 2-3 days (aka a really good coming soon campaign as we do at Jo & Co. boosts that, and your over asking price ratio!)

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Champion Forest.

What is happening in the real estate market nationally?

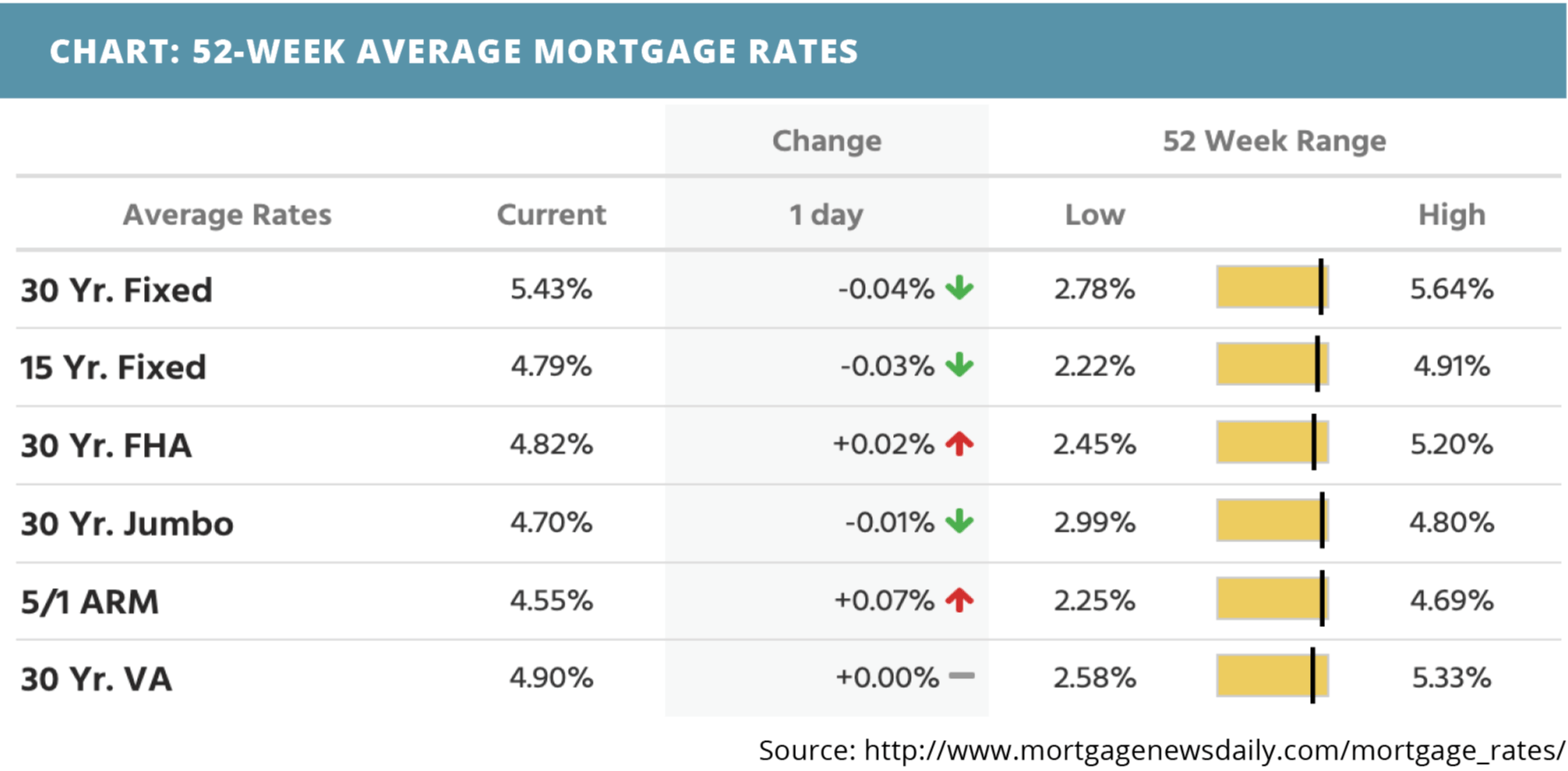

Mortgage rates trended higher last week. Home prices appreciated at a slower pace in March according to the FHFA home price index but a faster annual pace according to the 20-city Case-Shiller home price index. Mortgage application submissions decreased. Construction spending increased in April, largely due to residential construction spending. Job openings decreased in April, and in May private nonfarm payrolls showed the slowest increase in the pandemic-era recovery. Both continuing and initial jobless claims fell. The employment situation showed signs of stabilization.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- HousingWire Lead Analyst discusses home inventory, inflation, and purchase applications. Listen Now >>

- Home price will inevitably slow in coming months, says National Association of REALTORS® (NAR) chief economist. Watch Now >>

- The share of listings with a price cut is creeping up. Read Now >>

Market Recap

- The 20-city Case-Shiller home price index showed that home prices appreciated 2.4% month-over-month in March, the same pace as February. Year-over-year, home prices appreciated 21.2%, up from February’s 20.3%. Although one can safely predict that price gains will begin to decelerate, the timing of the deceleration is a more difficult call,” says Craig Lazzara, managing director at S&P DJI.

