Hi neighbor, Today I will be sharing with you our perspective on the local real estate market here in Houston, Texas, specifically a market update for the neighborhood of Oak Forest. Whether you are looking to buy, sell, or just keep an eye on the market, we look forward to being your resource.

What is happening in the real estate market in Oak Forest?

We currently have 49 homes pending, with 17 homes sold in the last two weeks, averaging a sale price of 320 a square foot. Seventeen homes sold over asking price, with one home selling 8% above the listing price. It's happening! Homes are starting to hit the market for summer and prices are continuing to rise. If you have a home with some flaws that you think may have hard time selling, now is the time. If you want to get the most for our house in an extremely favorable seller's market, you should consider listing now. We think the market may shift in the September/October time frame. We don't expect a market crash, and frankly with the absence of predatory lending we don't believe another crash is possible. What we do know is that the political climate can play a large role in the economy, and subsequently the housing market, whether it's perception or reality. The normal housing market undelations will turn into choppy water with a swift undertow. Much like the San Luis pass in Galveston, the only way to avoid it is to simply stay out of it.

Check out the graphic below for a larger overview of the real estate market for the last two weeks in Oak Forest.

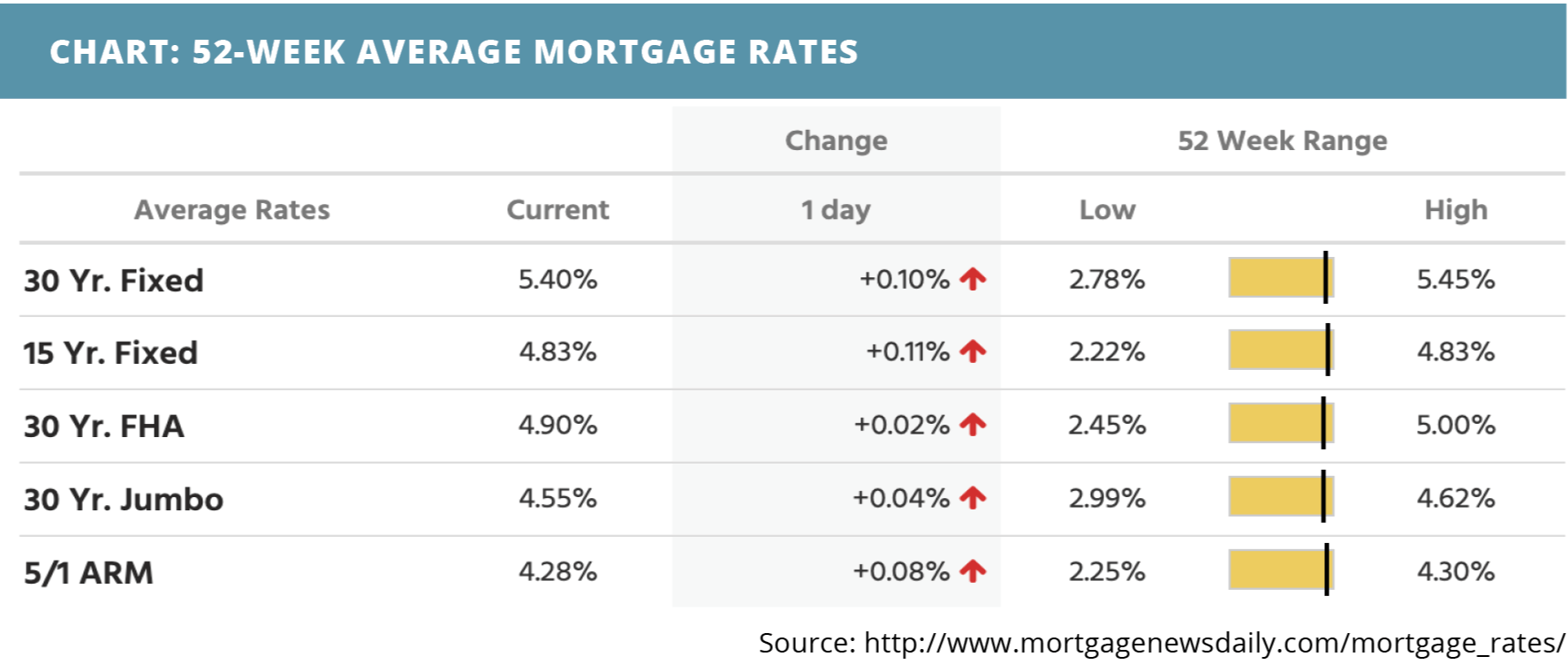

What is happening in the real estate market nationally?

Mortgage rates trended downward last week, brushing fresh two-week lows. Mortgage application submissions increased. Inflation according to the consumer price index increased at a decelerating pace. Continuing jobless claims dropped while initial jobless claims remained relatively unchanged.

| MORTGAGE RATES CURRENTLY TRENDING | THIS WEEK'S POTENTIAL VOLATILITY |

|

|

Notable News

- Mortgage rates are rising, but people are still buying homes. Watch Now >>

- Adjustable-rate mortgage hits 14-year high. Read Now >>

- Homeowner equity grows again in the first quarter of 2022. Read Now >>

Market Recap

- Mortgage application submissions increased a composite 2% during the week ending 5/6. Though the Refinance Index fell 2%, the Purchase Index climbed 5%.

