Hi neighbor, Today I will be sharing with you our perspective on the local real estate market here in Spring, Texas, specifically a market update for the neighborhood of Windrose. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Windrose?

We currently have 13 homes pending, with 4 homes sold in the last two weeks, averaging a sale price of $149 a square foot. Four homes sold over asking price, with one home selling 4% above the listing price. We are seeing very similar data to last week, while most neighborhoods are starting to see an uptick in inventory. We should start to see see some big rises in active listings soon. The rising interest rates are definitely something to keep an eye on as well. Some people in this neighborhoods price range are just simply being priced out of homes due to interest rates. The rise in inventory combined with the interest rates could put us back into a buyers market. We don't see anything that drastic happening, but it's possible.

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Windrose.

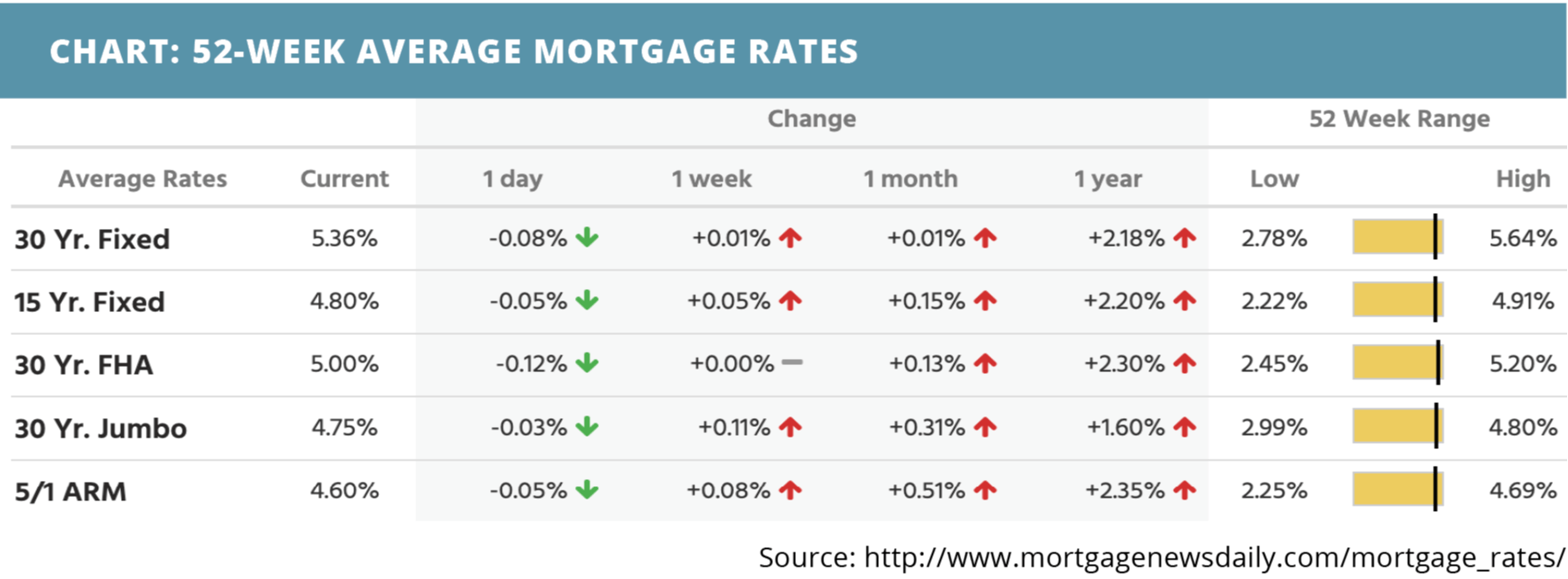

What is happening in the real estate market nationally?

Mortgage rates fluctuated throughout the week but were trending slightly lower by the end of the week. Retail sales climbed in April, while mortgage application submissions fell. Homebuilder sentiment decreased in May as did housing starts and building permits the month before. Continuing jobless claims dropped while initial jobless claims increased. Existing home sales fell, but existing home inventory looked healthier in April.