- The FHFA house price index showed that home prices appreciated at a slower pace in March, up 1.5% month-over-month compared to the 1.9% rise the month before. Year-over-year, home prices appreciated 19%, also lower than the month before.

- Mortgage application submissions fell 2.3% during the week ending 5/27. The Refinance Index decreased 5% while the Purchase Index decreased 1%.

- U.S. construction spending rose 0.2% month-over-month to a seasonally adjusted annual rate of $1.74 trillion in April. This rate is 12.3% higher than the April 2021 construction spending level. Once again, residential construction spending led the way in increases, rising 0.9% month-over-month to a seasonally adjusted annual rate of $891.5 billion. Nonresidential construction spending fell.

- Job openings slipped by 455,000 in April, according to the Labor Department’s Job Openings and Labor Turnover Survey. The decrease brought April’s number of job openings to a level of 11.4 million. The drop helped close the gap between the number of job openings and the number of available workers, which was 5.46 million. Hires and quits were little changed.

- In May, private nonfarm payrolls increased by just 128,000 according to the ADP employment report. This was the slowest increase in the pandemic-era recovery. Small businesses took the biggest hit, cutting 91,000 jobs. Large businesses, on the other hand, added 122,000 jobs to their payrolls. The slowed pace is consistent with the graph trends showing market stabilization.

- Continuing jobless claims fell to a level of 1.31 million during the week ending 5/21. Initial jobless claims fell to the level of 200,000 during the week ending 5/28.

- The employment situation showed signs of stabilization in May as well. Average hourly earnings climbed 0.3% month-over-month – the same pace of increase as the month before. The average workweek remained unchanged at 34.6 hours. Government payrolls increased slightly to 57,000 jobs. Manufacturing payrolls had a sharp fall in May, dropping by over 40,000 to a level of 18,000. Nonfarm payrolls decreased as well to a level of 390,000. The participation rate remained relatively unchanged at 62.3%. Private nonfarm payrolls decreased to 333,000. The unemployment rate was unchanged at 3.6%

Review of Last Week

GOOD JOBS BAD FOR STOCKS… A better-than-expected May jobs report slammed stocks, reinforcing investor fears the Fed would keep its foot on the gas with interest rate hikes that could spark a recession.

Jobs data saw wages up 5.2% annually, but they lag consumer price inflation of more than 8% by a substantial margin. Services sector activity slowed for the second straight month, to the lowest read since February 2021.

Yet business activity in the manufacturing sector expanded more than forecast, consumer confidence came in better than expected, and both initial and continuing jobless claims kept falling.

The week ended with the Dow down 0.9%, to 32,900; the S&P 500 down 1.2%, to 4,109; and the Nasdaq down 1.0%, to 12,013.

The May jobs report sent bond prices down, the 30-year UMBS 4.5% off 0.92, to $101.12. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate inched down, marking three straight weeks of declines. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Realtor.com reports, “Nearly 3 in 4 home sellers this year are also planning to buy a home, so what’s good for the buyer is also, in many cases good for the home seller.”

Market Forecast

INFLATION, JOBLESS CLAIMS GAIN, CONSUMERS UNHAPPY…The Consumer Price Index (CPI) should show inflation continuing to rise. Initial Unemployment Claims are also expected up. Small wonder the University of Michigan Consumer Sentiment index is forecast to remain historically low.

Summary

Residential construction spending headed up 0.9% in April, and is now 18.4% ahead of a year ago. Spending on new single-family home building gained 0.5%, while new multifamily spending increased 0.8%.

The national Case-Shiller Home Price Index saw record increases of 2.6% in March, and 20.6% annually. The FHFA index of prices for homes financed with conforming mortgages was up 1.5% in March and 19.0% for the year.

But the Mortgage Bankers Association’s forecasts: “prospective homebuyers should start to see moderation from the double-digit price appreciation reported for well over a year in most of the country.”

Mortgage rates trended downward last week. New home sales decreased, as did mortgage application submissions. Continuing jobless claims increased slightly while initial jobless claims fell. The GDP estimate for Q1 of 2022 dropped. Pending home sales declined as well. Inflation according to the PCE index showed a slower pace. Personal income increased as did consumer spending.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend. Thoughtfully written for you. Hugs, Jo.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our Blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/

• Download our Moving to Texas ebook! http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook! http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks

• Schedule a phone call or appointment with us! http://byjoandco.com/appointment.

• Email us! [email protected].

• Looking for a buyer’s agent? Fill out our buyer questionnaire! http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.