- Inflation according to the consumer price index decelerated in April. After March’s month-over-month gain of 1.2%, inflation in April rose just 0.3%. Year-over-year, the index read 8.3%, a slight drop from 8.5% in March.

- Continuing jobless claims dropped to a level of 1.34 million during the week ending 4/30. Initial jobless claims remained relatively unchanged at a level of 202,000 during the week ending 5/7.

Review of Last Week

COULDN'T BEAR IT… The S&P 500 ended shy of a 20% drop into bear market territory after six straight weeks of declines for the first time in more than a decade. The Dow's seven week losing streak was its longest since 2001.

Investors don't like high rates, lower growth, and high inflation. Inflation may be peaking because April's annual 8.3% rate was down from March's 8.5%, though April's 0.6% gain in core inflation was the largest in three months.

The University of Michigan's measure of consumer sentiment dropped to its lowest level in more than ten years, a 59.1 read for May, compared to 82.9 a year ago! Initial jobless claims gained a tick, but continuing claims dropped.

The week ended with the Dow down 2.1%, to 32,197; the S&P 500 down 2.4%, to 4,024; and the Nasdaq down 2.8%, to 11,805

Safe-haven buying sent bond prices up strongly, the 30-year UMBS 4.5% UP 0.76, to 101.06. Higher bond prices signal lower rates, yet the national average 30-year fixed mortgage rate edged up a tick in Freddie Mac's Primary Mortgage Market Survey. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information.

DID YOU KNOW… Renters should note that increasing mortgage rates are still at historic lows, and with a fixed-rate mortgage, monthly payments don’t change over time. That’s why, with skyrocketing rents, buying a home should remain their top goal.

Market Forecast

ALL UP: CONSTRUCTION SPENDING, MANUFACTURING, SERVICES, JOBS, THE FED RATE… It'll be nice to see Construction Spending growing, along with the manufacturing and services sectors of the economy, according to the ISM Manufacturing and Non-Manufacturing Indexes. We should see more Nonfarm Payrolls added in April, though Hourly Earnings will still lag well behind inflation. To rein that in, the FOMC Rate Decision is expected to be a half percent rate hike, for the first time since 2000.

Summary

Freddie Mac notes: “Homebuyers continue to show resilience even though rising mortgage rates are causing monthly payments to increase by about one-third compared to a year ago.”

Evidence of that came as the Mortgage Bankers Association said purchase applications rose two weeks in a row, even with the highest rates since 2009. Not surprisingly, there was also a rise in adjustable-rate loans.

A nationwide listing site reports that a record 15% of sellers dropped their asking prices during the four weeks ending May 1. However, in the same period, 56% of the homes sold for an average of 2.8% above list price, another record.

Can we sell yours?

So if you are in need of a listing agent, we would love the opportunity to see your home and meet you of course. My husband, Edward, and I, look forward to being the brokerage and team for you! You can reach out to us via email: [email protected] & [email protected] or telephone: 832-493-6685.

Read more:

If you are curious ‘How to get more money for your home when listing it for sale', check out this blog post.

I hope you have found this blog post super helpful. If there is anything else we can do for you, including helping you sell (or buy) a home, I would be honored to assist. I hope you have a great day/evening. Cheers, E + J.

We are so happy you found our little corner of the interwebs. We look forward to y'all reaching out to us. We love to answer questions and welcome them. Recently we created some local maps, and you can download those by clicking the image/link above. Below, you will find an index of some very helpful information to assist you in learning more about the Houston suburbs. If you are relocating to our neck of the woods, we hope you reach out to us, because we would love to help you by being your local realtor and friend.

We are Waiting for You

If you are looking to relocate to the Houston Area, we would love to meet you, and hear your story. Below you will find all of my contact information, as well as some homes for sale in the area. We truly look forward to hearing from you! P.S. Don't forget to check out our YouTube Channel!

If you are overwhelmed..

Now if you are feeling overwhelmed on where you should plant your roots, I would love to talk to you. You can schedule a call with me by click this link: http://byjoandco.com/call or just send us an email: [email protected]. There are some amazing communities all over the Houston suburbs. In this post, https://search.byjoandco.com/blog/best-neighborhoods-in-houston/, I deep dive into all the different suburbs/neighborhoods that you might want to consider, and why. There are many resources here, so please reach out if you are curious what to look at next! Thank you for trusting us.

What next?!

• Navigate our blog: https://byjoandco.com/categories-to-help-you-navigate-the-blog/.

• Download our Moving to Texas ebook: http://byjoandco.com/movingtotexasebook.

• Download our Where to Live in Houston Texas ebook: http://byjoandco.com/wheretoliveebook.

• Browse our Ebooks and Relocation Guides: http://byjoandco.com/ebooks.

• Schedule a phone call or appointment with us: http://byjoandco.com/appointment.

• Email us! [email protected]

• Looking for a buyer’s agent? Fill out our buyer questionnaire: http://byjoandco.com/q.

• Ready to find your dream home? Search, http://search.byjoandco.com.

• Subscribe to our YouTube Channel: http://byjoandco.com/youtube.