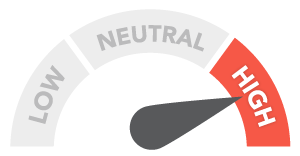

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- What can we expect from the new FHA commissioner? Listen Now >>

- Leading global investment business Blackstone says a housing crash is unlikely. Watch Now >>

- Senior Economist at Realtor.com talks about current housing market. Read Now >>

Market Recap

- Retail sales saw a slight increase in April, climbing 0.9% month-over-month and 8.19% year-over-year.

- Mortgage application submissions fell 11% overall during the week ending 5/23. The Purchase Index decreased 12% while the Refinance Index decreased 10%.

- The NAHB housing market sentiment index fell 8 points in May, down to a level of 69. Current sales conditions fell 8 points to 78, sales expectations for the next six months dropped 10 points to 63. Buyer traffic fell nine points to 52.

- Building permits in April were at a seasonally adjusted annual rate of 1.82 million, 3.2% below the rate in March and 3.1% above the April 2021 level. Housing starts were at a seasonally adjusted annual rate of 1.72 million, a 0.2% drop from the March level.

- Continuing jobless claims decreased to a level of 1.32 million during the week ending 5/7. Initial jobless claims increased to a level of 218,000 during the week ending 5/14.

- Existing home sales fell 2.4% month-over-month in April, down to a seasonally adjusted annual level of 5.61 million. With slower demand existing home inventory was able to further recover – climbing to a level of 1.03 million, or a 2.2-month-supply. This is 10.4% higher than the existing home inventory in March.

Review of Last Week

STILL CAN'T BEAR IT… Investors briefly sent the S&P 500 into bear market territory, 20% below its last high, but stocks rebounded above that trough, though the Dow is down eight straight weeks for the first time since 1932.

Wall Street traders hate inflation but fear the Fed may raise rates too aggressively to fight it and send us into recession. A slowing economy showed with high-profile retailers reporting lower profits thanks to higher costs for freight and fuel.

In fact, the Leading Economic Index (LEI) fell and initial jobless claims rose, yet Industrial Production and factory capacity grew. Retail Sales were up 8.2% from a year ago, though flat when you account for inflation.

The week ended with the Dow down 2.9%, to 31,262; the S&P 500 down 3.0%, to 3,901; and the Nasdaq down 3.8%, to 11,355

Bonds overall ended ahead for the week, the 30-year UMBS 4.5% UP 0.13, to $101.19. Higher bond prices signal lower rates, and Freddie Mac's Primary Mortgage Market Survey reported the national average 30-year fixed mortgage rate down slightly. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… A new Zillow study found that homes in the suburbs have recently been appreciating faster than urban homes, the typical suburban home gaining $66,490 in value versus $61,671 for the typical home in the city.

Market Forecast

ALL UP: CONSTRUCTION SPENDING, MANUFACTURING, SERVICES, JOBS, THE FED RATE… It'll be nice to see Construction Spending growing, along with the manufacturing and services sectors of the economy, according to the ISM Manufacturing and Non-Manufacturing Indexes. We should see more Nonfarm Payrolls added in April, though Hourly Earnings will still lag well behind inflation. To rein that in, the FOMC Rate Decision is expected to be a half percent rate hike, for the first time since 2000.

Summary

Existing Home Sales declined in April for the third month in a row, off 2.4%, at a 5.610 million annual rate. But demand remains strong, as 88% of the existing homes sold were on the market for less than a month.

Housing Starts dipped slightly in April, off just 0.2%, to a 1.724 million annual rate, yet starts are still 14.6% ahead of a year ago. Permits were down 3.2% in April, but the backlog of authorized projects is the highest since 1999.

Realtor.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/.

• Download our Moving to Texas ebook: http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook: http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks.

• Schedule a phone call or appointment with us: http://byjoandco.com/appointment.

• Email us! [email protected]

• Looking for a buyer’s agent? Fill out our buyer questionnaire: http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.